Altcoin Price Plummets, Developers Announce Buyback to Cover Losses

The Astra Nova (RVV) team announced that they will be buying back the affected RVV tokens from the market following recent events.

The company stated, “In light of recent developments, Astra Nova will repurchase an amount of RVV equivalent to the affected tokens. This decision reflects our commitment to protecting token holders, stabilizing liquidity, and strengthening long-term trust in the RVV ecosystem. We will share the official timeline for the repurchase process soon.”

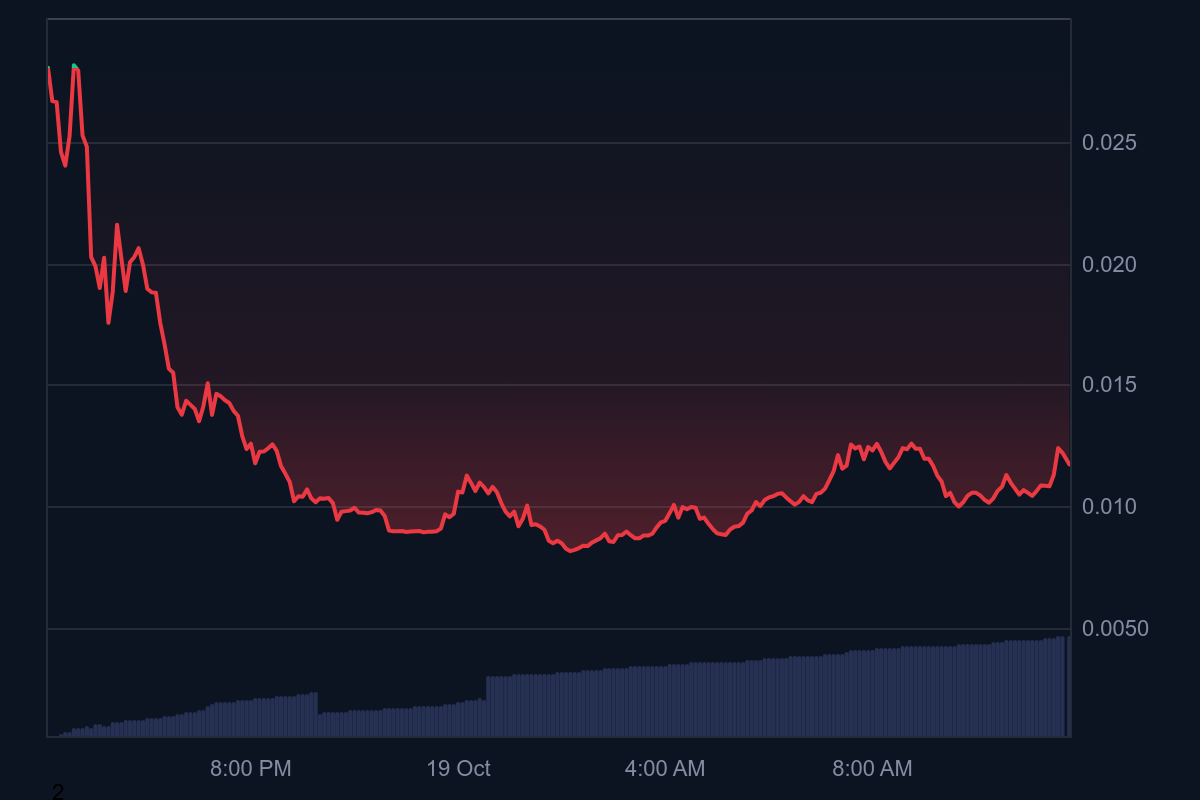

Astra Nova (RVV) recently announced that a third-party market maker account was hacked, and attackers took over the account and began selling assets. The team maintained that they had notified all exchange partners following the incident and that the project's smart contracts and infrastructure were fully secure and audited.

Astra Nova had stated that they were monitoring the fund movements together with on-chain security analysis institutions and that they would turn the matter over to law enforcement after the evidence was collected.

Officials claimed that the Astra Nova ecosystem remains robust and the process will be conducted in a transparent manner.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: "As ETFs Experience Rapid Growth, Metaplanet Remains Steadfast in the Battle for Bitcoin Leadership"

- Metaplanet holds 30,823 BTC, aiming for 210,000 by 2027 via preferred shares. - MicroStrategy's market value discounts raise debt concerns despite CEO's confidence. - ETF growth and institutional interest shift Bitcoin's perception as a long-term asset. - Japan's $2T assets drive Metaplanet's Bitcoin-backed fixed-income strategy.

Bitcoin News Today: Bitcoin’s Plunge Below $96K Sparks Concerns Over a Bear Market Resurgence Similar to 2024

- Bitcoin fell below $96,000, erasing 2025 gains and triggering $44M in liquidations as ETF outflows hit $870M. - Market cap dropped 5.4% to $3.36T, with Ethereum and XRP hitting multi-month lows amid weak demand. - Chain metrics show 815,000 BTC sold by long-term holders, while Bull Score Index collapsed to 20 from 80. - Technical indicators warn of further declines below $93,500, testing 2024 bear market lows if support breaks. - MicroStrategy added $835M BTC despite criticism, but fear/greed index hit 1

Bitcoin News Today: Bitcoin ETFs See $870M Outflow as Long-Term Holder Selling Drives Price Near $80k

- Bitcoin’s price nears $80,000 as fear indices hit 16, signaling panic-driven capitulation. - $870M ETF outflows and 815,000 BTC sold by LTHs accelerate downward pressure since October. - Key technical levels breached: 365-day SMA broken, 50-week SMA at risk, bear market risks rising. - Ethereum faces 200-day EMA resistance; whales accumulate ETH despite $3.66B in ETF outflows. - STHs near 12.79% losses, 6-12M holder cost basis at $94,000 may offer temporary support.

Bitcoin News Update: Bitcoin ETF Sees $1.5 Billion Withdrawals While Institutional Investors Increase Their Holdings

- BlackRock's IBIT ETF saw $1.5B net outflows over 10 days as investors reassess Bitcoin exposure amid volatility. - Harvard University boosted IBIT holdings to $442.8M, surpassing its combined stake in major tech firms, while diversifying into gold . - Institutional ownership in IBIT rose to 29% QoQ, with UAE entities and sovereign wealth funds among key holders, signaling crypto's growing institutional acceptance. - KuCoin expanded institutional services as ETF outflows highlight market recalibration, wi