Date: Sun, Oct 19, 2025 | 04:58 AM GMT

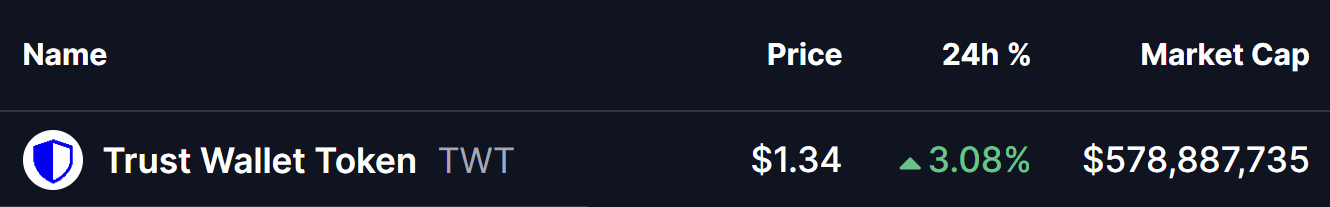

The cryptocurrency market is showing mild weekend relief after a choppy week, with both Bitcoin (BTC) and Ethereum (ETH) trading slightly in the green. Amid this modest recovery, several altcoins are showing signs of renewed strength — including Trust Wallet Token (TWT).

TWT is posting modest gains today, extending its positive momentum as a key harmonic pattern on its chart suggests that the rally could be far from over.

Source: Coinmarketcap

Source: Coinmarketcap

Bearish Gartley Pattern in Play?

On the 4-hour chart, TWT appears to be forming a Bearish Gartley harmonic pattern, a formation that often signals the completion of a corrective structure before a potential upside continuation.

The pattern began at Point X ($1.7287), followed by a steep decline to Point A, a rebound toward Point B, and another pullback that pushed the price lower to Point C near $1.2082. After hitting that low, TWT has shown signs of stability, now consolidating around $1.3448 as traders await a breakout confirmation.

Trust Wallet Token (TWT) 4H Chart/Coinsprobe (Source: Tradingview)

Trust Wallet Token (TWT) 4H Chart/Coinsprobe (Source: Tradingview)

Adding to the confluence, TWT’s 100-hour moving average (MA) — currently positioned near $1.4176 — acts as a key resistance to watch. A decisive move and sustained close above this level could confirm a bullish structural shift, potentially flipping it into a strong support zone for the next leg up.

What’s Next for TWT?

For this bullish setup to stay valid, TWT needs to hold support along the CD leg while gradually reclaiming levels above the 100-hour MA. If successful, the harmonic structure suggests a possible rally toward the Potential Reversal Zone (PRZ) — between $1.5749 and $1.7287, aligning with the 0.786 to 1.0 Fibonacci retracement levels.

This range represents an estimated 28% potential upside from current levels, implying that TWT could be gearing up for a meaningful rebound if broader market sentiment continues to stabilize.

However, traders should remain cautious. A breakdown below $1.31 would likely invalidate the pattern, suggesting that further consolidation or downside movement could follow before any sustained uptrend resumes.