Here’s How High XRP Could Easily Reach If Total Supply Shrinks by 40% by 2035

As XRP continues trading under $2.3, discussions about its long-term scarcity and deflationary nature are gaining renewed interest.

The XRP Ledger, known for its fixed supply of 100 billion tokens, steadily burns XRP through transaction fees. Currently, burns on XRPL average around 5,000 tokens daily.

Although small in scale, some analysts believe these incremental burns, combined with future increases in network activity, could meaningfully reduce XRP’s total supply over the next decade.

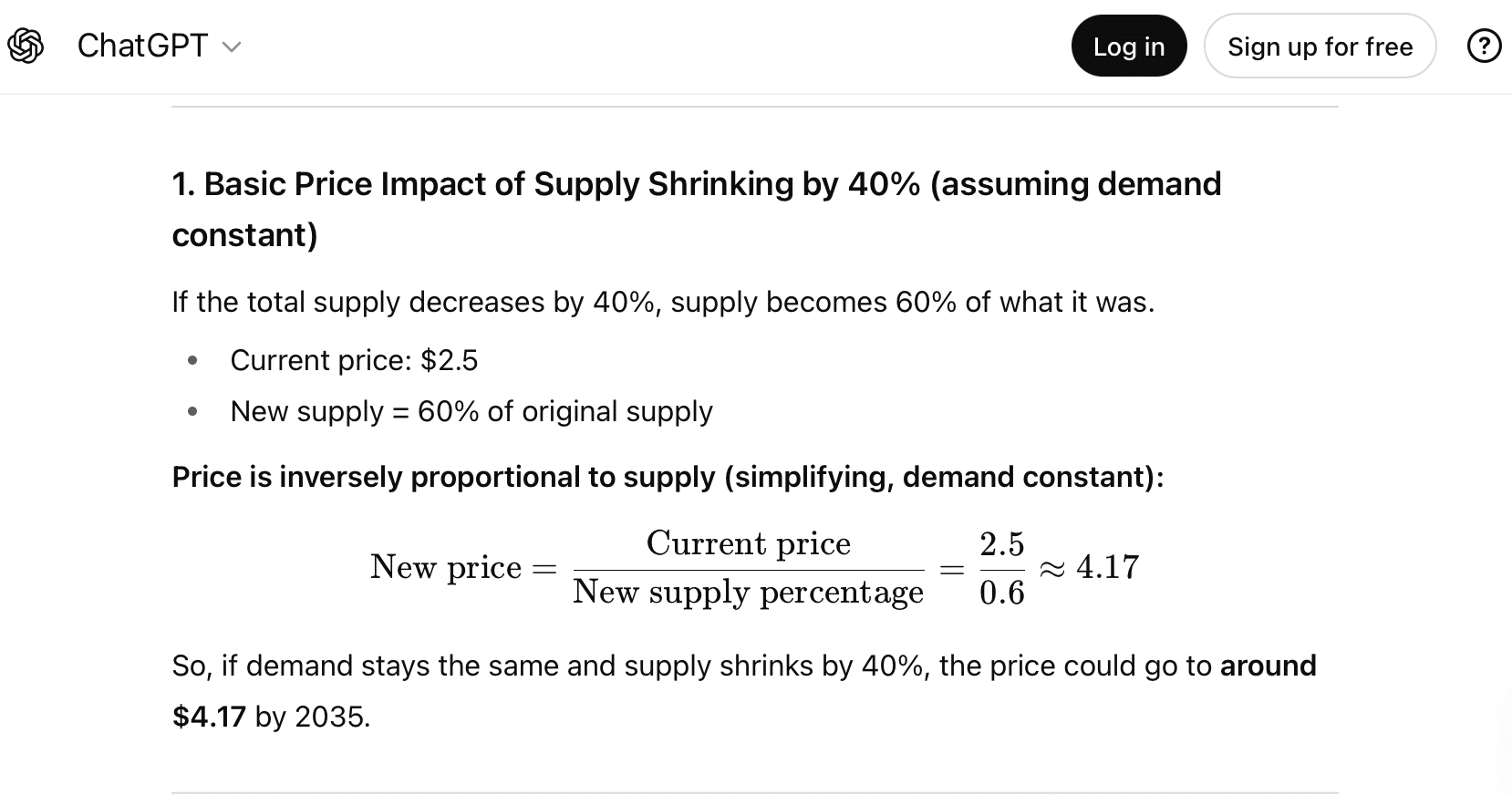

Under this scenario, if demand stays the same and supply shrinks by 40%, the price could be around $4.17, according to a proportional valuation model. This represents a 49% increase from its current level, driven solely by scarcity rather than demand growth.

