Key Market Information Gap on October 10th, a Must-See! | Alpha Morning Report

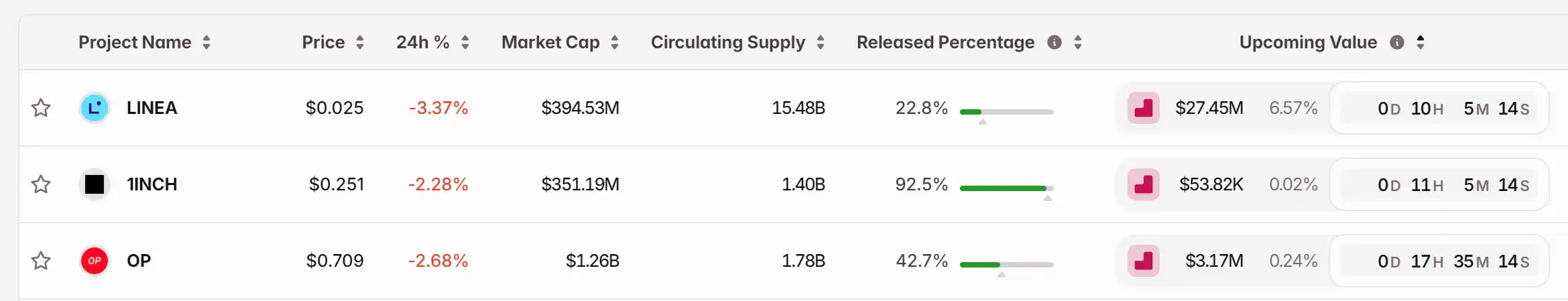

1. Top News: Boosted by Robinhood Listing, ZORA Surges Over 60% in 24 Hours 2. Token Unlocking: $LINEA, $1INCH, $OP

Top News

1.Boosted by Robinhood Listing, ZORA Surges Over 60% in 24 Hours

2.Bitcoin Sees Light Rebound This Morning, Recaptures $120,000 Milestone

3.U.S. Bureau of Labor Statistics Expected to Release CPI Report During Shutdown

4.U.S. Stock Market's Three Major Indexes Open Slightly Higher, Crypto Concept Stocks Mostly Down

5.DCG Invests $10 Million in Two Bittensor Subnet Funds Established by Subsidiary Yuma

Articles & Threads

1.《CZ's Midnight AMA: What's the Secret to Wealth?》

On October 8th, CZ made a rare appearance at the "BNB Super Cycle" AMA hosted by Trust Wallet, sharing the stage with BNB core projects like Aster, Four.meme, and Pancake. CZ responded to recent hot topics in the BNB Chain ecosystem and shared his in-depth insights and thoughts on the future trends of the crypto industry. BlockBeats has compiled his ten most noteworthy answers, covering topics such as the MEME market, Aster's growth, Yzi Labs' investment direction, new opportunities in RWA and AI, and the era-defining significance of "Binance Life."

2.《Industry Insights You Might Have Missed During the National Day Holiday》

The crypto market is heating up across the board, with Bitcoin and Gold hitting new highs together, BNB driving a BSC meme frenzy, Polymarket receiving a $2 billion investment from Intercontinental Exchange to re-enter the U.S., Aster entering a new phase, Monad airdrop imminent, and institutional funds continuing to flow into the Ethereum ecosystem.

Market Data

Daily overall market funding heat (reflected by funding rates) and token unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZK Technology's Price Rally: An In-Depth Analysis of On-Chain Usage and Protocol Enhancements

- ZKsync's Q3 2025 protocol upgrades (OS v0.0.5) achieved 15,000 TPS and 1-second block times, enabling high-frequency trading and institutional compliance via Merkle-proof verification. - November 2025 saw ZK rollups process 15,000 TPS, $3.3B TVL in ZKsync, and $2.98B derivatives volume, driven by enterprise adoption from Goldman Sachs and major banks . - Developer activity surged 230% with solx Compiler beta and LLVM-based tooling, while 35+ institutions tested ZKsync's Prividium for confidential cross-b

Bitcoin News Today: "Institutions See Bitcoin as the New Gold Amid Market Downturn"

- Institutional investors like Abu Dhabi’s ADIC and KindlyMD are buying Bitcoin amid its 29% price drop, viewing it as a long-term store of value akin to gold . - ADIC tripled its stake in BlackRock’s IBIT to $518M, while KindlyMD raised $540M to hold 5,398 Bitcoin at $118K average cost, signaling strategic crypto bets. - Despite $3.1B ETF outflows and regulatory risks, Harvard and El Salvador added to Bitcoin holdings, with analysts forecasting potential 2026 recovery if macroeconomic stability returns.

Bitcoin News Update: Index Firms' Reclassification May Trigger $9 Billion Outflow from MicroStrategy

- MicroStrategy risks $9B passive fund outflows if index providers reclassify it as a digital asset vehicle, excluding it from major benchmarks like MSCI USA and Nasdaq 100. - The company holds 80%+ of its value in Bitcoin ($54.4B), creating leverage risks as crypto prices fall and its stock trades below net asset value. - CEO Saylor claims "indestructibility" despite 67% stock price drop and $8.1B debt, while analysts debate whether MicroStrategy should be categorized as an operating firm or crypto fund.

Ethereum News Today: ETH Holds $2,700—Will Buyers Prevent a Drop to $2,500?

- Ethereum tests $2,700–$2,850 support as bearish momentum intensifies, with breakdown risks exposing $2,450–$2,550 levels. - Long-term holders sold 58,352 ETH ($175M) in one day, while whales accumulate, signaling potential redistribution. - Fed minutes triggered a seven-month low near $2,870, aligning with historical support clusters and 2021–2022 price range midpoints. - A $2,700–$2,850 defense could target $3,050–$3,150, but sustained recovery requires breaking above $4,200 trendline.