Spot Buyers Step In, Futures Sit Out — Can HBAR Recover?

HBAR’s spot buyers are driving a mild recovery, but weak Futures market participation threatens momentum as traders remain hesitant post-crash.

HBAR is showing signs of a modest recovery following last week’s sharp market crash, largely driven by spot investors buying the dip.

However, the Futures market tells a different story. Confidence among derivatives traders remains low, raising concerns about whether HBAR’s rebound can sustain its current momentum.

Hedera Traders Remain Skeptical

Despite the recovery in spot trading, HBAR’s Open Interest (OI) has yet to bounce back from the heavy losses seen during the crash. The Futures market experienced liquidations exceeding $200 million in a single day, pulling OI down to $202 million, where it continues to stagnate.

This stagnation reflects persistent skepticism among Futures traders about HBAR’s near-term prospects. Their hesitation to re-enter the market could hinder broader price recovery, as Futures activity often reinforces bullish momentum in volatile markets.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR Open Interest. Source:

Coinglass

HBAR Open Interest. Source:

Coinglass

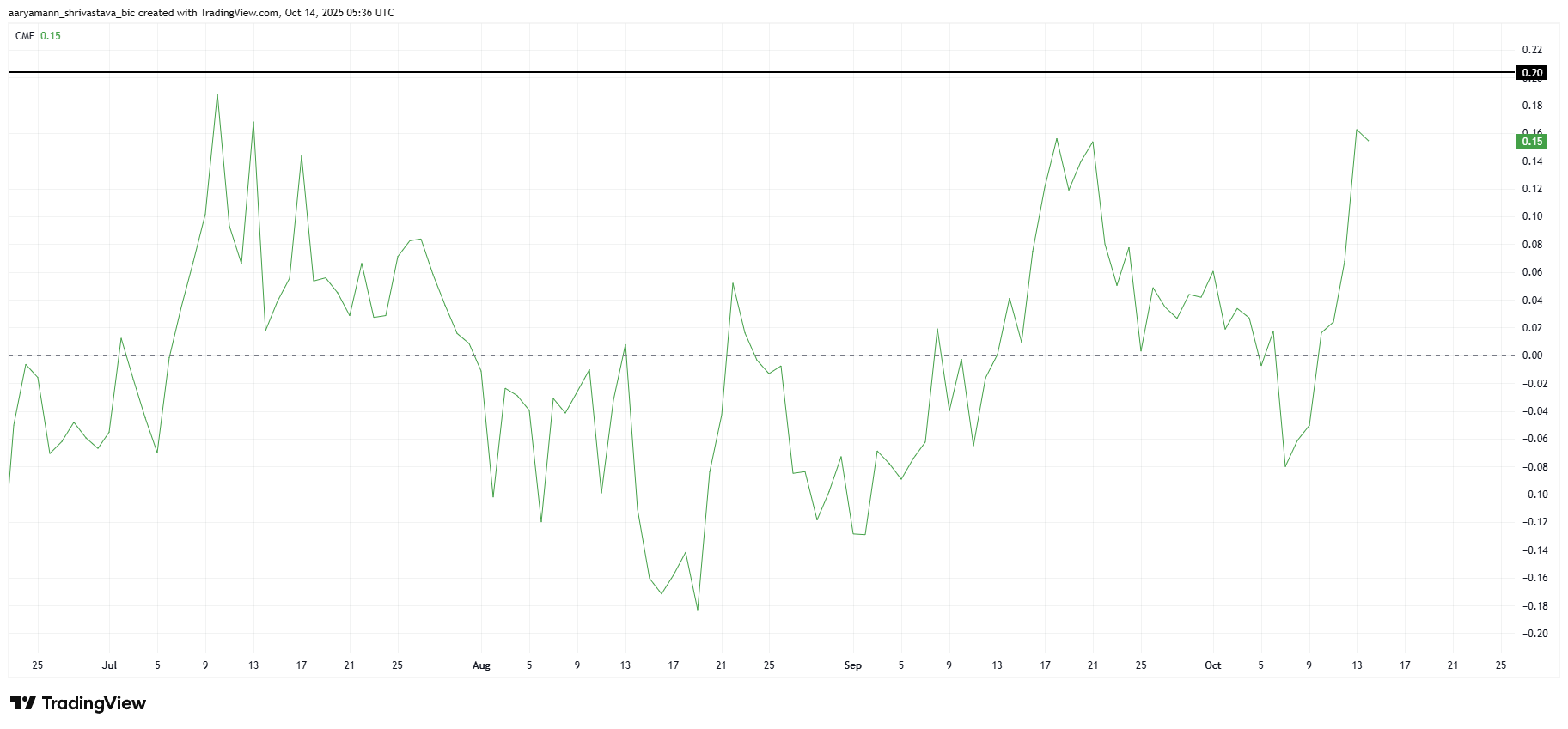

On the other hand, technical indicators show some encouraging signals. The Chaikin Money Flow (CMF) has spiked significantly since the crash, indicating strong inflows from spot investors.

This suggests that long-term holders and opportunistic buyers are taking advantage of lower prices to accumulate positions, aiding HBAR’s partial recovery.

However, CMF is approaching the 0.20 saturation mark, historically a level where inflows begin to slow and reversals can occur. If this pattern repeats, HBAR could face short-term headwinds, especially if broader market sentiment fails to improve.

