Date: Tue, Oct 14, 2025 | 04:56 AM GMT

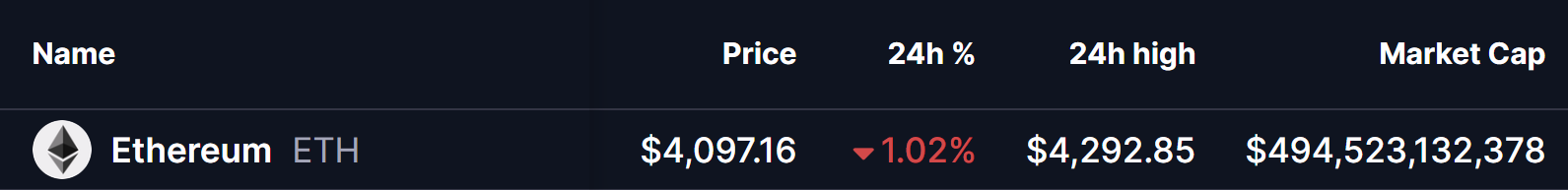

The cryptocurrency market is once again under pressure after Monday’s brief recovery that pushed Ethereum (ETH) to a 24-hour high of $4,292, before sliding back into red territory today around $4,097.

More importantly, Ethereum’s lower timeframe chart is now revealing a potentially bearish setup that could shape its next major move.

Source: Coinmarketcap

Source: Coinmarketcap

Power of 3 in Play?

On the 1-hour chart, ETH appears to be forming a “Power of 3” structure — a classic setup from smart money trading theory, which unfolds in three key phases: Accumulation, Manipulation, and Distribution.

The pattern starts with accumulation, where the price consolidates within a tight range. ETH followed this stage closely before making a sharp upward move — the manipulation phase — that drove the token to its local high at $4,291.

Ethereum (ETH) 1H Chart/Coinsprobe (Source: Tradingview)

Ethereum (ETH) 1H Chart/Coinsprobe (Source: Tradingview)

However, that surge quickly reversed, and ETH has since entered the distribution phase, sliding back toward the accumulation zone support near $4,082. This level has acted as a critical short-term demand area, and how the price reacts here could determine whether the bulls maintain control or the bears take over.

What’s Next for ETH?

If Ethereum fails to hold above the $4,082 support, it would confirm the final stage of the Power of 3 structure — the breakdown. Such a move could open the doors for a deeper retracement, with the next downside target around $3,874, effectively unwinding much of Monday’s rally.

On the flip side, if buyers manage to defend the $4,082 zone and trigger a bounce, ETH could remain range-bound for a while longer, possibly giving bulls another chance to reattempt a move above $4,200 in the short term.

Overall, the coming hours may prove pivotal for Ethereum’s next directional bias — with $4,082 now standing as the key battleground between buyers and sellers.