Pi Coin Price Risks 23% Drop To Historic Lows As Bullish Crossover Fails

Pi Coin’s failed bullish setup and negative Bitcoin correlation hint at deeper losses. Unless support is regained, a 23% drop may follow soon.

Pi Coin has been trading sideways for several weeks, showing little momentum despite broader market activity. The altcoin’s consolidation phase now appears to be breaking down as market conditions deteriorate, pushing prices lower.

Recent indicators suggest that the token could be heading toward a deeper correction if bearish sentiment persists.

Pi Coin Is Not Following Bitcoin

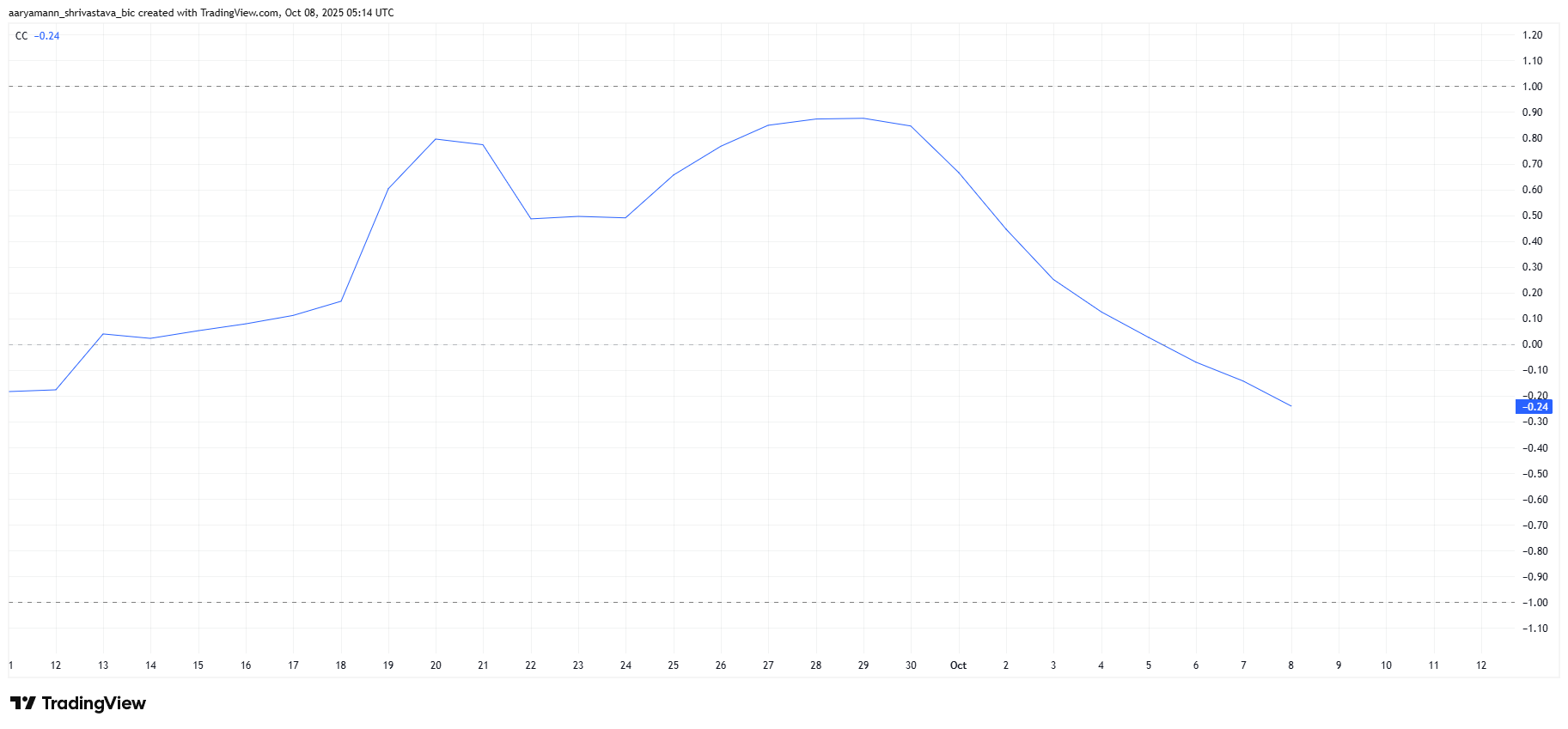

Pi Coin’s correlation to Bitcoin has dropped to a negative 0.24, indicating that it is currently moving independently of the broader crypto market. This detachment is unfavorable, as Bitcoin’s recent gains have historically lifted smaller altcoins. Pi’s inability to follow this pattern highlights weakening investor confidence and diminished market participation.

