Will Zcash Price Continue To Rally Or Fall Flat After Its 4-Year High?

Zcash (ZEC) has defied the recent crypto market crash, rising 74% in a week and 10% in a day. Both retail traders and large holders are fueling the rally, but growing leverage positions could add risk if momentum fades.

While most altcoins are still trying to recover from the recent crypto market crash, the Zcash (ZEC) price seems to be living in a different world. The privacy-focused token has climbed nearly 74% in the past week, holding firm while others wobbled.

What’s driving this strength isn’t hype — it’s conviction. Both large holders and retail traders are quietly buying the dips, and ZEC’s price chart shows that momentum could still have some room left. But with more upside comes a few risks, too.

Buyers Refuse to Back Down as Money Keeps Flowing In

Zcash’s buying pressure has held steady even through the market-wide panic. Both institutional and retail activity have stayed strong, the two segments that usually move in opposite directions during crashes.

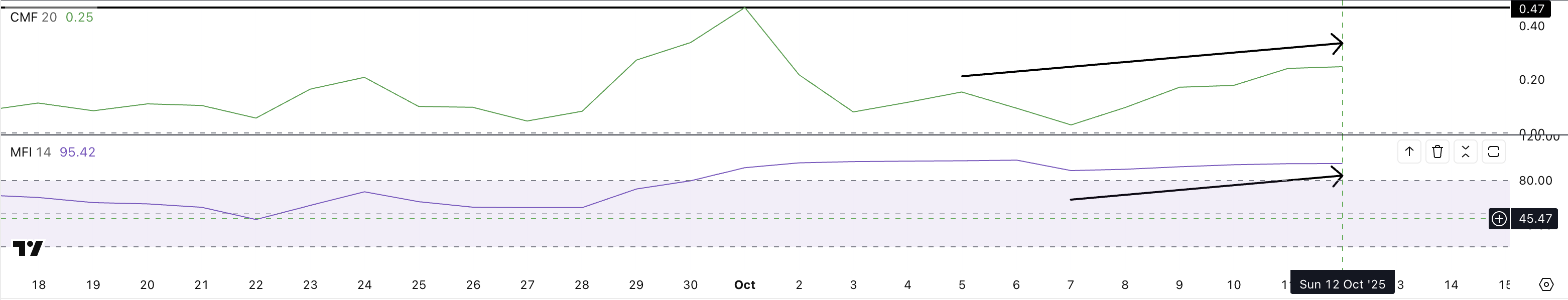

The Money Flow Index (MFI), which tracks buying strength and trading volume, sits above 95, showing that traders are still actively buying at higher prices.

Meanwhile, the Chaikin Money Flow (CMF), which reflects larger or institutional activity, remains positive around 0.25, confirming that big players haven’t stepped away.

Zcash Money Flow:

TradingView

Zcash Money Flow:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Together, these trends explain why the ZEC price rebounded so sharply after briefly dipping to $150 on October 10 (threatened by the crash).

Buyers quickly absorbed the fall, sending the ZEC price back to nearly $290. This consistent inflow of money — from both retail and whales — has kept Zcash’s uptrend intact even when most of the market turned red.

However, CMF hasn’t yet climbed back to its early-October peak. That means while buying is strong, full-scale institutional momentum hasn’t fully returned. If large money picks up again, the Zcash price rally could easily stretch further.

