3 BNB Meme Coins to Watch This “Uptober”

BNB meme coins like BROCCOLI, PALU, and BUILDon are driving the latest wave of trading activity this October. Whale movements, sharp price levels, and bullish technical setups highlight why these tokens are at the heart of the current BNB meme coin season.

It’s officially BNB meme coin season. BNB Chain’s daily DEX volume has crossed $6 billion day-on-day, with a sizable chunk now led by BNB meme coins. The trend took off after former Binance CEO CZ posted “#BNB meme szn,” sparking a flood of new community-driven launches.

Data by BubbleMaps shows over 100,000 active traders, with most already in profit over the past 24 hours. From dog-themed tokens to playful Binance-inspired names, BNB meme coins are driving the network’s latest breakout moment. Below are three standout BNB Chain or BSC meme coins to watch this season, driven by big money attention and interesting technical patterns.

CZ’s Dog (BROCCOLI)

It wouldn’t be a real BNB meme coin season without a nod to CZ’s Dog, better known as BROCCOLI. The meme token has quickly become a fan favorite across the BNB Chain, thanks to its link to Binance’s former CEO.

The buzz picked up after CZ’s viral post on X declared that “BNB meme szn” had officially arrived, sparking a wave of trading across new and old meme tokens. Over the past week, BROCCOLI has nearly doubled in price, cementing its place as one of the top-performing BNB meme coins.

#BNB meme szn! 😆I didn't expect this at all. And people keep asking me to predict the future… 🤷♂️Keep building!

— CZ 🔶 BNB (@cz_binance) October 7, 2025

On-chain data shows mixed but telling activity among major holders. In the past 24 hours, whales sold 11.55% of their holdings. That’s equal to around 1.16 million BROCCOLI, or roughly $58,000 at the current price. However, this selling has been offset by smart money addresses. That group added 45.55% to their balance, about 3.47 million BROCCOLI (around $173,000).

BROCCOLI Holders:

BROCCOLI Holders:

The top 100 addresses also increased their combined holdings by 3.64%, adding around 32.6 million BROCCOLI, valued at $1.63 million. This shows that while some whales are booking profits, influential wallets are still positioning for a near-term upside.

