Key Market Information Discrepancy on October 20th, a Must-See! | Alpha Morning Report

1. Top News: This week's CPI Data is Coming, Fed to Hold Payment Innovation Meeting to Discuss Stablecoins, Tokenization 2. Token Unlock: $ZRO, $KAITO, $HTM, $HOOK, $SVL

Top News

1.This Week's CPI Data Released, Fed to Hold Payment Innovation Meeting to Discuss Stablecoins, Tokenization

2.pump.fun Launches X Account Spotlight Aimed at Accelerating ICM

3."1011 Insider Whale" Once Again Shorts Bitcoin with 10x Leverage, Entry Average Price at $109,133.1

4.MLN Surges Over 73% in 24 Hours, Market Cap Reaches $25.5 Million

5.Binance Alpha to List SigmaDotMoney (SIGMA) on October 21

Articles & Threads

1. "$15 Billion Bitcoin Private Key Accidentally Cracked by U.S."

In October 2025, a massive cryptocurrency seizure case was revealed in the U.S. Federal District Court for the Eastern District of New York, where the U.S. government confiscated 127,271 bitcoins worth approximately $15 billion at market prices.

2. "New York Times: Trump Family's Cryptocurrency Scam Worse Than Watergate"

In American political history, no president has intertwined national power, personal brand, and financial speculation on a global scale like Trump. As cryptocurrency enters the White House and the digital shadow of the dollar entangles with national will, we must rethink a fundamental question: In this era of "on-chain sovereignty," do the boundaries of power still exist?

