Bitcoin (BTC) Price Analysis for October 19

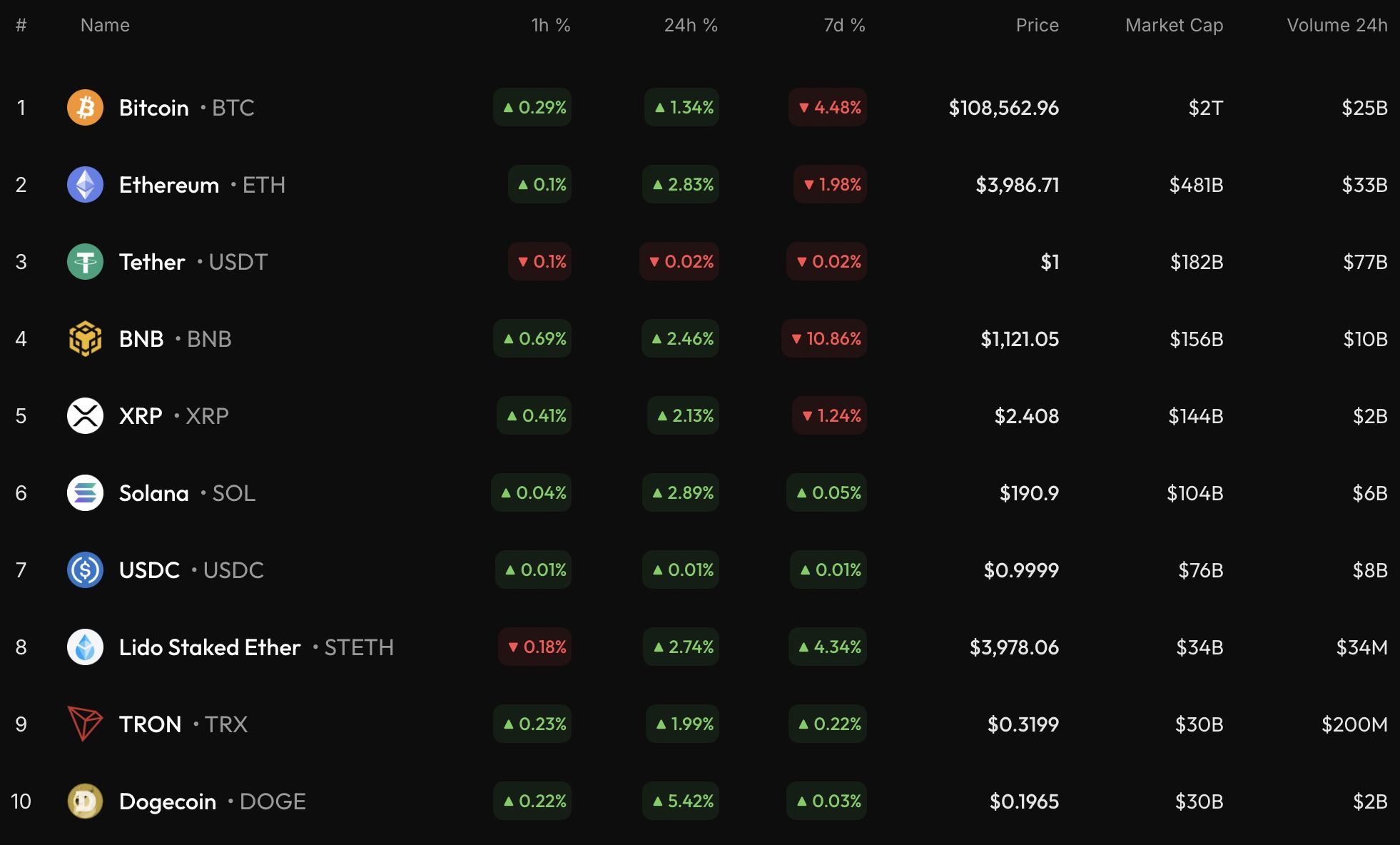

The rates of most coins keep rising on the last day of the week, according to CoinStats.