Leverage Traders Could Be the Spoiler

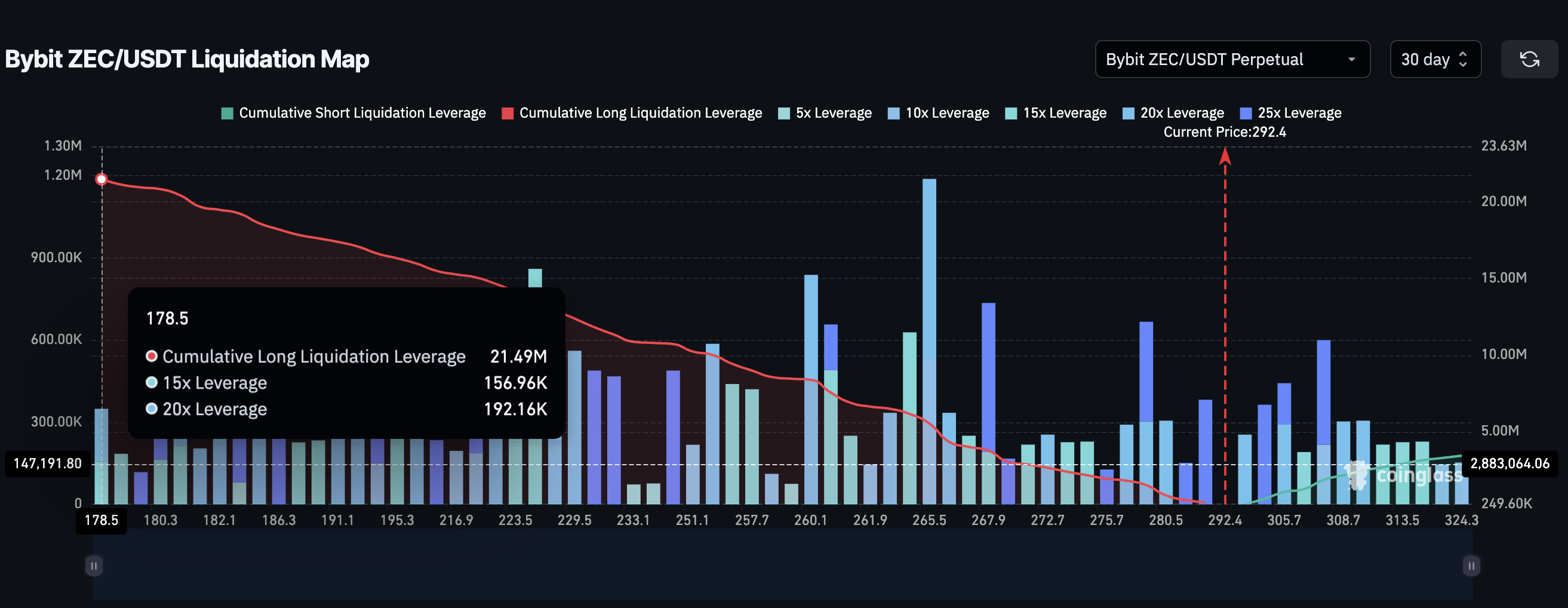

The only major risk for the Zcash price right now lies in the derivatives market. Data from Bybit’s ZEC/USDT liquidation map shows that the market is heavily tilted toward long positions — $21.49 million in cumulative long leverage versus just $3.43 million in shorts.

Zcash Longs Can Pose A Risk:

Coinglass

Zcash Longs Can Pose A Risk:

Coinglass

That means most traders are betting on ZEC’s price to keep rising. But if the price drops suddenly toward $178, all those leveraged longs could start getting liquidated, creating a chain reaction of forced selling — similar to what triggered the recent broader crash.

So while spot buying remains strong, leverage traders might be building a pressure point that could spark short-term volatility if sentiment shifts.

Can Zcash Hold Its Ground Above $250?

Zcash’s daily chart shows that the rally is still technically sound. The token continues to trade inside an ascending triangle, with Fibonacci levels providing strong structure. At press time, ZEC sits around $287, with immediate support near $251.

Zcash Price Analysis:

TradingView

Zcash Price Analysis:

TradingView

If the price manages to hold that level — and if buying pressure continues from both retail and whales — ZEC could move toward $331, which is the next resistance to beat. A daily close above that would likely open the door to $461, continuing the strong run.

But if leveraged positions start to unwind, the first fallback zones sit around $223 and $170. Those would be key areas for dip buyers to step in again if the rally cools off.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.

HyENA officially launched: Perp DEX supported by Ethena and based on USDe collateral goes live on Hyperliquid

The launch of HyENA further expands the USDe ecosystem and brings institutional-grade margin efficiency to the on-chain perpetuals market.