BNY’s Tokenized Deposits Pilot Enters Regulatory Spotlight

BNY Mellon is piloting tokenized deposits to settle client payments on blockchain rails, part of its $2.5 trillion daily network overhaul. Regulators from the EBA to the IMF are assessing how programmable money could speed cross-border settlement while reshaping liquidity and oversight.

BNY Mellon confirmed it is exploring tokenized deposits to let clients move money on blockchain rails. The initiative is part of its plan to modernize a $2.5 trillion-a-day payments network.

The pilot aims to show how regulated deposits can settle in seconds instead of days, without leaving the banking system’s protection.

BNY Explores Tokenized Deposits Amid Evolving Policy Frameworks

Earlier this year, the bank launched its Digital Asset Data Insights platform. It broadcasts fund-accounting data to Ethereum through smart contracts to improve transparency and accuracy.

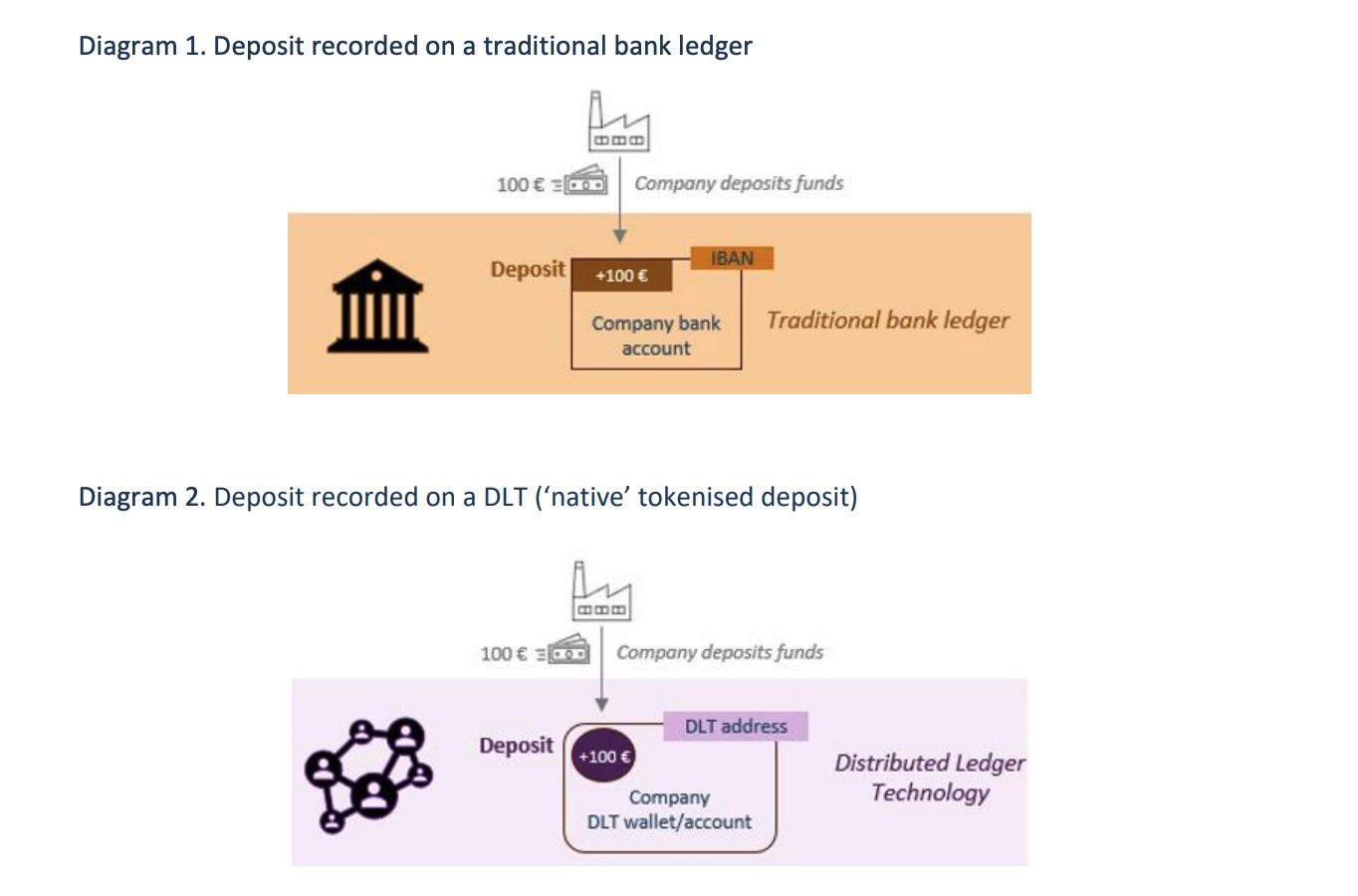

Source: European Banking Authority

Source: European Banking Authority

In July, it introduced a tokenized money-market-fund system that records mirrored shares on GS DAP®. The setup enables near-instant settlement while BNY maintains the official ledger.