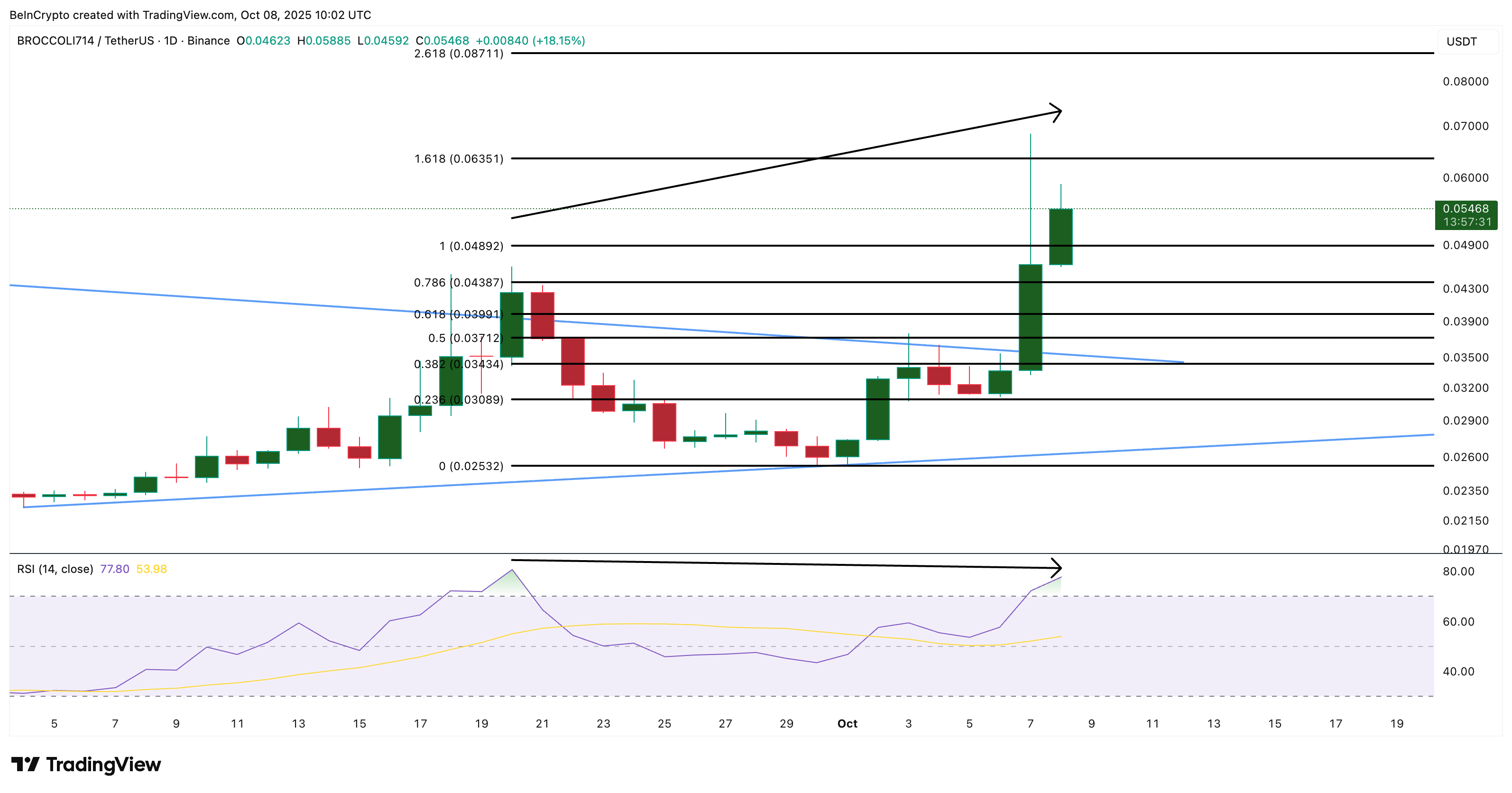

Technically, BROCCOLI broke out of a symmetrical triangle on the daily chart. The Relative Strength Index (RSI) — which tracks momentum — shows bearish divergence, where prices climb but RSI drops, signaling fading strength.

BROCCOLI Price Analysis:

BROCCOLI Price Analysis:

A short-term dip toward $0.037 (former strong resistance turned support) could allow BROCCOLI to reset before the next move.

If it breaks above $0.063, it could regain strong momentum and continue its rally through meme season.

Palu (PALU)

Among the newer BNB meme coins, PALU has become one of the most talked-about tokens this season. Inspired by Binance’s viral mascot, PALU blends meme culture with on-chain community engagement. It’s one of the first meme tokens on the BNB Chain to build a brand identity around the Binance community itself, making it a standout project in the ongoing BNB meme coin season.

PALU is among the top BSC Meme coins that made a profit for the traders:

BNB memecoin szn is realOver 100k onchain traders bought into new memecoins, and 70% are in profit:• 1 made $10M+• 40 made $1M+• 900 made $100K+• 6,000 made $10K+• 21,000 made $1K+🧵 https://t.co/FlbU2r2tap pic.twitter.com/9g5VvmLWQO

— Bubblemaps 泡泡地图 (@bubblemaps) October 7, 2025

Over the past 24 hours, PALU’s price has risen about 9%, trading near $0.08 at press time. On-chain data shows a clear divide in investor behavior. Smart money wallets — typically active, short-term traders — have cut their holdings by 25.06%, reducing their stash to 24.61 million PALU. I

In contrast, the top 100 addresses (mega whales) have increased their holdings by 31.31%, now holding 697.55 million PALU, adding roughly 166 million PALU in the past day, worth about $13.3 million.

PALU Holders:

PALU Holders:

This suggests smaller traders are booking quick profits, while larger holders are positioning for a potential continuation of the rally.