The Demand Factor

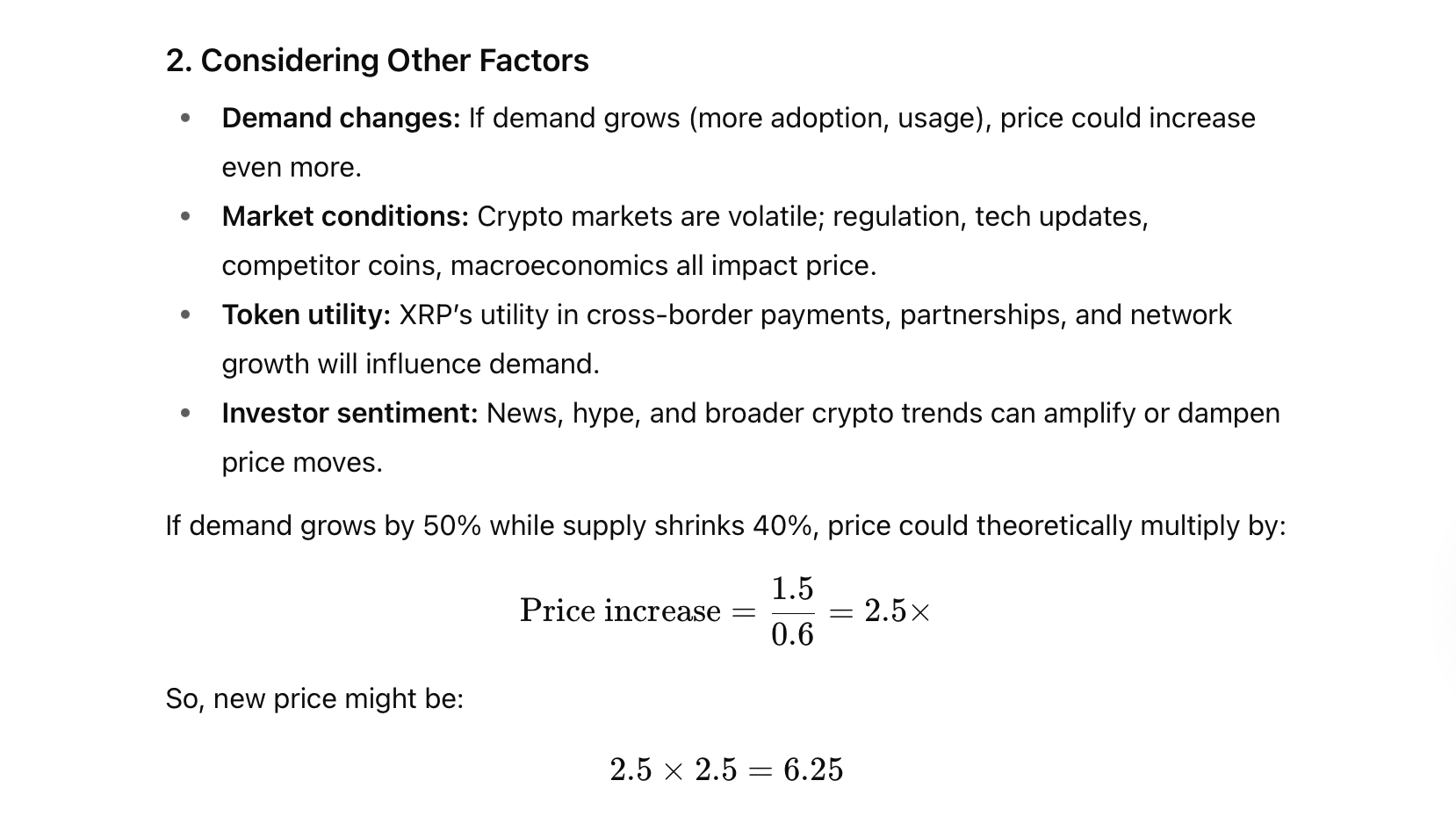

Meanwhile, price movements in crypto rarely depend on supply alone. XRP’s long-term performance will hinge on demand-side catalysts. These include institutional adoption, payment volume through RippleNet, and the growth of tokenized settlements on the XRP Ledger.

If global utility expands, particularly through Ripple payment solutions, financial integrations, and corporate treasuries, the combination of rising demand and contracting supply could amplify price gains.

For example, a 50% rise in demand alongside a 40% supply cut could theoretically send XRP toward $6.25. Meanwhile, with a doubling in demand, prices could surpass $8.

However, the deflationary impact becomes even more pronounced if network activity accelerates. If XRP burns 15,000 to 20,000 tokens per day—a three- to fourfold increase from current levels—its total supply could shrink more aggressively.

By 2035, such an intensified burn rate could erase over 100 million XRP. This tightening of circulating liquidity suggests prices could reach the $12–$16 range, assuming constant demand.

Realistic Outlook: Slow Burn, Long-Term Impact

Despite the bullish math, a 40% supply reduction by 2035 remains a challenging feat. The current burn rate of 5,000 XRP per day translates to roughly 1.8 million XRP per year, or about 20 million XRP burned by 2035.

That’s a small fraction of the total supply. To achieve a meaningful supply shock, XRP network usage would need to surge exponentially to drive higher transaction fees and faster burns.

Still, XRP’s fixed maximum supply and steady deflationary model provide a foundation for long-term appreciation. Even moderate increases in daily burns, paired with rising adoption, could strengthen its scarcity narrative.