This negative correlation also suggests that Pi Coin may struggle to capitalize on Bitcoin’s rally in the near term. Without a strong alignment with Bitcoin’s bullish cycle, Pi Coin risks further downside pressure as investor enthusiasm fades.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Pi Coin Correlation To Bitcoin. Source:

Pi Coin Correlation To Bitcoin. Source:

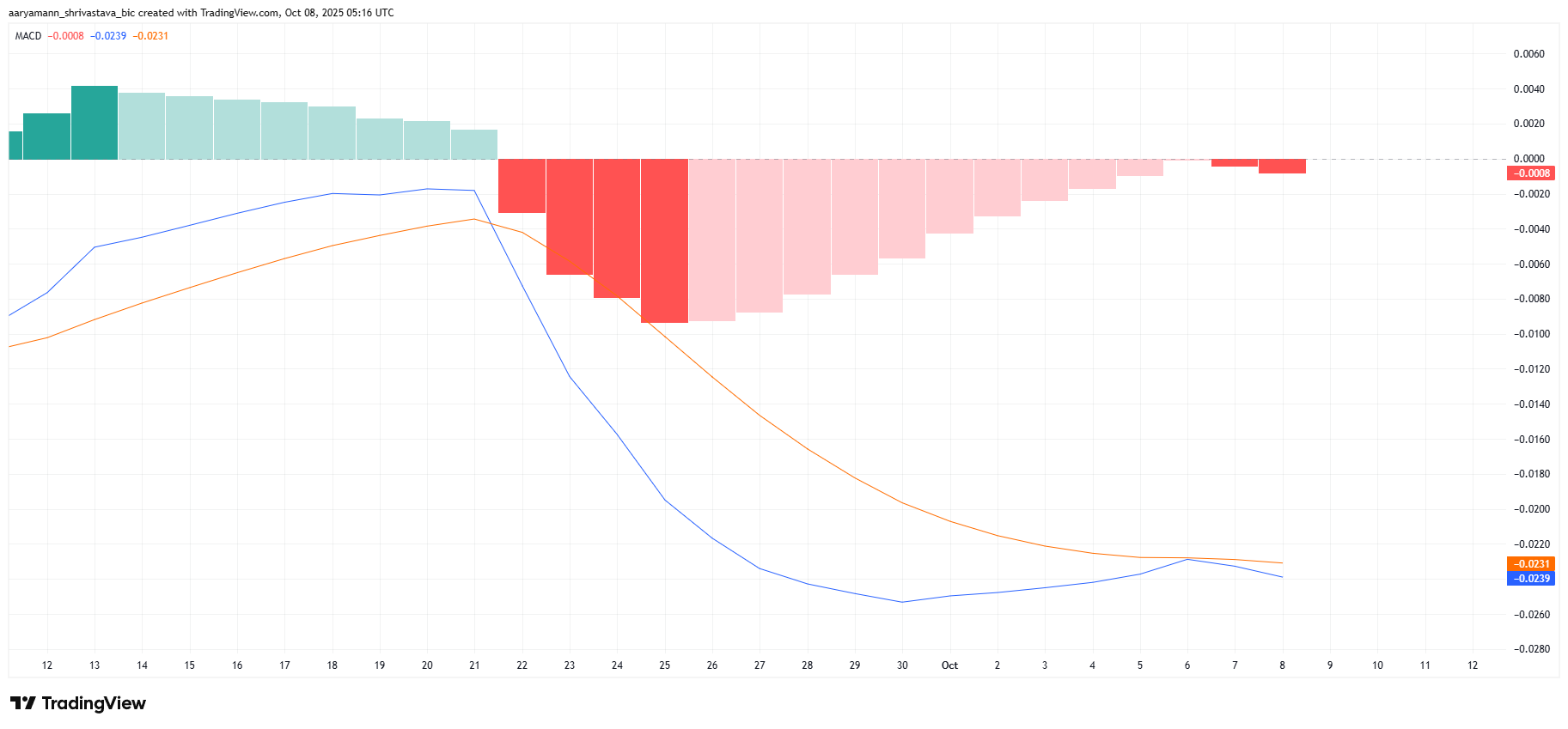

From a technical standpoint, Pi Coin’s Moving Average Convergence Divergence (MACD) indicator was on the verge of a bullish crossover last week. Such a signal typically marks the beginning of a recovery phase after an extended downtrend.

However, worsening market conditions disrupted this momentum, delaying the reversal and extending the token’s two-week bearish streak. The failed crossover highlights the fragile state of Pi Coin’s momentum. Instead of confirming an uptrend, the indicator now suggests continued weakness.

