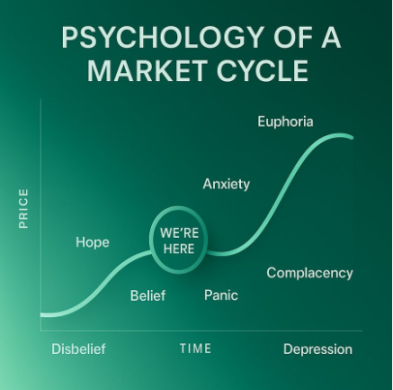

This is not a bull market signal, but one of the most dangerous turning points in history.

During the recent market turbulence, although Bitcoin experienced the largest correction of this cycle,

on-chain data shows that about 90% of holders are still in a profitable state.

This sounds very “bullish,” but from historical experience,

when almost everyone is making money, it is often the time when market risk is at its highest.

❶ High Profitability Rate = Potential Point of Divergence

On-chain data shows that currently about 95% of BTC wallets are still in profit.

This is one of the most extreme levels in history.

In every previous cycle, when the profitability rate broke through 90%,

the market usually underwent a sharp adjustment within a few weeks.

The reason is simple:

When “everyone wins,” some veteran players are already quietly selling off.

❷ Repeating the Structure of April 2021

A similar structure appeared in April 2021.

At that time, the proportion of profitable wallets also exceeded 94%,

and then Bitcoin dropped by 50% within a few weeks.

Smart money did not exit the market, but began to shift from BTC to ETH and the altcoin sector.

Today's on-chain data is almost identical to that time.

❸ Old Addresses Awakening: Prelude to Profit Taking

In the past few weeks, old wallets that had been dormant for three to five years have begun to show signs of activity.

These long-term holders partially cash out before the top of every bull market,

and this time is no exception.

Meanwhile, Bitcoin dominance (BTC.D) is consolidating at a high level,

and historical experience shows that this usually signals the imminent start of capital rotation.

❹ Retail Investors Are Optimistic, Institutions Are Exiting

The number of new addresses has increased by 18% within a month,

indicating that retail investors are entering the market with full positions.

However, ETF capital inflows have begun to slow down,

and incremental demand from institutions is weakening.

This is a dangerous combination:

“Smart money” is exiting,

while “emotional money” is increasing their bets.

❺ Extreme Greed and Rotation Signals

The Fear & Greed Index

is currently in the extreme greed zone.

Historically, whenever market sentiment reaches this level of excitement,

what follows is always a rapid cooling off.

Meanwhile, the activity of ETH and the DeFi sector is rising,

indicating that capital is already seeking new premium opportunities.

❻ Reviewing History: Every Time After 95% Profitability, the Story Is the Same

In the bull markets of 2017 and 2021,

when the proportion of profitable wallets exceeded 95%:

large funds began to reduce their BTC positions;

capital flowed into mid- and low-cap coins;

the market experienced a short-term correction, followed by a major rally in altcoins.

Investors who stayed in Bitcoin missed out on the main gains that followed.

❼ Current Stage: Not the End, but the “Eve of Divergence”

Today's market almost perfectly replicates the structure of spring 2021.

Everyone feels like a winner,

but this “everyone profits” balance has never lasted long.

In the coming weeks,

weak hands will be shaken out,

strong hands will rebuild positions,

and the bull market will enter a more “intelligent” phase.

Conclusion:

This is not the end of the bull market,

but rather a period of divergence in sentiment and structure.

When 90% of people are still in profit,

smart money will not wait for the last 10% of “fantasy gains,”

they will start reallocating, rotating, and positioning for the next sector.

For ordinary investors,

true victory is not “capturing the last bit of upside,”

but staying calm during the hottest times and accumulating positions during the quietest times.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hotcoin Research | Fusaka Upgrade Approaching: Analysis and Outlook on Ethereum Long and Short Positions

This article will review Ethereum's recent performance, provide an in-depth analysis of the current bullish and bearish factors facing Ethereum, and look ahead to its prospects and trends for the end of this year, next year, and the medium to long term. The aim is to help ordinary investors clarify uncertainties, grasp trends, and provide some reference to support more rational decision-making during key turning points.

Crypto Market Surges as Bitcoin Rebounds and Privacy Coins Shine

In Brief Bitcoin rebounded over the weekend, testing the $86,000 mark. Privacy-focused altcoins Monero and Zcash showed notable gains. Total market value surged, crossing the $3 trillion threshold again.

Crypto Markets Rebound as Traders Signal Seller Fatigue

In Brief Crypto markets rebounded amid significant liquidations and oversold RSI signals. Weekend trading conditions with thin liquidity influenced rapid price shifts. The rebound's sustainability remains uncertain, prompting scrutinous investor attention.

Cardano : Network security questioned after a major incident