The new meme has been memed, why are players angry this time?

Players want nothing fancy, just fairness

The day before yesterday, Binance launched the "Rebirth Support" plan and distributed the first batch of "Rebirth Support" airdrops yesterday, undoubtedly giving meme players on BSC another good topic to discuss.

However, a "forking" event sparked controversy among players.

The first "Rebirth" coin that gathered players' consensus and launched, had a contract address ending in "4444." As seen from the following candlestick chart, after a successful launch, the "Rebirth" coin with a contract ending in "4444" began to rise, reaching a peak market cap that once exceeded $15 million.

Approximately 8 hours later, another "Rebirth" coin, with a contract address starting with "4444," also successfully launched and quickly rose in the next 2 hours, reaching a peak market cap that once exceeded $12 million.

During the rapid rise of the new "Rebirth" coin, the OG "Rebirth" coin suffered a heavy blow, dropping by more than 50% at one point. At this time, a tweet from KOL Li Ping supporting the new "Rebirth" coin made him the target of players' criticism:

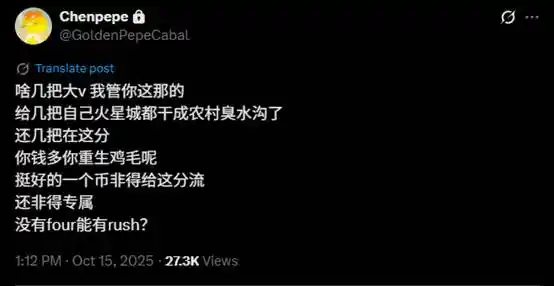

Soon after, another prominent supporter of the OG "Rebirth" coin, KOL Chenpepe, criticized this "forking" behavior:

Previously, "forking" situations have occurred in the crypto world, such as the cases of lowercase and uppercase Neiro, CZ's dog "Broccoli," and so on. However, this time, looking back at yesterday's scenario, Binance was still at the center of public opinion under a massive player "siege," and the BSC meme market was not as hot as before. Furthermore, the OG "Rebirth" coin had already reached a peak market cap of $15 million based on its spontaneous consensus. In this context, the sudden surge of the new "Rebirth" coin, accompanied by KOL endorsements, made it difficult for players supporting the OG "Rebirth" coin to believe that the new coin's uptrend was a result of a spontaneous consensus migration, rather than a conspiracy.

If these two coins had launched successfully at the same time and migrated to external trading to compete, players would not have such strong emotions. In the eyes of many players, if a highly influential KOL has a positive outlook on a topic and, in a situation where their financial capacity alone surpasses that of many ordinary players, joins in to develop the market cap further, what's the harm? Even if initially both coins had identical themes and tickers, competing on the same starting line would still be relatively fair.

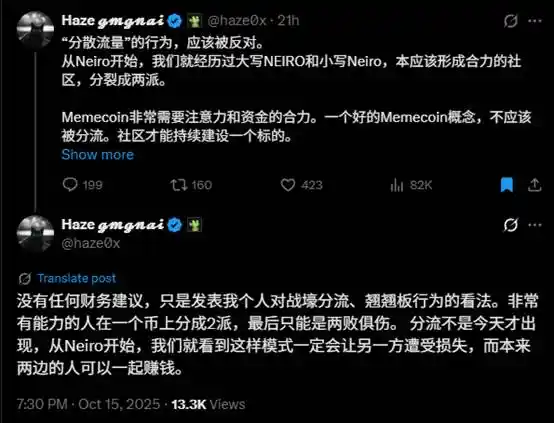

Last night, the founder of gmgn.ai, @haze0x, also expressed his opinion, stating that the act of "forking" should be opposed:

