Pi Network Token Price Declines After Upgrade

- Pi Network price fell 90% post-upgrade, centralization cited.

- Expert opinions highlight inflationary supply, liquidity issues.

- No major exchange listings hinder market liquidity.

The Pi Network price crash, over 90% down from its peak, is fueled by rapid token unlocks, centralization, and a lack of significant exchange listings. Learn from similar events with Filecoin and EOS facing intense volatility.

The event is significant due to the massive price drop despite the upgrade, indicating major underlying market and investor concerns.

The Pi Network’s price crash comes amidst rapid token unlocks and a centralized token supply, raising doubts among investors. Founder Dr. Nicolas Kokkalis emphasized real-world crypto utility but has not addressed the crisis officially.

Dr. Nicolas Kokkalis, Founder, Pi Network, “The recent App Studio upgrade aims at enhancing developer tools and ensuring better ecosystem integration.”

The lack of exchange listings on platforms like Binance and Coinbase, along with low trading volumes , contribute to the token’s decline. Dr. Chengdiao Fan, who co-founded Pi Network, will speak at TOKEN2049, potentially swaying investor views.

Market reactions show a trend of extreme fear among investors. Other cryptocurrencies remain unaffected. Experts suggest token burns and leading exchange listings could be solutions, although no formal plans are reported by Pi’s leadership.

The crypto community remains unsettled, with discussions focusing on Pi’s centralization and lack of liquidity. Historical trends show similar issues have led to significant downturns in other crypto projects. The absence of regulatory actions or broader L1/L2 impacts limits contagion risk.

As the aftermath unfolds, potential outcomes could include higher market volatility, regulatory scrutiny, or shifts in investor trust. Long-term recovery would need strategic moves such as decentralization and improving liquidity .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO rises by 0.21% even after a 5.32% decline over the week, reflecting ongoing market fluctuations

- ALGO rose 0.21% to $0.1439 on Nov 24, 2025, but fell 5.32% weekly and 56.92% annually amid market volatility. - Persistent selling pressure and lack of project/regulatory catalysts highlight structural valuation declines since peak levels. - Analysts project continued downward pressure unless major developments like regulatory updates or institutional adoption emerge. - Investors advised to remain cautious as short-term gains fail to offset 18.77% monthly losses and broader bearish market conditions.

Bitcoin Updates: Saylor’s Bitcoin-Linked Strategy Encounters Index Removal and Industry-Wide Sell-Off Challenges

- Michael Saylor of MicroStrategy (MSTR) defends Bitcoin-centric strategy despite 41% stock decline, claiming resilience against 80% drawdowns. - MSCI's proposed index exclusion rule (for crypto-heavy firms) threatens $8.8B in losses for MSTR , which holds 90% Bitcoin on its balance sheet. - Bitcoin treasury sector faces "player-versus-player" selloff, with 26/168 firms trading below reserves and peers like Metaplanet launching buyback facilities. - Saylor envisions $1T Bitcoin balance sheet for financial

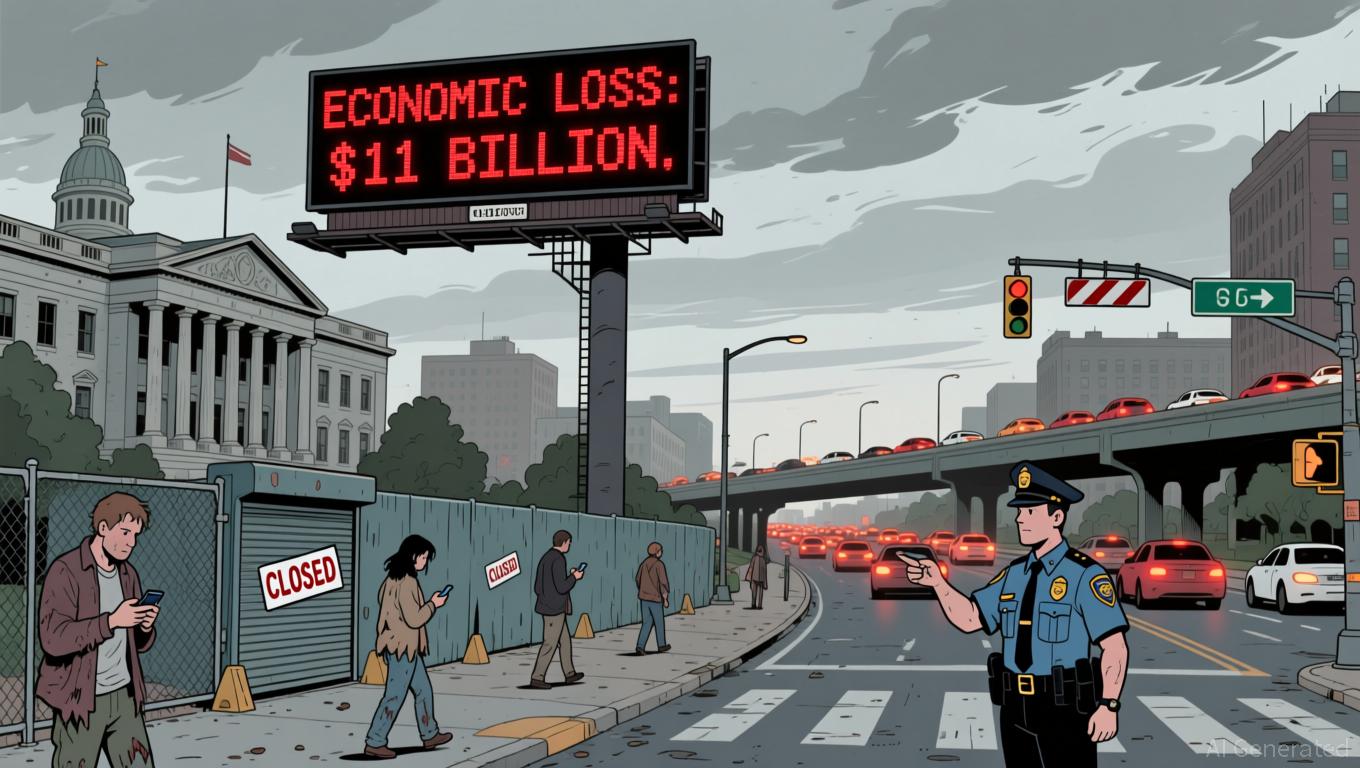

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

XRP News Today: XRP ETFs Ignite Discussion: Could Institutional Investments Drive a 465% Price Increase?

- Franklin Templeton and Grayscale's XRP ETFs cleared NYSE Arca approval, set for Nov 24 launch, marking institutional adoption of digital assets. - XRPZ ETF (0.19% fee) and Grayscale's entry boost institutional credibility, with XRP rising 5% amid 26% higher trading volume. - Analysts project 465% XRP price potential by 2028 via ETF-driven demand, though BlackRock's potential entry could strain XRP's 60B token supply. - Regulatory clarity and pro-crypto policies, including the Genius Act, reinforce invest