You Could Soon Pay For Your Favorite Subscriptions In Stablecoins Via Stripe

Stripe’s quiet move to enable stablecoin subscription payments could revolutionize crypto usability, making Web3 and stablecoins a seamless part of everyday transactions.

Stripe surreptitiously revealed that it will allow stablecoin payments for subscriptions and other recurring transactions, not just one-offs. This signals its increasing commitment to crypto.

Such a feature could provide a major onramp for crypto functionality, making all of Web3 that much more mainstream.

Stripe’s Stablecoin Subscriptions

Stripe, a global leader in payments processing, has been incorporating stablecoins for the past few months now. This took place after major acquisitions as part of a broader strategy to re-enter the crypto space.

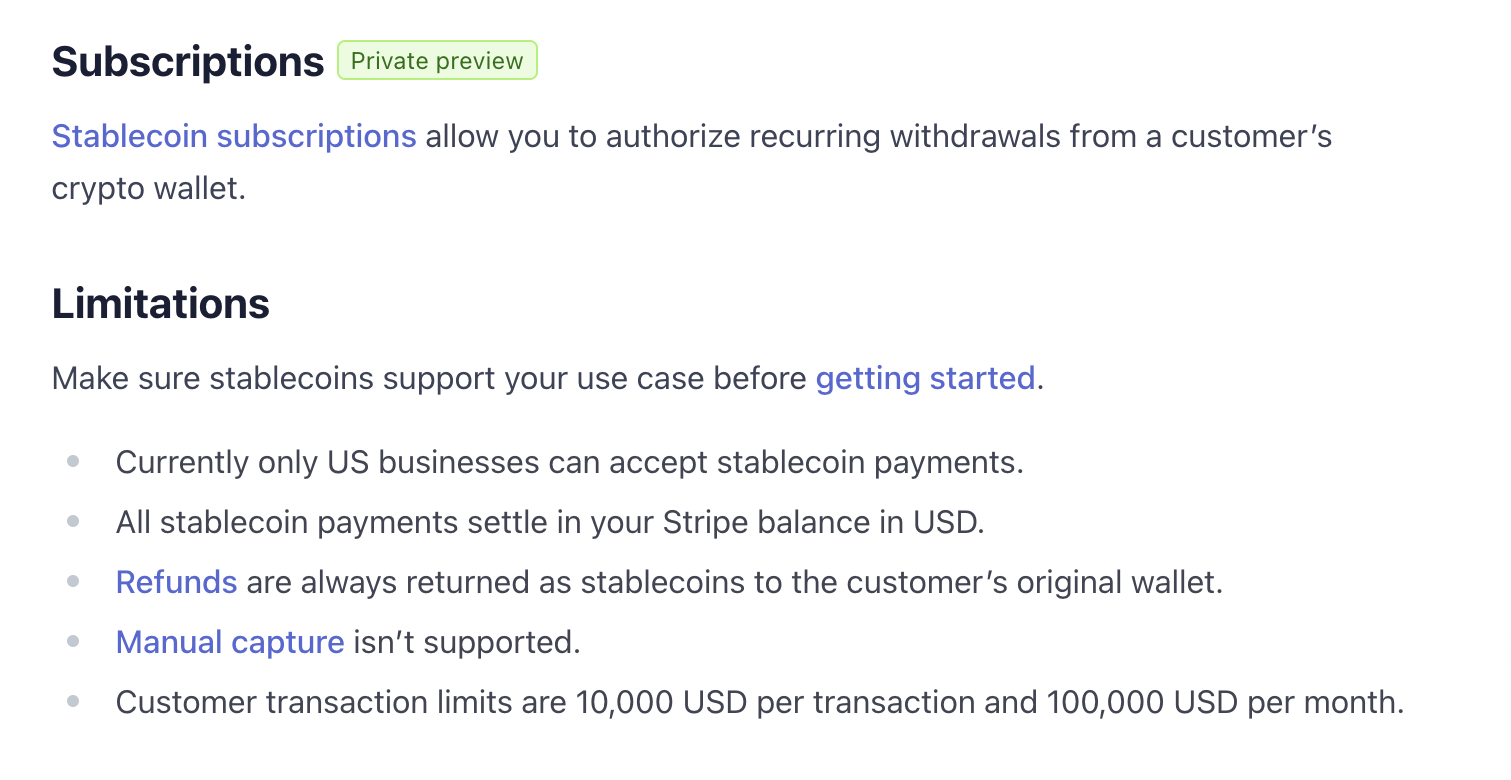

Today, unverified rumors have been circulating that Stripe would begin allowing stablecoins for subscription payments. Although the company hasn’t evidently announced it outright, a key clue corroborates these claims: a section labeled “private preview” on an FAQ page.

Stablecoin Subscription Payments. Source:

Stripe

Stablecoin Subscription Payments. Source:

Stripe

The line about subscription payments is very small, but still confirms that Stripe is adding or has already added this stablecoin functionality.

Such a move could have huge implications for crypto, enabling a major new onramp and functionality for stablecoins.

So far, it seems likely that USDC will continue being Stripe’s main stablecoin for this feature, but a lot is unclear. Either way, recurring payment functionality would fully cement this corporate giant’s interest in Web3.

Slack, Squarespace, Notion, and Shopify are just some of the big names that use Stripe’s payment module for subscriptions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Buyers Struggle to Maintain FILUSDT's $1.85 Level Amid Key Turnaround Attempt