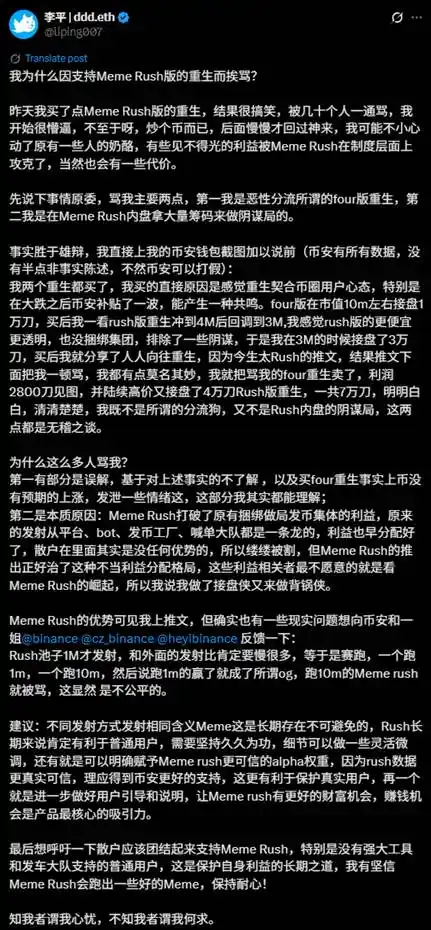

The controversial KOL Li Ping responded this morning, stating that he initially bought both coins but later shifted his support to the new "rebirth" coin, once again expressing support for the new "rebirth" coin:

Currently, the market capitalization of the new "rebirth" coin and the OG "rebirth" coin is both around $3.7 million, putting them back on the same starting line.

With CZ's tweet supporting Chinese tickers and the news of Binance possibly testing Chinese ticker contracts, Chinese ticker tokens in the BSC meme market have started to heat up. The turmoil between "rebirth" coins is unlikely to be resolved quickly but is expected to continue with the potential arrival of the second wave of Chinese market trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Billions Flow Out of Bitcoin ETFs While Stablecoins Strengthen as Core of Finance

- BlackRock's IBIT Bitcoin ETF recorded a record $523M outflow, pushing November's total U.S. spot Bitcoin ETF redemptions to $2.96B amid Bitcoin's 30% price drop. - Analysts link the exodus to weak fundamentals and macroeconomic uncertainty, with ETF outflows and long-term holder sales tightening liquidity and eroding investor confidence. - BlackRock filed for an Ethereum staking ETF as stablecoins surge in cross-border finance, processing $9T in 2025 payments while Bitcoin ETFs face sustained outflows an

Zcash (ZEC) Price Rally: Factors Fueling Privacy Coins Amid Regulatory Scrutiny

- Zcash (ZEC) surged 472% to $420 in 2025, driven by institutional adoption and regulatory clarity under the U.S. Clarity Act. - Grayscale's $137M Zcash Trust investment and Cypherpunk's $18M treasury boost signaled institutional confidence in privacy coins. - Zcash's dual-mode privacy features attracted investors fleeing Bitcoin's transparency, with 30% of its supply now in shielded pools. - Regulatory risks persist, including potential FinCEN crackdowns on shielded transactions, despite the Clarity Act's

Bitcoin Updates Today: Is Crypto’s Intense Fear Signaling a Market Bottom or Just a Misleading Decline?

- Crypto Fear & Greed Index fell to 24, with Bitcoin consolidating between $103,000-$115,000 amid prolonged market anxiety. - Extended fear periods historically precede market bottoms, but traders warn the index often lags and misfires in volatile conditions. - Coinbase aims to stabilize markets with 24/7 altcoin futures, yet regulatory clarity and persistent ETF outflows remain critical factors.

Bitcoin News Update: Bitcoin ETFs See $2.96 Billion Outflow as November Optimism Wanes

- BlackRock's Bitcoin ETFs lost $523M in single-day outflows on Nov 17, marking fifth consecutive net redemptions totaling $2.96B for November. - Despite November's historical 41.22% Bitcoin price surge, ETF redemptions signal cooling institutional/retail demand with average investor cost basis at $89,600. - Michael Saylor's firm bought 8,178 BTC at $102k average price, while JPMorgan warned Bitcoin-heavy companies risk index delistings by 2026. - BlackRock's IBIT holds 3.1% of Bitcoin supply but NAV multi