Ethereum Price Analysis: ETH Could Drop Below $3K Without Key Recovery

Ethereum is recovering slightly after a massive drop that took the price below $4,000. The broader market remains cautious as traders reassess their positions following recent volatility, which could lead to a reversal of the bullish trend.

Technical Analysis

By Shayan

The Daily Chart

On the daily timeframe, ETH recently broke below the midline of its ascending channel, the 100-day moving average, and touched the 0.5 Fibonacci retracement level near $3,400-$3,500. This zone coincides with the previous structure support, triggering a bounce toward $3,800.

However, the RSI is still below 40, showing weak momentum. A daily close back above $4,000 could mark a short-term recovery, but failure to reclaim the channel would likely send ETH below the $3,000 range, which would mean the end of the bull market.

The 4-Hour Chart

The 4-hour chart reveals that Ethereum found temporary support within the $3,400 demand zone after a sharp decline. The RSI also dipped into the oversold area, and is now near 24, suggesting a potential short-term reversal.

Still, resistance at $3,800 remains critical. A rejection there could lead to another retest of $3,400, while a clean breakout may open the path toward $4,200 again.

Onchain Analysis

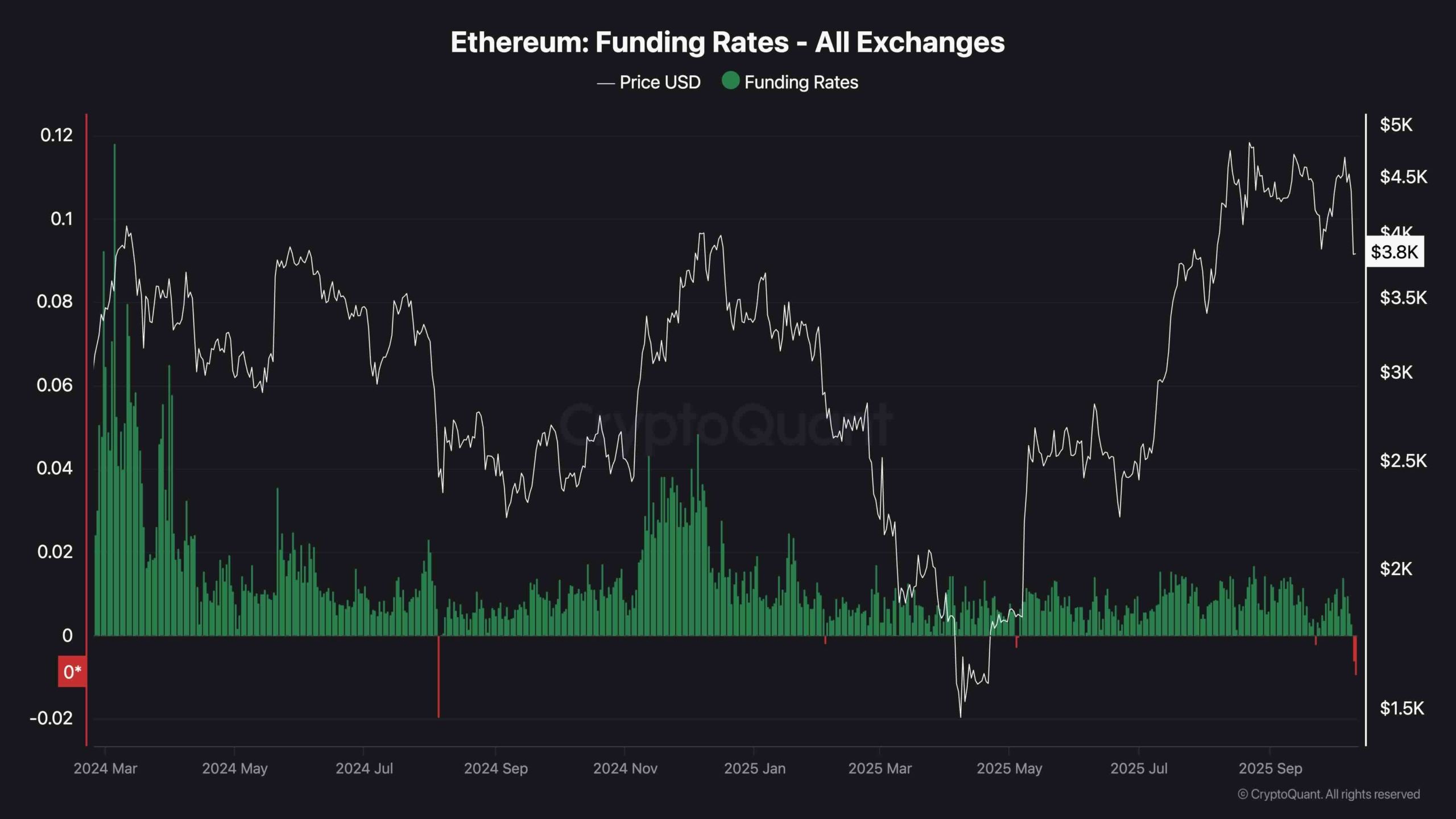

Funding Rates

Funding rates across exchanges have plunged into negative territory, the lowest since late 2024, as traders rushed to unwind long positions. This reset indicates fear and liquidation pressure, but could also hint at a potential bottom if the bearish sentiment continues while the price stabilizes. Historically, negative funding rates during deep pullbacks have preceded short-term recoveries once selling momentum fades.

Therefore, while the market could be in the early stages of a bearish reversal, there is still hope that this move could just be a flush out to cool off the futures market and pave the way for a spot-driven, sustainable rally.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | BTC sees heavy turnover and high-volume bottoming structure, a typical short-term bottom signal

Cardano experienced a brief chain split due to an old code vulnerability, with the FBI launching an investigation; BTC is showing short-term bottom signals; Port3 suffered a hacker attack causing its token price to plummet; Aave launched a retail savings app to challenge traditional banks. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

This Week's Preview: BTC Returns to 86,000, Trump’s Epic Showdown with Major Shorts, Macro Turmoil Just Settled

After last week's global market panic and subsequent recovery, bitcoin rebounded to $86,861. This week, the market will focus on new AI policies, the standoff between bears and bulls, PCE data, and geopolitical events, with intensified competition. Summary generated by Mars AI. The accuracy and completeness of this summary, produced by the Mars AI model, are still being iteratively improved.

At risk of being removed from the index? Strategy faces a "quadruple squeeze" crisis

Strategy is facing multiple pressures, including a significant narrowing of mNAV premiums, reduced coin hoarding, executive stock sell-offs, and the risk of being removed from indexes. Market confidence is being severely tested.

VIPBitget VIP Weekly Research Insights