BTC/USD

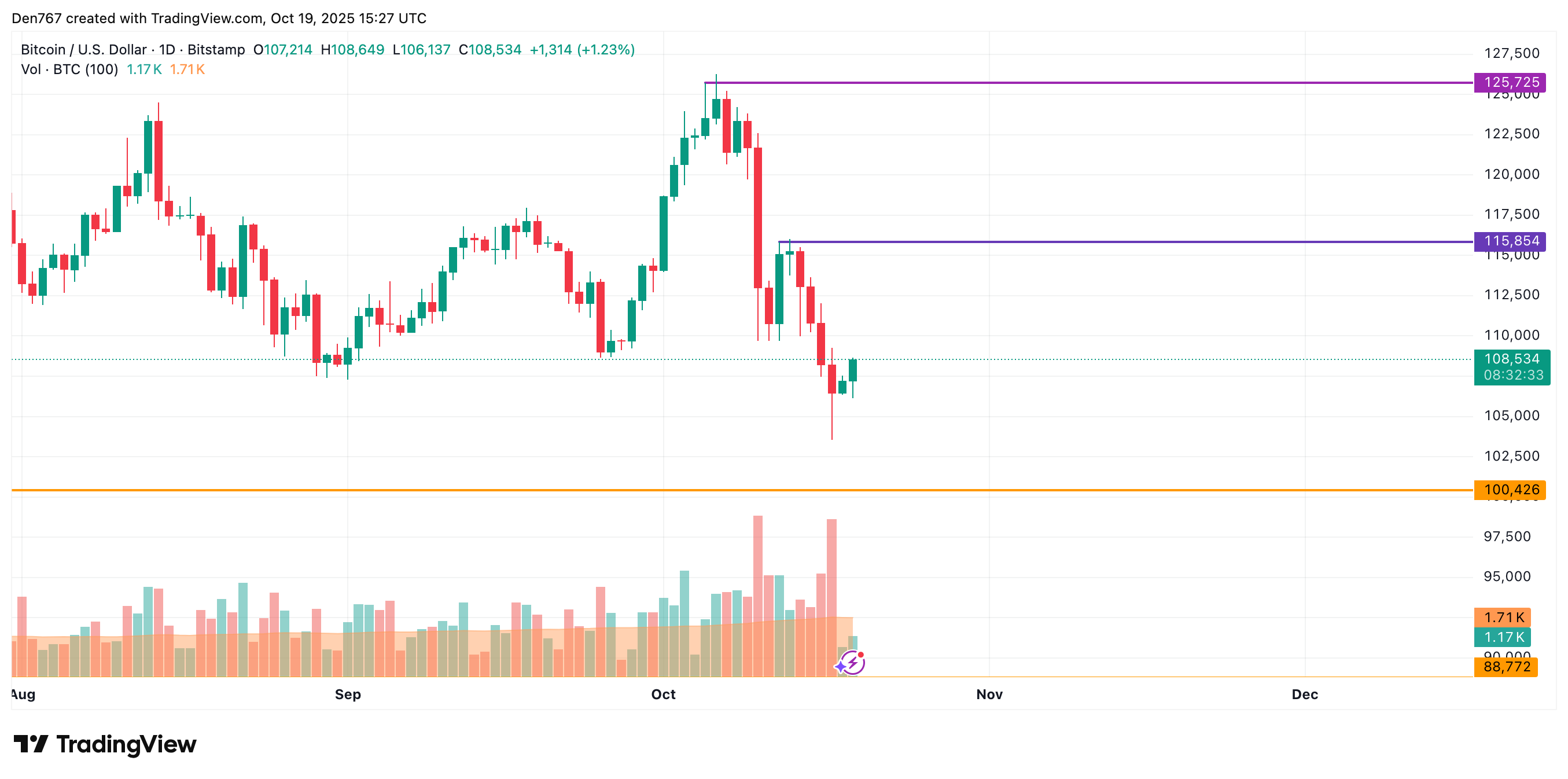

The price of Bitcoin (BTC) has gone up by 1.34% over the last 24 hours.

On the hourly chart, the rate of BTC has broken the local resistance of $108,234. If the daily bar closes above that mark, the upward move is likely to continue to the $109,000 range.

On the bigger time frame, the price of the main crypto is going up after yesterday's bullish closure. However, the volume is low, which means bulls might need more time to get strength for a continued move.

In this regard, consolidation in the narrow range of $108,000-$110,000 is the more likely scenario.

From the midterm point of view, the situation is less positive for buyers. If the weekly bar closes near its low, there is a high chance of a test of the support of $100,426 by the end of the month.

Bitcoin is trading at $108,455 at press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

MAHA's Struggle with Identity: Corporate Connections Versus Community Origins

- Robert F. Kennedy Jr.'s MAHA movement faces internal fractures as corporate partnerships and policy shifts alienate grassroots supporters. - Critics accuse the administration of abandoning anti-vaccine roots through $500M funding cuts and collaborations with biotech firms like Eli Lilly . - Former allies condemn MAHA's "identity crisis," while 67% public support persists despite warnings about coalition dilution from experts. - Kennedy defends pragmatic alliances as necessary for governance, but faces pr

Redefining Confidence: How DeFi's Openness is Transforming Crypto Lending

- DeFi platforms now dominate 66.9% of crypto lending, surpassing CeFi with $41B in Q3 2025 growth driven by yield farming and innovations like Pendle tokens. - The shift reflects demand for transparency and composability, with Aave's Plasma blockchain attracting $3B in borrows within weeks and Mutuum Finance's $20M presale highlighting DeFi's permissionless liquidity. - CeFi lenders like Tether hold 59.91% of tracked loans but face 33% smaller market size than 2022 peaks due to stricter collateral rules a

Bitcoin News Update: Crypto at a Turning Point: Major Investor Acquires $2.3B While $3.8B Leaves ETFs

- Bitcoin's RSI hit a 2022 low (33), signaling extreme oversold conditions as institutional buyers and crypto whales re-enter the market. - Ark Invest led $79. 3M in crypto stock purchases (Bullish, Circle , Bitmine) while U.S. spot Bitcoin ETFs saw $3.79B in November outflows. - Whale accumulation added $2.3B in BTC (26,300 coins) but contrasted with BlackRock's $523M IBIT redemption and Owen Gunden's $1.3B BTC liquidation. - Market analysts highlight conflicting signals: Ark's "buy the dip" strategy vers

Van Eck CEO Managing Billions of Dollars Says, “If This Happens, We’ll Walk Away from Bitcoin,” Names One Altcoin