Arthur Hayes’ family office seeks $250m for crypto buyout fund: Bloomberg

Arthur Hayes’s family office is looking to raise at least $250 million for a new fund that will invest in or acquire medium-sized cryptocurrency firms.

- Arthur Hayes’ family office eyes a new fund to buy crypto companies.

- Maelstrom Equity Fund I has an initial target of $250 million and $1 billion by September 2026.

- The fund will invest $40 million to $75 million in each deal, with a focus on cash generating companies.

Maelstrom, the family office of BitMEX co-founder Arthur Hayes, is seeking $250 million for its debut private equity fund, which, as Bloomberg reported on Oct. 17, 2025, will target buyouts of distressed or undervalued crypto infrastructure and services companies.

A $250 million war chest for crypto investments

The fund, Maelstrom Equity Fund I, will seek equity stakes in trading and data analytics platforms, with each deal struck via special purpose vehicles.

Per the report , Maelstrom plans to plough between $40 million and $75 million into each acquisition – with the target being as many as six crypto related investments.

Maelstrom co-founder and managing partner Akshat Vaidya noted that the fund’s goal is to scoop up crypto platforms with income-generating models, strong fundamentals, and clearer valuations.

Rather than the previous strategy of buying startup tokens, Maelstrom plans to focus exclusively on equity capital. The gist of what the fund invests in will be “off-chain” companies, crypto-related platforms with realistic valuations, not prone to the deceptive environment of inflated token prices.

“You can’t artificially inflate value with a token that isn’t used in the off-chain world,” Vaidya noted.

Fund targets $1b raise

Hayes and the team, including new partner Adam Schlegel, plan to register this new fund in the United States. The group’s fundraising efforts will focus on institutional investors, pension funds, and family offices, they said in a statement.

Vaidya added that the private equity fund will be for investors keen on the crypto investment space, offering an initiative they can tap without the technical expertise that makes the market complex to navigate.

While Maelstrom Equity Fund I is expected to have its first closing in March 2026, the plan is to reach a total of $1 billion by September of that year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Turmoil and AI Breakthroughs: Grok 4.1, Gemini 3, Cloudflare Outage

