172 Companies Now Hold 1.02 Million Bitcoins as of Q3 2025

In Q3 2025, bitcoin establishes itself as a pillar of companies’ financial strategies. With 1.02 million bitcoins held by 172 listed companies, the crypto queen moves beyond speculation to become an essential store of value. Decoding a revolution underway.

In brief

- In the third quarter of 2025, 172 companies now hold 1.02 million bitcoins, representing 4.87% of the total supply and a 40% increase compared to the previous quarter.

- Strategy, MARA Holdings and XX1 lead bitcoin adoption, with strategies ranging from aggressive accumulation to gradual integration.

- Despite volatility and regulatory risks, bitcoin asserts itself as a store of value and a diversification tool for companies.

Q3 2025: The historic rise of bitcoin in institutional portfolios

The third quarter of 2025 marks a turning point for bitcoin . Indeed, publicly traded companies holding bitcoin now represent nearly 40% of the total, that is 172 companies, compared to far fewer three months ago. Furthermore, the total volume has risen to 1.02 million bitcoins, accounting for 4.87% of the total supply. An increase of 20.87% in just three months, with a valuation exceeding 117 billion dollars.

Companies are no longer just observing: they are acting. In Q3 2025, 48 new companies have added bitcoin to their balance sheet, a record. Among them, historical players like Strategy , which has strengthened its position with an additional 40,000 bitcoins. But also newcomers attracted by the liquidity and market growth potential. This dynamic reflects a growing confidence in BTC as a safe haven asset and diversification tool.

Bitcoin giants: who holds what and why?

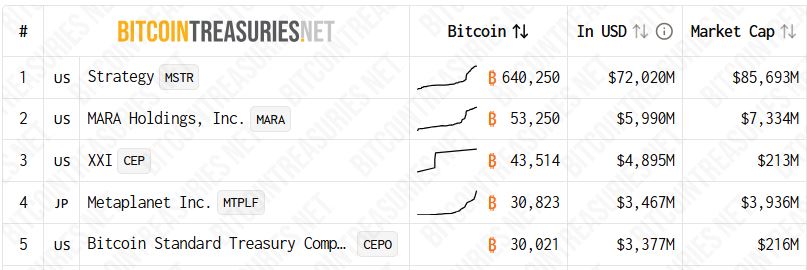

Among the 172 companies holding bitcoin in 2025, some stand out for the size of their reserves. Strategy, with 640,031 bitcoins, remains the undisputed leader, followed by MARA Holdings (53,250 BTC) and XX1 (43,514 BTC). These players adopt varied strategies:

- Aggressive accumulation for Strategy;

- Mining and targeted acquisition for MARA;

- Gradual integration for XX1.

The companies holding the most bitcoin in 2025.

The companies holding the most bitcoin in 2025.

Their motivation? A combination of inflation hedging, speculation on rising prices, and financial innovation. With 48 new players entering crypto treasury in the past 3 months , the movement is accelerating. Metaplanet, a Japanese company, embodies this trend in Asia, where bitcoin is increasingly viewed as a strategic asset. With 30,823 bitcoins, it demonstrates how Asian companies are embracing the topic. This, in response to unstable local monetary policies.

The record acquisition of 176,762 bitcoins in Q3 2025, mostly by American and Asian companies, highlights this race for adoption. Companies no longer just hold bitcoin: they integrate it into their business model. Whether to attract investors, optimize cash flow, or position themselves as pioneers in a booming market.

BTC: a legitimate corporate asset or a risky bet?

Despite its growing adoption, bitcoin remains a volatile and controversial asset. Its detractors point to sharp price fluctuations, such as the 20% drop recorded in 2024, or regulatory uncertainties, especially in the United States and Europe. For companies, these risks are not trivial: they can impact their stock market valuation and credibility with traditional shareholders.

However, the benefits are real. BTC offers a hedge against the depreciation of fiat currencies, a strong argument in a context of persistent inflation. It also allows companies to differentiate themselves by attracting investors and talent sensitive to technological innovations. Some companies, like Tesla, have already shown how bitcoin can serve as a communication and growth tool.

Bitcoin enters a new era dominated by companies , with reserves exceeding one million units. Between historic opportunity and calculated risk, its adoption raises a fundamental question: are we witnessing the emergence of a new financial standard, or a speculative bubble without a future?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.