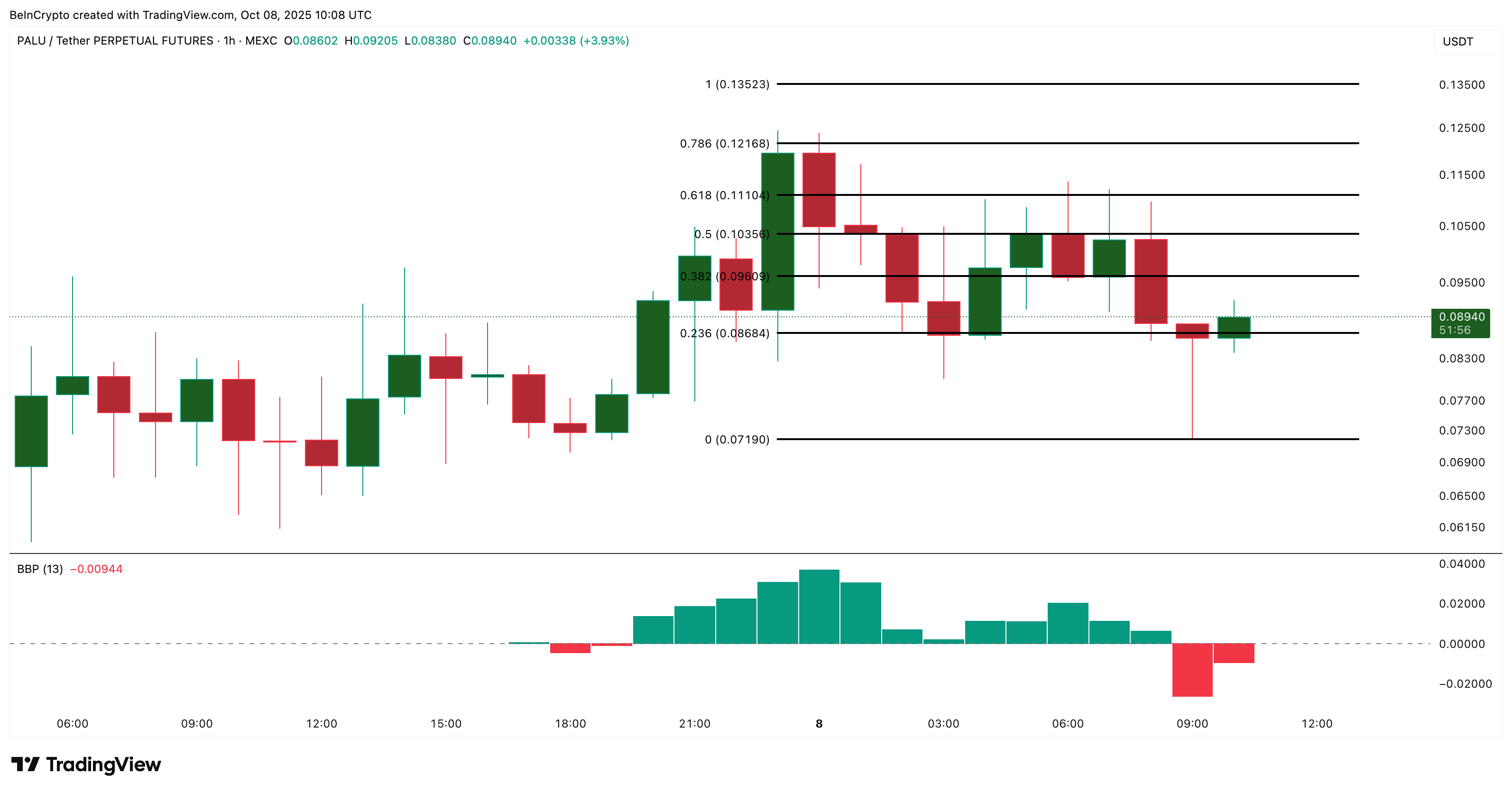

On the hourly chart, PALU is currently testing support at $0.086, which previously acted as resistance. A break above $0.10 and $0.12 could open the way toward a retest of its prior high, while a close below $0.076 would weaken the bullish setup. The Bull Bear Power (BBP) indicator — which measures the balance between buyers and sellers — has started showing less negative readings, signaling that bearish pressure is fading.

PALU Price Analysis:

PALU Price Analysis:

If bulls manage to hold the current range, PALU could be gearing up for another leg higher as meme sentiment across the BNB Chain stays hot.

BUILDon (B)

BUILDon is one of the standout BNB meme coins gaining traction during the current meme season. Inspired by Binance’s “keep building” culture, the token reflects the network’s grassroots energy — combining a community-driven narrative with the broader hype around BNB-based memes.

Over the past 24 hours, the top 100 addresses (mega whales) have increased their holdings by 0.93%, bringing their combined stash to 182.88 million B tokens. That’s an addition of roughly 1.69 million tokens, valued at about $425,000 at the current $0.253 price level. The steady inflow into whale wallets suggests growing confidence that BUILDon may be close to a trend reversal.