XRP Price Beyond Supply Reduction

Beyond supply reduction through token burns, analysts have projected far more ambitious price targets for XRP by 2035, which exceed what supply dynamics alone would suggest.

For instance, Tradeship University founder Cameron Scrubs believes XRP could become the number one cryptocurrency by 2030, potentially overtaking Bitcoin.

Other XRP commentators, such as Coach JV, share a similar sentiment. Notably, these outlooks envision XRP prices surpassing $300.

Meanwhile, the Changelly exchange believes XRP could reach $115 by December 2034.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell faces the ultimate test: At least three dissenters at the December meeting, Federal Reserve consensus collapses!

The "Fed mouthpiece" reported that internal divisions within the Federal Reserve have intensified amid a data vacuum, with three board members appointed by Trump strongly supporting a dovish stance, while the hawkish camp has recently expanded.

Weekly Hot Picks: Data Disappearance Doesn’t Stop the Fed’s Hawkish Stance! Global Multi-Asset Markets Face “Backstabbing”

The U.S. government shutdown has ended, but the release of key data remains chaotic. The Federal Reserve has sent frequent hawkish signals, causing significant declines in gold, silver, stocks, and currencies on Friday. The U.S. has launched Operation "Southern Spear". Buffett delivered his farewell letter, and the "Big Short" exited abruptly. What exciting market events did you miss this week?

SignalPlus Macro Analysis Special Edition: Is It Going to Zero?

Over the past week, cryptocurrency prices declined once again. BTC briefly reached $94,000 on Monday due to lighter selling pressure before pulling back, and major cryptocurrencies saw further week-on-week declines...