Pi Coin MACD. Source:

Pi Coin MACD. Source:

PI Price Needs To Reclaim Support

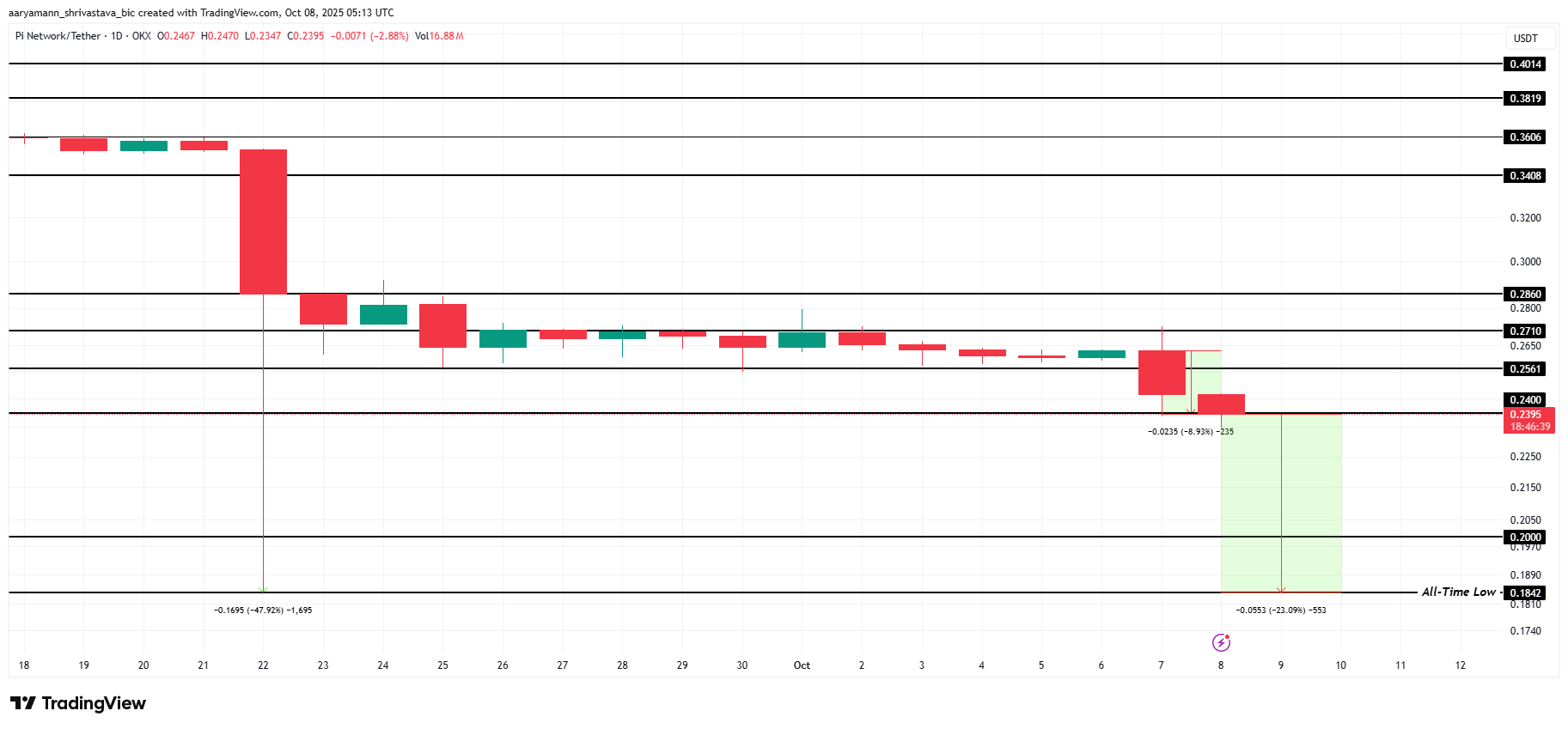

At the time of writing, Pi Coin is trading at $0.239, just below the $0.240 threshold. The token has declined nearly 9% in the past 24 hours, reflecting growing selling pressure. Unless demand returns, Pi could continue to lose value in the coming days.

Based on current indicators, Pi Coin’s price could drop toward $0.200, with a possible retest of its all-time low (ATL) at $0.184—roughly 23% below current levels. Sustained bearish conditions would make this scenario increasingly likely.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

Conversely, if the broader crypto market stabilizes, Pi Coin could stage a rebound. A move above $0.270 would invalidate the bearish outlook, paving the way for a recovery toward $0.286 and potentially higher levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How do 8 top investment banks view 2026? Gemini has summarized the key points for you

2026 will not be a year suitable for passive investing; instead, it will belong to investors who are skilled at interpreting market signals.

Valuation Soars to 11 Billions: How Is Kalshi Defying Regulatory Pressure to Surge Ahead?

While Kalshi faces lawsuits and regulatory classification as gambling in multiple states, its trading volume is surging and its valuation has soared to 11 billion dollars, revealing the structural contradictions of prediction markets rapidly growing in the legal gray areas of the United States.

How will the Federal Reserve in 2026 impact the crypto industry?

Shifting from the technocratic caution of the Powell era, the policy framework is moving towards a more explicit goal of reducing borrowing costs and serving the president's economic agenda.

Babylon partners with Aave Labs to launch native Bitcoin-backed lending services on Aave V4

Babylon Labs, the team behind the leading Bitcoin infrastructure protocol Babylon, today announced the establishment of a strategic partnership with Aave Labs. Both parties will collaborate to build a native Bitcoin-backed Spoke on Aave V4 (the next-generation lending architecture developed by Aave Labs). This architecture adopts a Hub and Spoke model, aiming to support markets built for specific scenarios.