BUILDon Mega Whales In Action:

BUILDon Mega Whales In Action:

The daily chart adds weight to that view. While the BUILDon price has made a lower low, the Relative Strength Index (RSI) has formed a higher low, confirming a bullish divergence. This pattern often hints that selling pressure is weakening, paving the way for a potential rebound or rather reversal.

The key support sits around $0.250, which will be critical for bulls to defend, while resistance levels at $0.32 and $0.38 could shape the next recovery leg if momentum strengthens. A daily close under $0.250 can invalidate the near-term bullishness.

BUILDon Price Analysis:

BUILDon Price Analysis:

After falling nearly 33.5% over the last three months, BUILDon now sits at a technical inflection point. With whales accumulating and RSI divergence flashing early reversal signals, it could become one of the BNB meme coins to watch closely this season.

Honorary Mention: BinanceLife (币安人生)

Binance Life (币安人生), one of the most talked-about BSC meme coins, has become a magnet for smart money in the current BNB meme coin season. Even though it hasn’t yet been listed on major centralized exchanges, the token is seeing strong activity on PancakeSwap and other DEXes as large traders position early.

BNB meme coins are taking over DEX trading and screeners:

If you were here in 2021 you’d know better not to joke with bnb trenches

— Sheyi Phillips (@sheyiphillips1) October 7, 2025

On the hourly chart, Binance Life trades near $0.35, consolidating after a steep rise. The Chaikin Money Flow (CMF) indicator — which tracks the strength of buying and selling pressure by big money — has just moved above zero, signaling that large money inflows are starting to outweigh outflows. This shift often marks the early stages of a renewed uptrend.

BinanceLife (币安人生) Price Analysis:

BinanceLife (币安人生) Price Analysis:

A clean break above $0.51 could open room for another strong rally. And a drop below $0.31 may invite short-term profit-taking.

BinanceLife (币安人生) Support Level:

BinanceLife (币安人生) Support Level:

With positive CMF momentum and continued interest from top traders, Binance Life remains one of the most-watched BSC meme coins this season.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: MicroStrategy's Bold Bitcoin Investment Stands Strong Despite 57% Drop in Stock Value

- MicroStrategy's CEO reaffirms Bitcoin buying strategy amid market volatility, adding 8,178 BTC for $835.6M. - Despite 57% stock decline, MSTR's Bitcoin holdings reach $61.7B, funded by preferred shares and convertible notes. - Critics question debt-driven model's sustainability, but analysts praise its Bitcoin-per-share growth and $535 price target. - Saylor envisions $1T Bitcoin balance sheet, leveraging appreciation for credit products and reshaping global finance.

Ethereum Updates Today: Buddy Goes All-In on ETH with $13 Million Leveraged Wager Amid Market Slump

- Buddy Huang’s ETH long position was liquidated, prompting a $9.5M reentry amid market turmoil. - Market selloff attributed to macroeconomic pressures, with BTC dropping 28.7% below $90K. - A $1.24B ETH whale added 13,117 ETH despite $1.59M unrealized losses, signaling bullish conviction. - Institutional caution grew as SoftBank exited $5.8B NVIDIA stake, while Coinbase hinted at December 17th product launch. - Buddy’s $13M leveraged bet faces liquidation risk if ETH fails to stabilize above $3,000, highl

The Rapid Drop in COAI Shares: Red Flag or Investment Chance?

- COAI Index fell 88% YTD in Nov 2025, sparking debate over systemic collapse vs undervalued opportunity. - Market sentiment diverges from fundamentals: C3.ai shows 26% YoY revenue growth despite governance crises and $116M Q1 loss. - CLARITY Act regulatory uncertainty, leadership turmoil at C3.ai, and crypto frauds like Myanmar's $10B scam fueled sector-wide selloff. - C3.ai's $724M cash reserves and 69% gross margin highlight resilience, but legal battles and regulatory ambiguity persist as key risks. -

DappRadar's Shutdown Reflects Challenges Faced by the Industry Amid Market Volatility

- Web3 analytics firm DappRadar announced its shutdown due to "financially unsustainable market conditions," causing its RADAR token to drop 30%. - Companies like PG Electroplast and GEM Aromatics reported revenue declines amid U.S. tariffs, GST changes, and raw material costs, reflecting broader economic challenges. - Geox cut 2025 sales forecasts by high single digits after 6.2% year-to-date revenue fall, while cost cuts helped stabilize its EBIT margin. - Tech stocks face volatility: Nvidia downgraded a