AI Confidence and Economic Concerns Set Crypto Strength Against Market Downturn

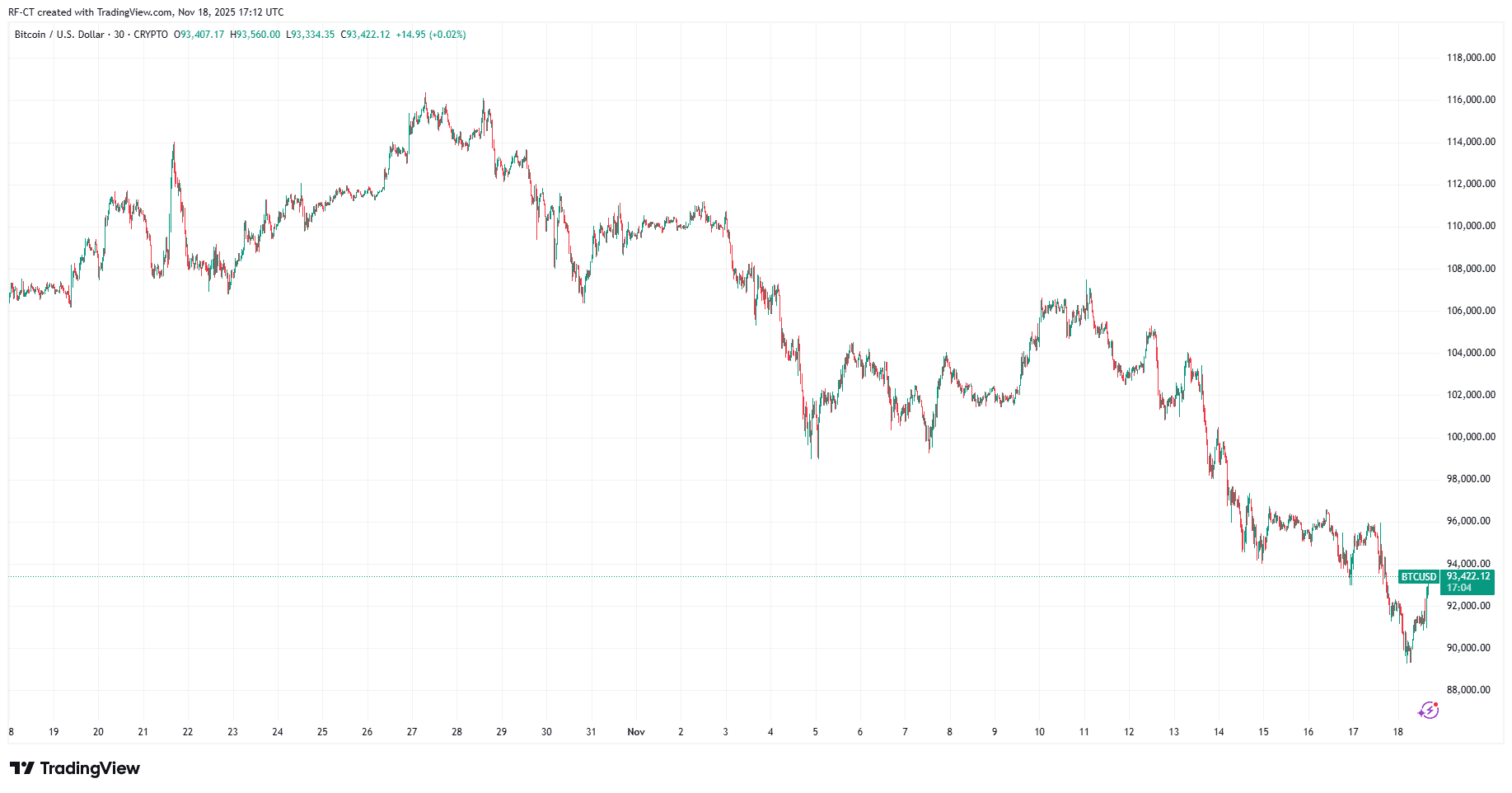

- U.S. stock indexes fell on Nov. 18, 2025, while crypto and AI-linked stocks showed resilience amid broader market weakness. - Nvidia's upcoming earnings and 54% YOY EPS forecast fueled gains in correlated stocks like TSMC (+41% YTD) and SMCI (+15% YTD). - Bitcoin rebounded 1% temporarily, but analysts warned crypto remains vulnerable to inflation fears and $1B+ leveraged liquidations. - Home Depot's 3% premarket drop dragged on the Dow after missing Q3 earnings and slashing profit forecasts amid housing

Solana's Breakthrough: Ushering in a New Age of Fast and Scalable Smart Contracts?

- Solana's 2025 upgrades (Firedancer, Alpenglow) achieved 1M TPS and sub-150ms latency, outperforming Ethereum and Sui . - Enterprise partnerships with Visa , PayPal , and Stripe leverage Solana's speed and low fees for payments and remittances. - Institutional ETF inflows and energy-efficient proof-of-history consensus boost Solana's appeal for green finance. - Challenges include competition from Ethereum upgrades, stablecoin liquidity declines, and regulatory risks.

Trump’s Federal Reserve Shakeup Raises Concerns Over Stagflation and Divides Within GOP

- Trump announced his Fed chair pick but withheld the name, criticizing resistance to removing Powell before his 2026 term ends. - Shortlisted candidates include Waller, Bowman, and Rieder, with Trump hinting at a "standard" choice amid political tensions. - The dispute with Rep. Greene over Epstein files highlights GOP fractures, as Trump accused her of betraying party loyalty. - Critics warn politicizing the Fed risks stagflation, while the Epstein files debate underscores transparency vs. loyalty tensio