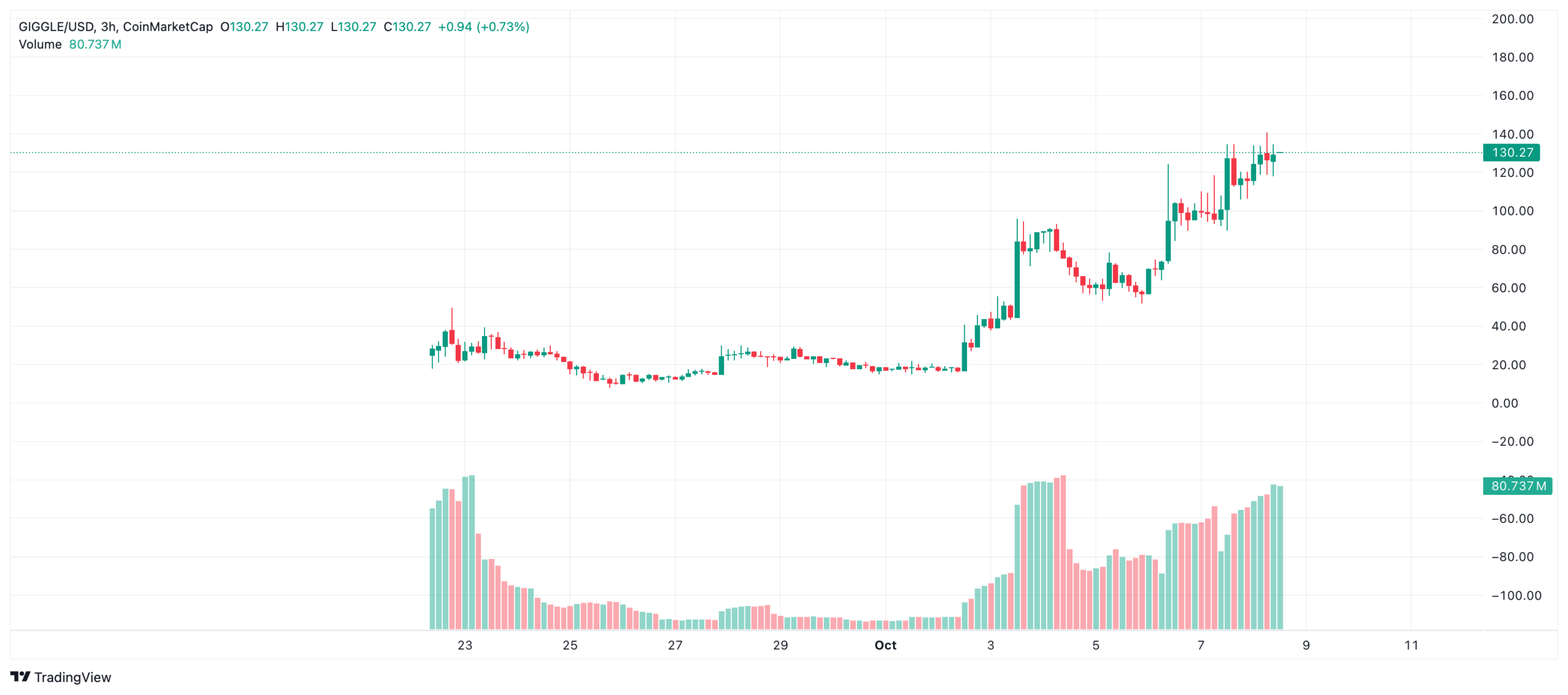

The interest in memecoins within the BNB ecosystem has significantly reignited. Following posts from Binance ‘s co-founder and former CEO Changpeng Zhao on his social media account, memecoins such as GIGGLE and 4 experienced record-breaking rises. This surge led to rapidly changing trend lists on decentralized exchanges (DEXs), with trading volumes doubling and prices climbing swiftly. Specifically, GIGGLE soared by 33.5% in the last 24 hours, reaching a peak of $140, and recording a weekly gain of 717%. On the other hand, the 4 token appreciated by 19% daily and 349% weekly.

Zhao Sparks Investor Interest

According to CoinMarketCap data, GIGGLE coin’s new peak has been confirmed, with attention drawn to its donation mechanism fueled by trading fees. These fees, collected through the Giggle Academy initiative, are converted to BNB and directed towards education. Moreover, resources reaching $5.5 million at a price above $1,300 alleviate selling pressure on BNB. Analysts suggest that maintaining the momentum requires about 1,000 transactions daily.

In the case of the 4 token, Zhao’s reference to “4” on social media increased both individual investor interest and whale demand. The market value of this memecoin briefly surpassed $200 million, while the 24-hour trading volume neared $290 million.

Liquidity rotation within the BNB Chain has also drawn attention. Some major wallets’ profit-taking from ASTER coin and redirection to the lower market cap 4 token exemplify this situation.

Rising Momentum of the BNB Ecosystem

Data from DeFiLlama shows that on October 7, the DEX volume on BNB Chain rose to $6.05 billion. PancakeSwap alone generated approximately $4.29 billion in trading volume. Among the altcoin projects accompanying the rally across the ecosystem, PAUL and Binance Life stood out with rises of 2,246% and 415% respectively. PUP and SZN coins saw surges up to 5,600%. Bubblemaps reported that over 100,000 participants joined the BNB meme wave, with about 70% in profit.

On the profitability front, information from Lookonchain indicated that some addresses gained millions of dollars. One wallet made over $10 million from transactions related to the 4 token, while earnings from GIGGLE transactions ranged between $200,000 and $700,000. Nevertheless, the sustainability debate continues. The fee model focusing on donations, along with maintaining transaction numbers, emerges as key variables in determining mid-to-long-term momentum.