HBAR Price at Risk of Dropping to July Lows Amid Weak Momentum

HBAR’s sideways momentum shows signs of fading as selling pressure builds. With RSI and Elder-Ray Index turning bearish, the token risks falling back to its July low near $0.18 if support at $0.2089 fails to hold.

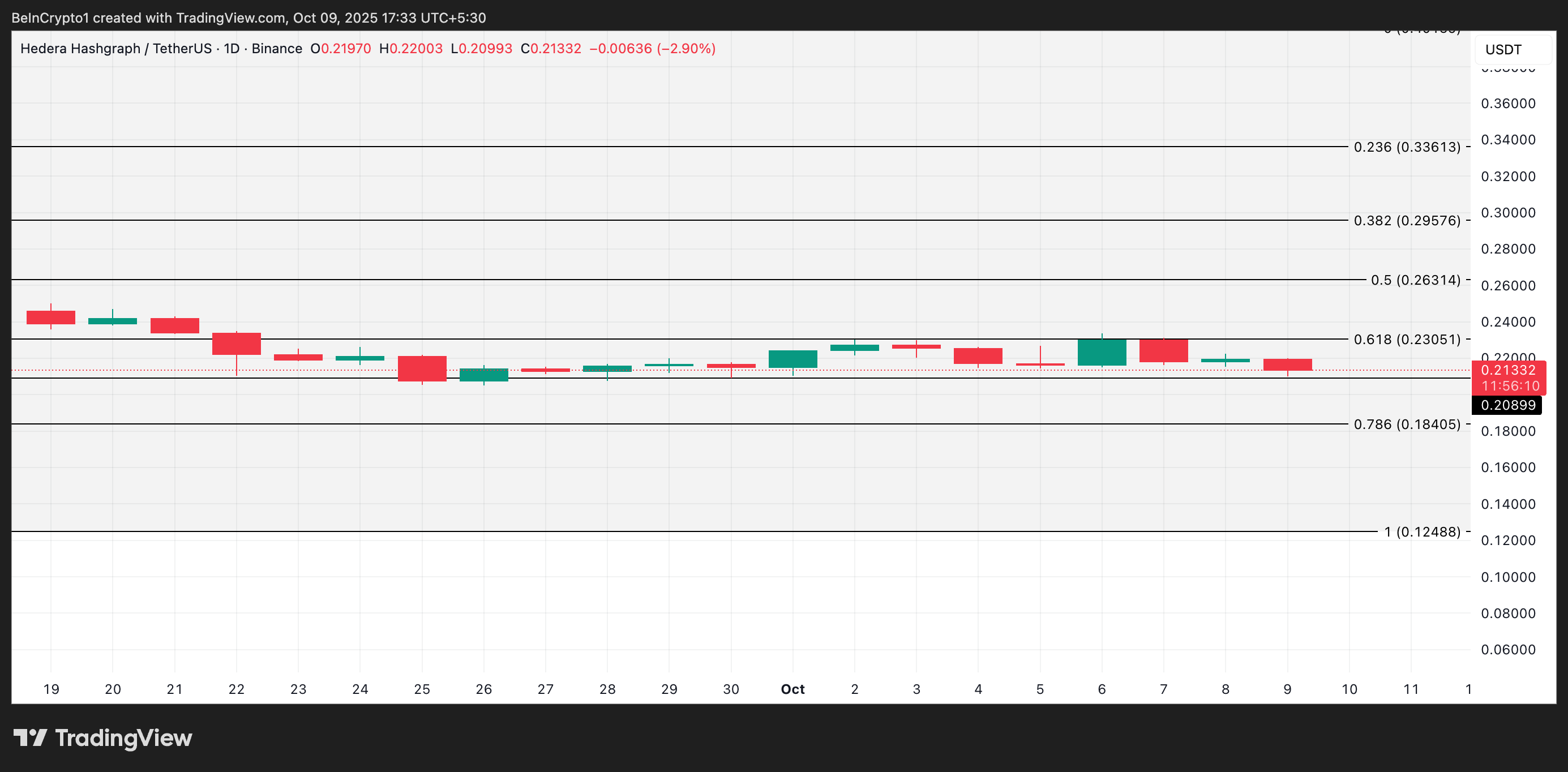

Hedera Hashgraph’s native token HBAR has stalled despite the recent market rebound, remaining largely sideways since September 22.

Market indicators now signal growing bearish pressure, suggesting the token could break below its support level.

Sideways No More? HBAR Risks Cracking $0.2089 Support

Readings from the HBAR/USD one-day chart show that the altcoin has trended sideways since September 22, facing resistance near $0.2305 and finding support at $0.2089.

