Europe’s Crypto Adoption Shifts: Russia Now in the Lead

The latest European Crypto Adoption report by blockchain analytics firm Chainalysis shows that Russia has surpassed the United Kingdom, emerging as the leader in cryptocurrency adoption in Europe. Despite steady growth across the region, Russia now holds the top position, while the UK and Germany trail behind.

In brief

- The UK and Germany trail behind as Russia rises to lead Europe in crypto adoption.

- Russia received $376.3 billion in cryptocurrency inflows between July 2024 and June 2025, surpassing the United Kingdom.

- Institutional participation and decentralized finance activity are driving much of Russia’s rapid growth.

Russia Leads Europe in Crypto Activity

Between July 2024 and June 2025, Russia’s crypto market saw inflows of $376.3 billion, surpassing the $273.2 billion recorded by the United Kingdom. This marks a shift in regional leadership, as the UK had previously held the dominant spot. Chainalysis attributes Russia’s rise to a combination of growing institutional activity and the rapid expansion of decentralized finance (DeFi) usage.

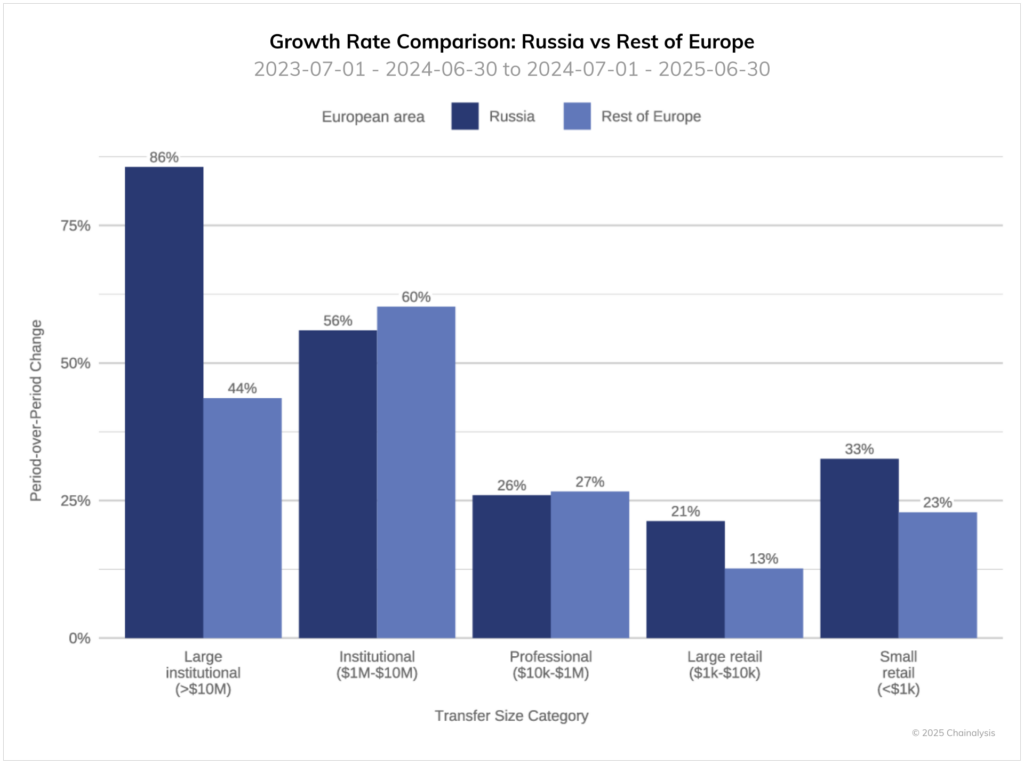

Chainalysis’ findings indicate that large cryptocurrency movements in Russia— those exceeding $10 million—rose by 86% compared with the previous reporting period. This pace is nearly double the 44% growth rate seen across other European countries. Such activity reflects stronger participation from institutions, including corporations and major investors, which now account for a larger share of the country’s crypto volume.

Other parts of Russia’s crypto market showed steady growth, with both large and small retail users recording year-on-year increases about 10% higher than in other European countries.

Russia leads crypto growth in most transfer categories in Europe.

Russia leads crypto growth in most transfer categories in Europe.

Further Growth from DeFi and Stablecoin Activity

At the same time, DeFi activity in Russia rose sharply. Chainalysis explained that “early 2025 saw DeFi activity surge to eight times its previous levels, eventually stabilizing at roughly three and a half times the mid-2023 baseline.”

The report pointed to the ruble-pegged stablecoin A7A5 as an example of Russia’s growing role in digital finance. Introduced in early 2025, A7A5 has become a major tool for cross-border payments among institutional and business users.

Even while facing multiple sanctions, the stablecoin grew to become the largest outside the U.S. dollar by market capitalization. By late September, its value had reached $500 million, surpassing other non-U.S. dollar stablecoins, including Circle’s euro-pegged EURC.

Other European Crypto Markets Show Strong Growth

Although Russia now leads the region, several other European crypto markets also experienced notable progress.

- Germany recorded 54% growth, showing its rising appeal as a base for crypto-focused companies.

- Ukraine and Poland recorded 52% and 51% growth, respectively, supported by everyday use and increasing remittance activity.

Regulation and Institutional Interest Reshape Europe

According to Chainalysis, the European crypto market between 2024 and 2025 has entered a stage of advanced transformation. This evolution has been influenced by factors such as the rollout of the Markets in Crypto-Assets (MiCA) regulatory framework, stronger institutional engagement, and the ongoing growth of DeFi adoption.

MiCA regulations have provided clearer guidelines for crypto operations across the European Union, helping formalize industry standards and attract institutional investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.