Market Data

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

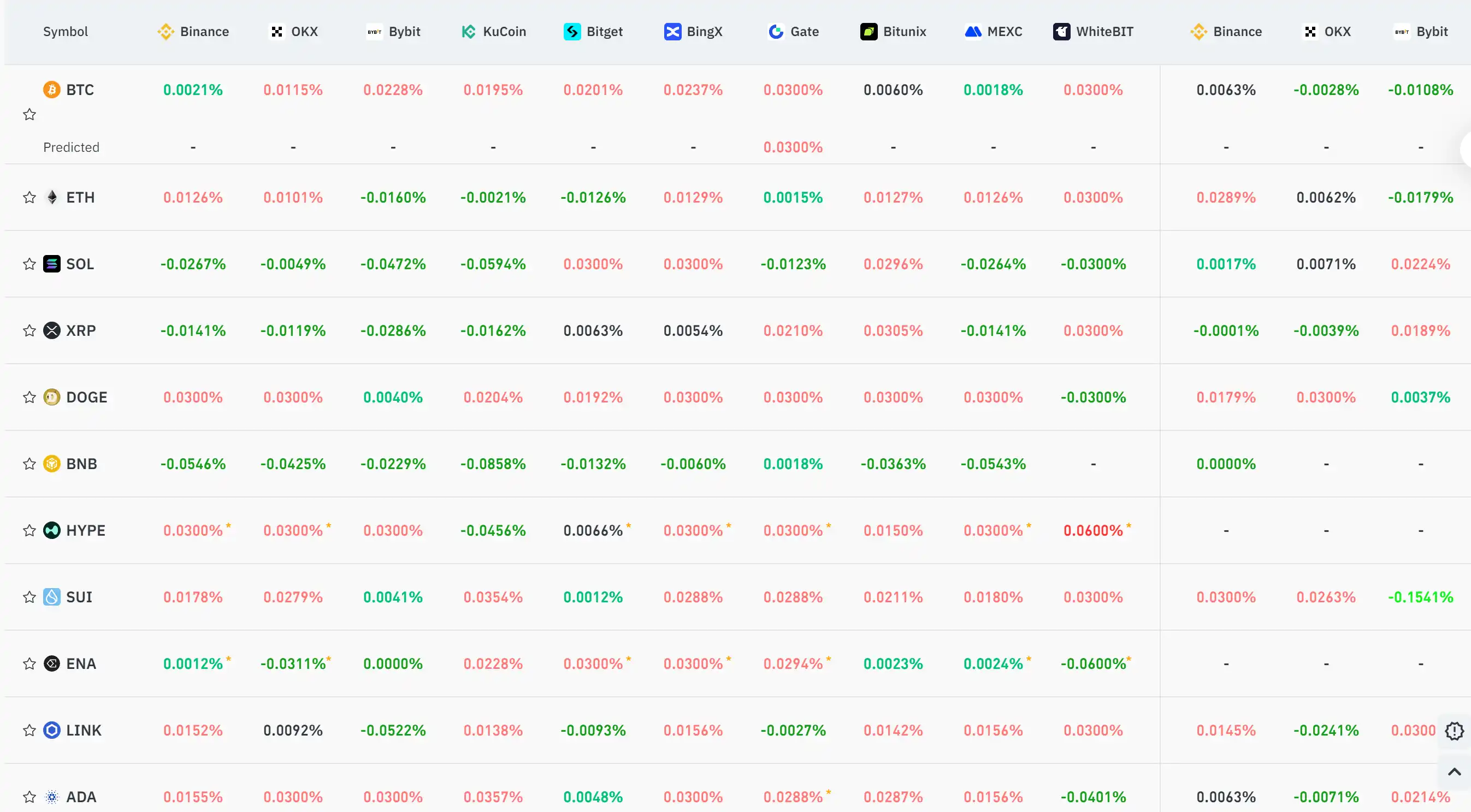

Funding Rate

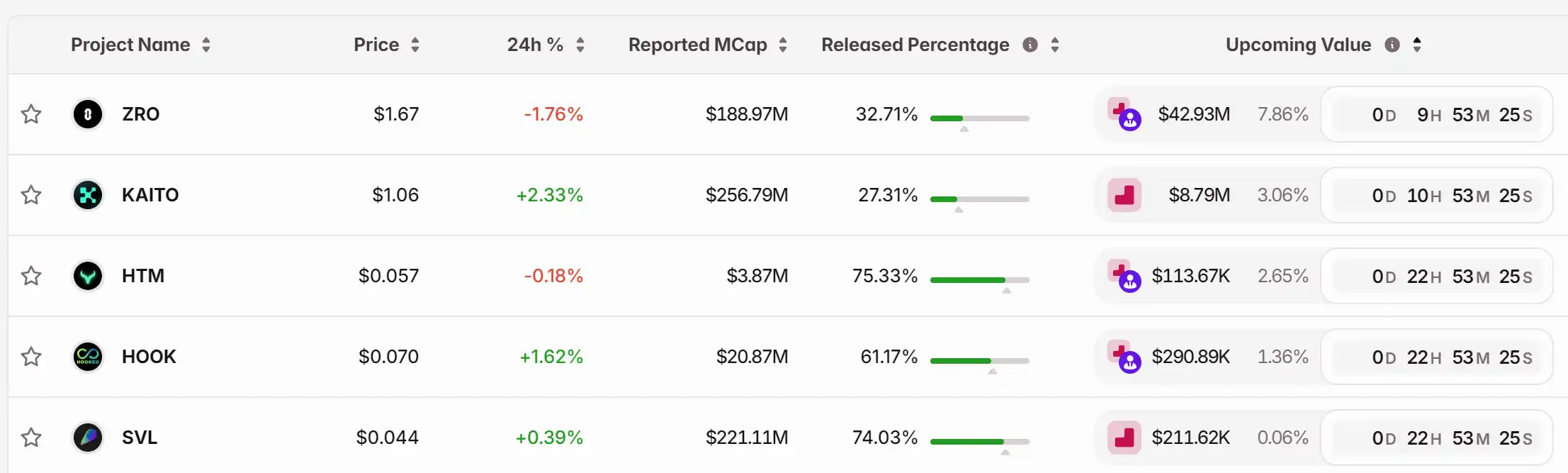

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Netflix’s co-CEO talked about the Warner Bros. agreement with Trump

Short the Prediction Market

Mean Reversion of the Super Cycle of Speculation

Timeless Insights on Investing from 1927: How Human Behavior Continues to Shape Market Outcomes

- McNeel’s 1927 treatise and Buffett’s strategies emphasize intrinsic value and emotional discipline, countering market volatility through long-term focus. - Behavioral finance validates their approach, showing emotional biases like panic selling distort valuations during crises, while disciplined investors capitalize on dislocations. - Compounding through retained earnings, exemplified by Berkshire Hathaway’s Apple investments, highlights patience’s role in outperforming reactive market timing. - Modern v

Vitalik Buterin's Promotion of ZK Technology and the Prospects for DeFi: An In-Depth Strategic Investment Review

- Vitalik Buterin is driving blockchain's ZK-DeFi convergence, prioritizing scalability and privacy as Ethereum's core upgrades. - His GKR protocol accelerates ZK verification tenfold, while hybrid ZK-FHE/TEE solutions enhance security for voting and governance. - ZK rollups now process 15,000-43,000 TPS, with institutions like Deutsche Bank adopting them for compliance and supply chain transparency. - The $7.59B ZKP market (22.1% CAGR) and $237B DeFi TVL highlight ZK's role in enabling institutional-grade