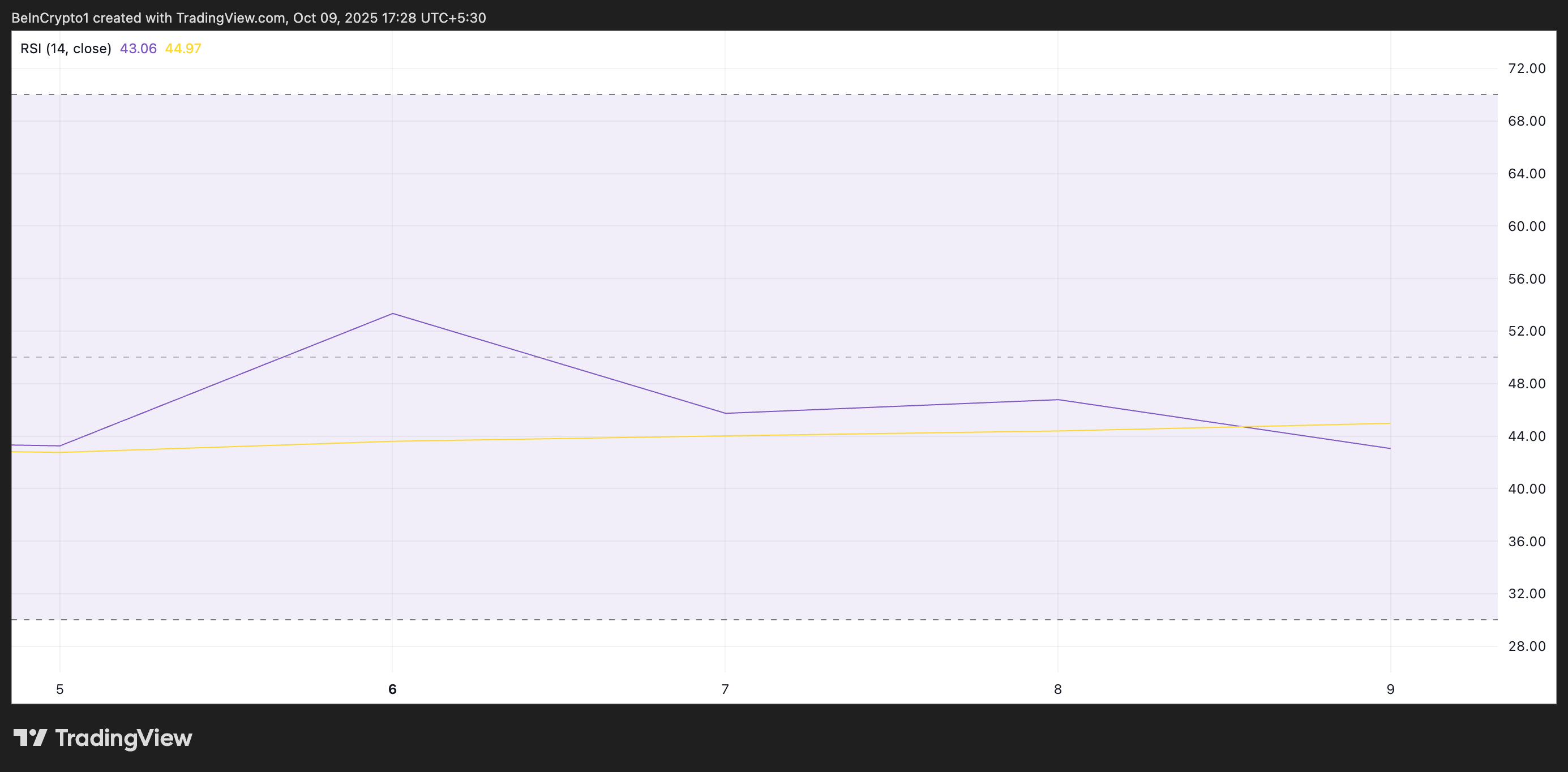

With the growing bearish tilt in broader market sentiment, technical indicators now point to a likelihood of a breach of that support floor in the near term. For example, HBAR’s Relative Strength Index (RSI) continues to fall, and is currently at 43.06 at press time.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

HBAR RSI. Source:

TradingView

HBAR RSI. Source:

TradingView

An asset’s RSI indicator measures its overbought and oversold market conditions. Its values range between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 43.06, HBAR’s RSI signals weakening momentum. It hovers below the neutral 50 level and suggests that selling pressure could continue to outweigh buying interest.

