These 3 Altcoins Turned the Market Crash Into a Comeback With Massive Buybacks

Following Trump’s abrupt tariff announcement that triggered a sharp crypto downturn, several blockchain projects—including World Liberty Financial, Aster, and Sonic Labs—announced large-scale token buybacks to stabilize their ecosystems.

The crypto market continues to recover from the sharp downturn triggered by US President Donald Trump’s abrupt tariff announcement.

While traders are still processing the impact, several blockchain teams are taking proactive steps to stabilize sentiment and rebuild confidence across digital assets.

WLFI Leads Token Buyback

Over the past 24 hours, World Liberty Financial (WLFI), Aster, and Sonic Labs each announced large-scale token buyback programs. These initiatives aim to ease selling pressure and demonstrate long-term commitment to their ecosystems.

On October 11, WLFI disclosed that it had allocated $10 million to repurchase its native WLFI tokens using the USD1 stablecoin.

While others panic, we stack. 🦅Today we bought $10 million worth of $WLFI — and this won’t be the last time.We know how the game is played.

— WLFI (@worldlibertyfi) October 11, 2025

According to the team, the initiative forms part of a broader resilience plan designed to steady prices as the broader market remains volatile.

Blockchain data shows the buyback was executed using a Time-Weighted Average Price (TWAP) model. The algorithm spreads purchases evenly over time to prevent sudden price swings.

By dividing orders into smaller intervals, WLFI avoided distorting its own market and achieved an average purchase rate closer to fair value.

Notably, the project previously confirmed that all repurchased tokens will be permanently burned. This strategy reduces circulating supply and strengthens price support over time.

Aster and Sonic Follows

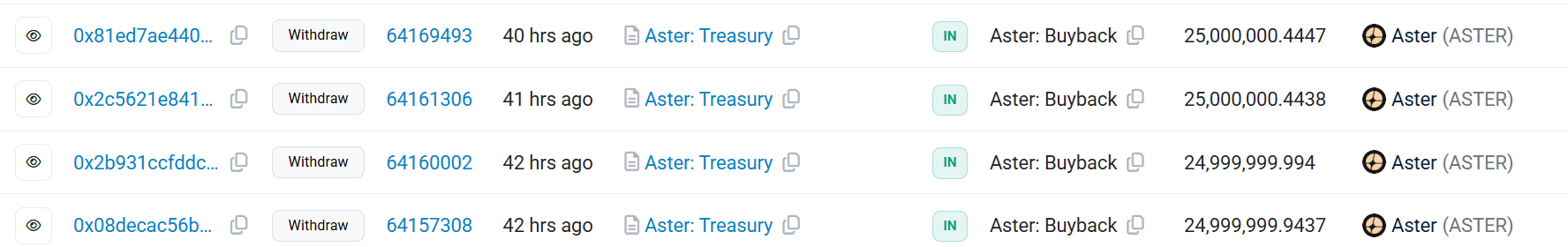

On the other hand, Aster, a decentralized exchange backed by Binance founder Changpeng Zhao, followed suit with a 100 million ASTR token buyback.

Unlike WLFI’s open-market strategy, Aster transferred tokens from its treasury wallet but emphasized that the effort reflects its long-term confidence in the project.

Aster Token Buyback. Source:

BSC Scan

Aster Token Buyback. Source:

BSC Scan

Meanwhile, the timing coincides with the rollout of its Stage 2 Airdrop Checker, which has spurred higher user engagement as Aster continues to challenge perpetuals leader Hyperliquid.

At the same time, Sonic Labs also acted to shield its ecosystem from further declines.

While most networks were struggling to stay online, Sonic operated flawlessly. Zero pending transactions, near-instant finality, and sub-cent fees across every DEX and app.And while others pulled back, we stepped forward by adding $6 million in open-market buying, increasing…

— Sonic (@SonicLabs) October 11, 2025

On October 11, Sonic Chief Executive Mitchell Demeter revealed that the firm purchased 30 million $S tokens—roughly $6 million worth—and added them to its treasury.

Indeed, Demeter argued that holding native assets provides more substantial long-term returns than stablecoins.

“Through it all, the Sonic network performed exactly as designed. Zero pending transactions, hundreds of TPS sustained for hours, near-instant finality, and sub-cent fees. No congestion across DEXs or infrastructure. Pure, consistent performance,” he added.

These buyback programs underscore how blockchain teams use token repurchases and burns to absorb selling pressure and stabilize markets.

As a result, DWF Labs Managing Partner Andrei Grachev said his firm plans to support struggling projects recovering from the recent market downturn. This would include deploying a combination of capital injections, loans, and repurchase programs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: BTC Returns to 86,000, Trump’s Epic Showdown with Major Shorts, Macro Turmoil Just Settled

After last week's global market panic and subsequent recovery, bitcoin rebounded to $86,861. This week, the market will focus on new AI policies, the standoff between bears and bulls, PCE data, and geopolitical events, with intensified competition. Summary generated by Mars AI. The accuracy and completeness of this summary, produced by the Mars AI model, are still being iteratively improved.

At risk of being removed from the index? Strategy faces a "quadruple squeeze" crisis

Strategy is facing multiple pressures, including a significant narrowing of mNAV premiums, reduced coin hoarding, executive stock sell-offs, and the risk of being removed from indexes. Market confidence is being severely tested.

VIPBitget VIP Weekly Research Insights

How to plan a perfect TGE launch?

Most TGE failures are not due to poor products or inexperienced teams, but because their foundations were never prepared to face public scrutiny, competition, and shifts in narrative.