HBAR CMF. Source:

TradingView

HBAR CMF. Source:

TradingView

HBAR Price Finds Support

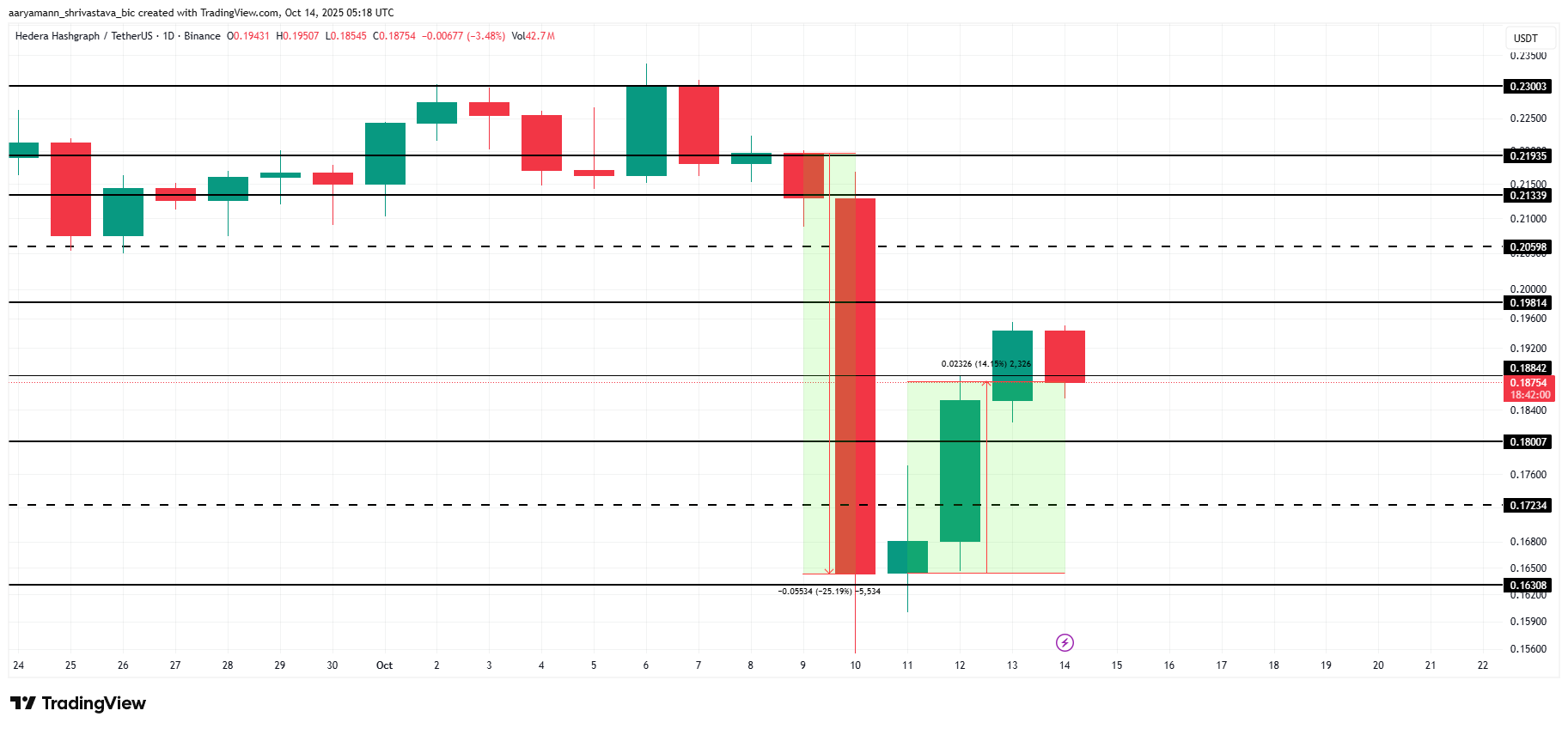

HBAR has gained 14% since the crash, currently trading at $0.187 while attempting to secure $0.188 as a support floor. Holding this level is essential for maintaining recovery momentum and preventing another pullback.

The altcoin dropped by 25% during the crash, and a full rebound would require reclaiming $0.219. This move depends on collaboration between spot buyers and Futures traders. Without Futures market support, HBAR risks slipping back to $0.180 or lower.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

However, if HBAR price receives renewed backing from investors, the altcoin could breach the $0.198 resistance. This would push the crypto token toward $0.205, signaling a return of bullish strength.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Cysic Network (CYS)

Decoding 30 Years of Wall Street Experience: Asymmetric Opportunities in Horse Racing, Poker, and Bitcoin

A horse race, a poker book, and the wisdom of three legendary investors led me to discover the most underestimated betting opportunity of my career.

Fed cuts rates again: Internal divisions emerge as three dissenting votes mark a six-year high

This decision highlights the unusual divisions within the Federal Reserve, marking the first time since 2019 that there have been three dissenting votes.

Antalpha highlights strong alignment with industry leaders on the vision of a "Bitcoin-backed digital bank" at Bitcoin MENA 2025

Antalpha confirms its strategic direction, emphasizing the future of bitcoin as an underlying reserve asset.