NYSE AI Trading Drives Market Activity to 1.2 Trillion

- AI trading significantly boosts NYSE message volume to record levels.

- Institutional interest in IPOs has surged alongside automated trading.

- AMD, Nvidia, and OpenAI partnerships impact tech-stock valuations.

AI-driven trading has increased Wall Street’s order flows to 1.2 trillion messages, as confirmed by NYSE President Lynn Martin. This growth surpasses previous peaks and emphasizes the role of AI in enhancing market oversight and activity.

Lynn Martin, President of the New York Stock Exchange (NYSE), confirmed a surge in Wall Street trading activity due to AI, totaling 1.2 trillion messages on peak days.

AI trading’s rise revolutionizes market oversight and efficiency, with increased automation attracting renewed institutional interest.

The New York Stock Exchange experienced a significant leap in message flows, reaching 1.2 trillion due to AI-driven trading technologies. Lynn Martin emphasized that AI is crucial for managing today’s trading volumes. Market technology partnerships involving AMD and Nvidia further escalate this activity. AMD and Nvidia have collaborated with OpenAI, enhancing their infrastructure and driving up market interest.

“The immediate impact includes heightened liquidity in tech stocks while indirectly affecting cryptocurrency-linked assets. ‘We now rely on artificial intelligence to monitor trading flows in real time, because humans alone are no longer capable of keeping up with the velocity of activity,’ said Lynn Martin, President, NYSE.”

Institutional confidence in the NYSE has strengthened due to advance automation, renewing IPO activities after a long dry spell. Financial implications suggest a robust market rebound, with tech stocks like AMD and Nvidia benefiting from AI partnerships and valuations increasing. Regulatory reliance on AI for market policing and integrity preservation is another outcome.

This trend points to more sophisticated market structures emerging with AI at the helm, as regulatory bodies are challenged to adapt quickly to ever-evolving technologies. AI’s role in enhancing oversight underlines the need for advanced regulatory frameworks to maintain market stability amid unprecedented trading volumes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO Falls 1.74% as 1-Month Results Remain Subdued

- Algorand (ALGO) dropped 1.74% on Nov 24, 2025, extending its 1-month decline to 20.35% amid sustained bearish sentiment. - The token’s annual price has fallen 57.76% from its peak, driven by macroeconomic volatility and uncertainty over potential interest rate cuts. - No ALGO-specific news or on-chain developments were reported, with price movements linked to broader economic factors and risk appetite shifts. - Analysts warn the bearish trend may persist unless major upgrades emerge, urging investors to

DOGE drops 53.85% over the past year after early dissolution of federal agency

- Trump's DOGE department, aimed at cutting federal spending, was disbanded early, with functions absorbed by OPM. - DOGE's aggressive cost-cutting, including $1.9B in canceled contracts, faced scrutiny over lack of transparency and legal concerns. - The DOGE cryptocurrency token fell 53.85% in a year, while Grayscale launched spot ETFs as the department dissolved. - Former DOGE staff now hold federal roles, but its legacy raises ongoing questions about executive authority in reform efforts.

YFI Value Increases by 1.18% During Market Fluctuations

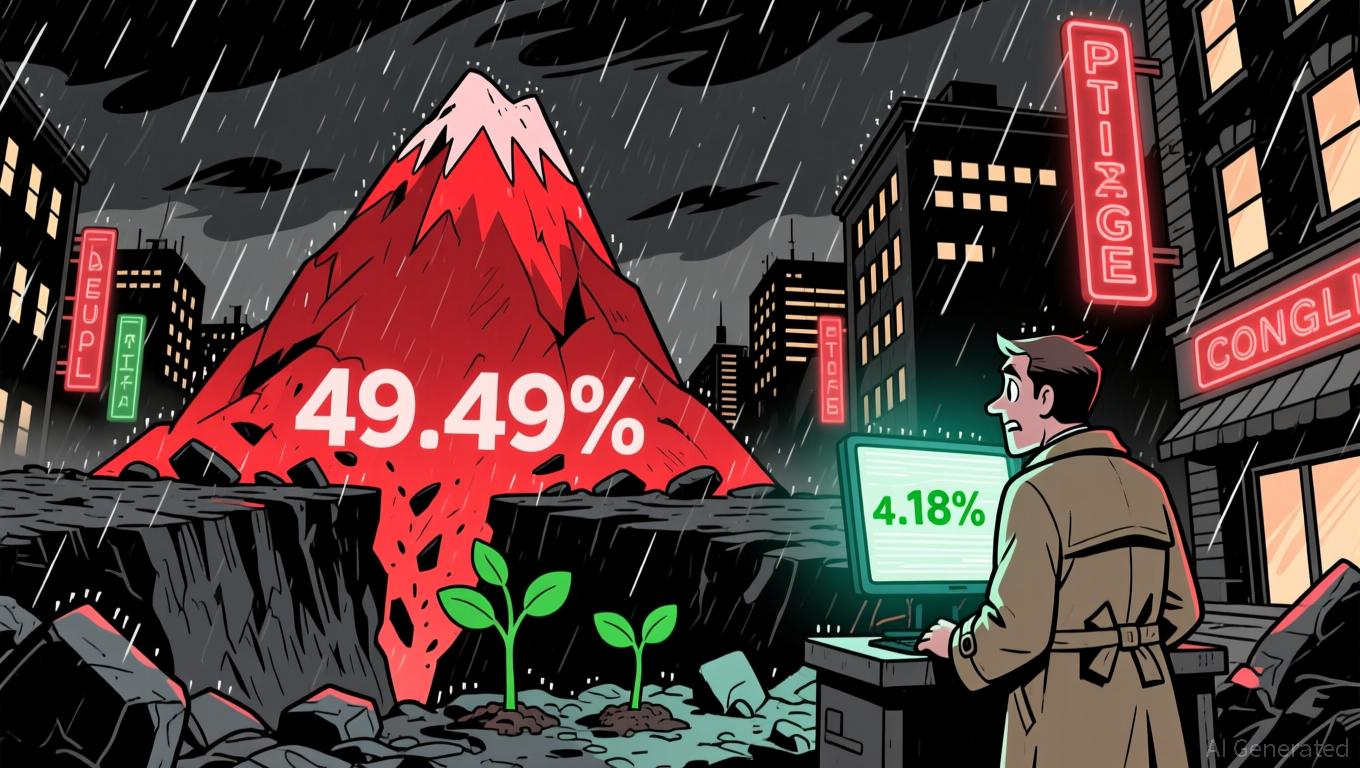

- YFI rose 1.18% in 24 hours to $4,036 but fell 49.49% annually, highlighting extreme volatility. - Short-term gains lack clear catalysts, with analysts noting broader market dynamics drive fluctuations. - Long-term bearish trends persist despite temporary rebounds, urging caution amid macroeconomic pressures.

Aave News Today: The Two Sides of DeFi: Aave's Expansion Increases Volatility Concerns

- Aave's AAVE token faces volatility risks near 0.57 support level, with whale accumulation and leveraged positions amplifying short-term instability. - A major Aave whale added 24,000 AAVE tokens (total 276,000) at $165 average cost, but remains vulnerable to repeat October 11 liquidation risks. - A $80M WBTC long position on Aave approaches $65,436 liquidation threshold, threatening forced selling and downward price pressure. - Tangem's Aave-integrated stablecoin yield feature highlights protocol's DeFi