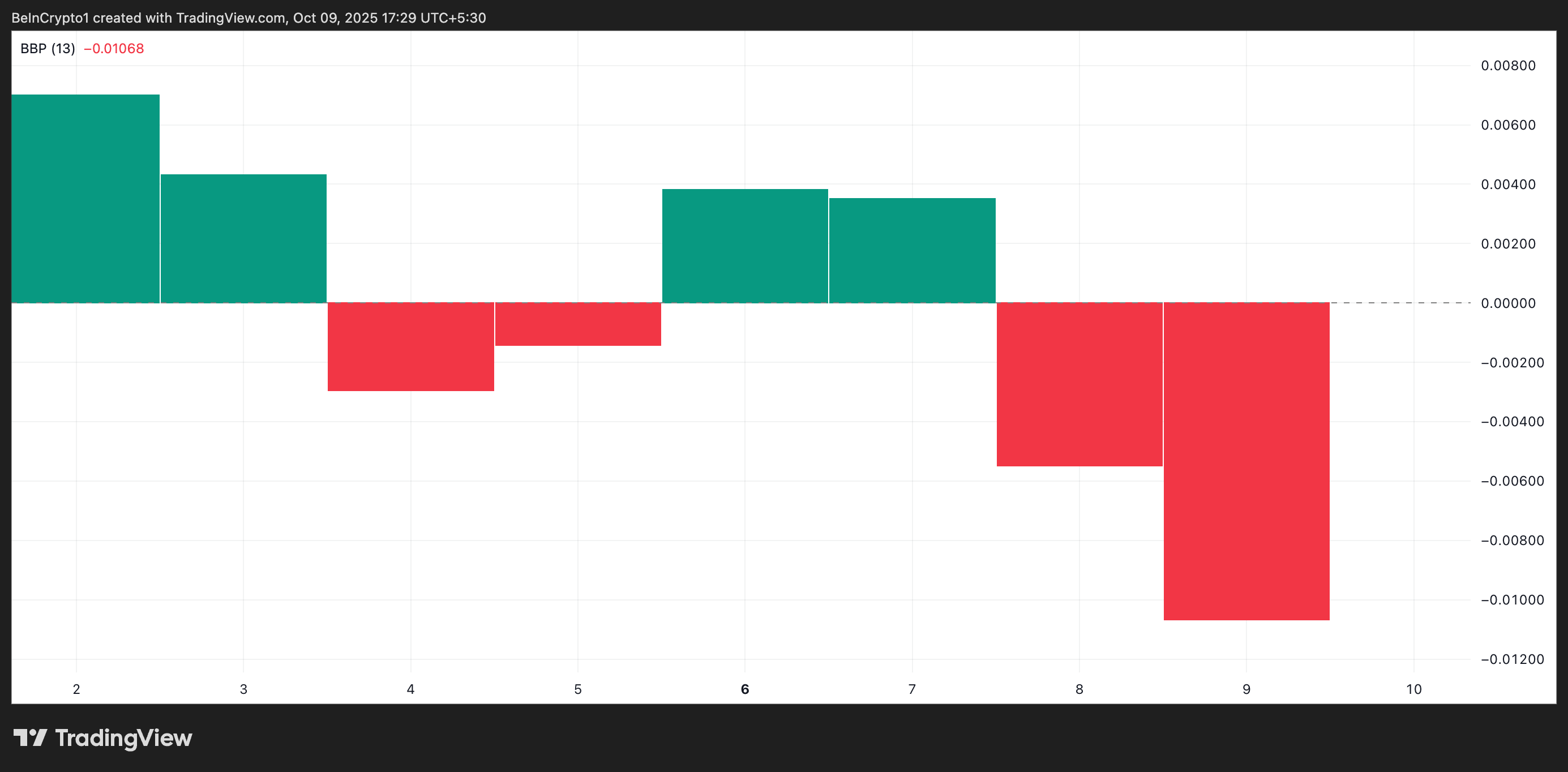

Furthermore, readings from HBAR’s Elder-Ray Index confirm this bearish bias. As of this writing, the indicator’s value is at -0.01051.

HBAR Elder-Ray Index. Source:

TradingView

HBAR Elder-Ray Index. Source:

TradingView

The Elder-Ray Index indicator measures the strength of bulls and bears in the market by comparing buying pressure (Bull Power) and selling pressure (Bear Power).

When the value is positive, the market is experiencing more buying pressure than selling, suggesting a potential uptrend.

However, when the value turns negative, as it has for HBAR, it signals that bearish forces dominate the market.

Will Buyers Hold the Line or Let Bears Drag It to $0.18?

If the bearish trend persists and HBAR breaches the support at $0.2089, it risks revisiting its July low of $0.18405, which could mark the next key support level.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

Conversely, increasing buyer activity could trigger a rally above its current sideways range and push HBAR’s price to $0.2631.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hotcoin Research | Fusaka Upgrade Approaching: Analysis and Outlook on Ethereum Long and Short Positions

This article will review Ethereum's recent performance, provide an in-depth analysis of the current bullish and bearish factors facing Ethereum, and look ahead to its prospects and trends for the end of this year, next year, and the medium to long term. The aim is to help ordinary investors clarify uncertainties, grasp trends, and provide some reference to support more rational decision-making during key turning points.

Crypto Market Surges as Bitcoin Rebounds and Privacy Coins Shine

In Brief Bitcoin rebounded over the weekend, testing the $86,000 mark. Privacy-focused altcoins Monero and Zcash showed notable gains. Total market value surged, crossing the $3 trillion threshold again.

Trending news

MoreBitget Daily Digest (Nov 24) | Total Crypto Market Cap Rebounds Above $3 Trillion; Michael Saylor Posts “Won’t Surrender,” Hinting at Further Bitcoin Accumulation; Bloomberg: Bitcoin’s Decline Signals Weak Year-End Performance for Risk Assets, but 2026 May Have Growth Momentum

Following the attack, Port3 Network announced it would migrate its tokens at a 1:1 ratio and burn 162.7 million PORT3 tokens.