- FILUSDT traders focus on $1.85 support as key reversal level amid bullish momentum signs. - Technical analysis shows RSI nearing oversold territory and WTI-like support patterns reinforcing potential rebound. - Successful defense of $1.85 could trigger $3.90 target, with $2.50-$2.70 zone acting as next critical validation point. - Broader crypto optimism and risk-on market conditions further support potential upward trajectory for FILUSDT.

G20 Crypto Agreement Strikes a Balance Between Fostering Innovation and Managing Worldwide Risks

- G20 leaders agreed to harmonize global crypto regulation, prioritizing stablecoin and DeFi standards to balance innovation with systemic risk mitigation. - The declaration includes a Critical Minerals Framework to ensure sustainable resource-driven growth in Global South nations while securing crypto infrastructure supply chains. - Market shifts show USDC overtaking USDT in on-chain activity due to regulatory clarity, while DeFi faces $12B liquidity stagnation from fragmented protocols. - Regulatory scru

Bitcoin Updates: Hybrid Investment Strategies Drive Surge in Bitcoin Purchases Amid Ongoing Market Slump

- Cardone Capital buys 185 BTC for $15. 3M at $82,500/coin, expanding its real estate-crypto hybrid portfolio amid crypto market weakness. - Bitcoin falls below $90K for first time in seven months as U.S. ETFs lose $3.79B in November outflows, with BlackRock's IBIT accounting for 63%. - Grant Cardone's hybrid model contrasts with pure-play crypto treasuries, using real estate cash flow to fund Bitcoin accumulation and claiming $125M in year-one EBITDA. - Market fears a prolonged bear market as Bitcoin drop

Bitcoin Updates Today: The Future of Bitcoin in 2026 Hinges on Federal Reserve's Actions on Inflation

- Bitcoin's 2026 recovery depends on Fed inflation policy linked to CPI, PPI, and PCE metrics. - Persistent CPI/PCE inflation above 2% delays rate cuts, increasing Bitcoin's opportunity cost as non-yielding asset. - PPI input cost trends influence manufacturing pricing, prolonging inflation risks for Bitcoin's bearish environment. - PCE's alignment with consumer behavior shifts could accelerate Fed rate cuts, boosting Bitcoin's appeal as monetary easing hedge. - Housing/energy inflation volatility and Fed