Intercontinental Exchange (ICE) announced a strategic investment in Polymarket to distribute event-driven market data. It also agreed to collaborate on tokenization projects — another sign mainstream market infrastructure is turning blockchain-native.

Macro Forecasts, Regulatory Posture, and Risks

The European Banking Authority published its Report on Tokenised Deposits. It found only one live European case but called for shared definitions under MiCAR to avoid overlap with e-money tokens. The watchdog also warned that programmable deposits could affect liquidity, requiring new prudential guidance.

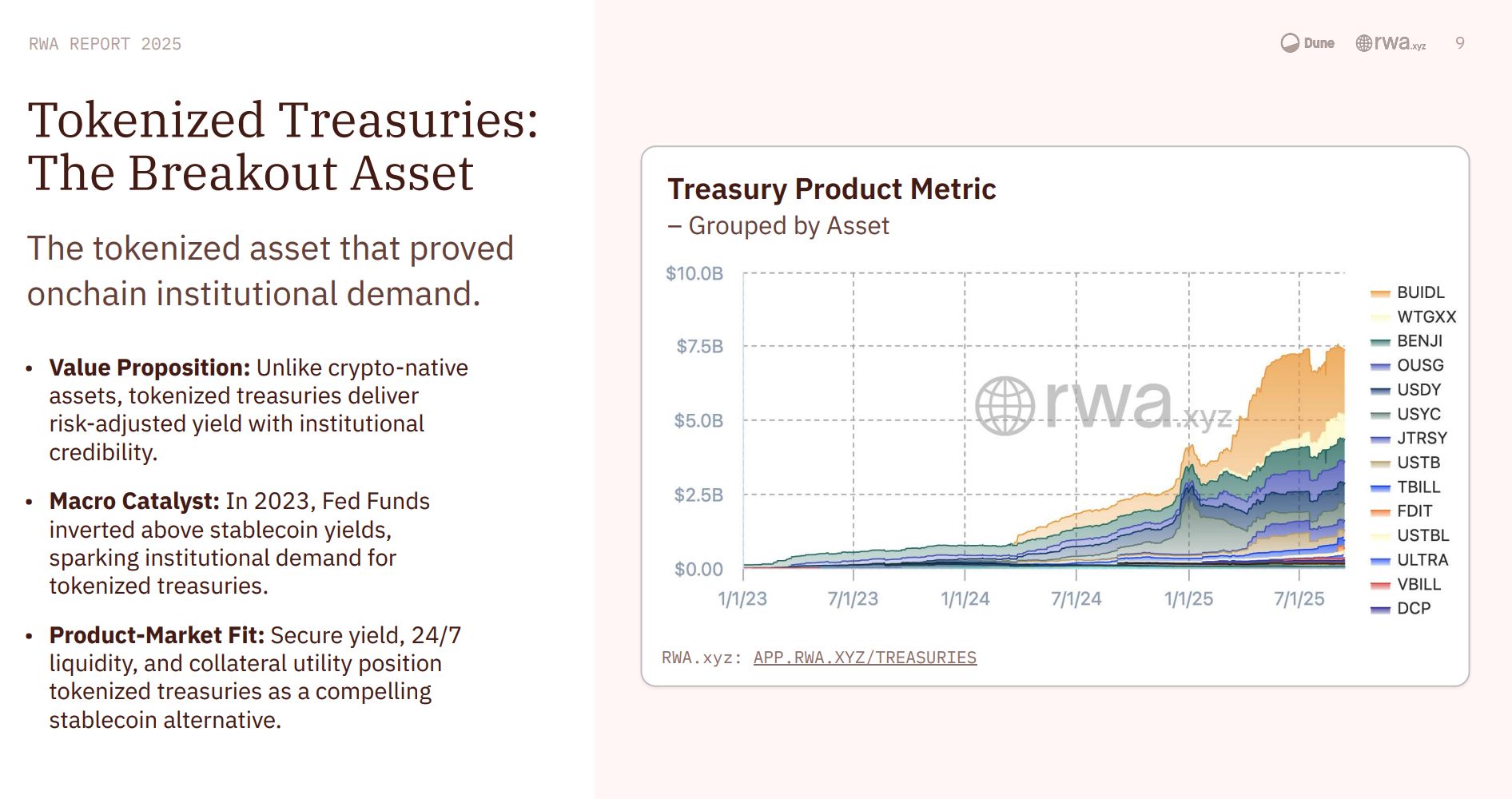

Source: Dune × RWA 2025 Report

Source: Dune × RWA 2025 Report

The Dune × RWA 2025 report showed tokenized U.S. Treasuries rising to $7.5 billion — proof that on-chain settlement is scaling beyond pilots. Deloitte’s Financial Services Predictions 2025 projected that one in four large-value cross-border transfers will run on tokenized rails by 2030, saving firms roughly 12.5% in fees, or $50 billion a year.

Franklin Templeton’s Max Gokhman told BeInCrypto that tokenization “starts more with the retail level.” He said retail flows can bootstrap liquidity until institutional markets mature. His view matches how tokenized deposits and ETFs gain early traction among retail users, while institutions wait for clearer rules and deeper secondary markets.

The IMF’s Fintech Note 2025 argued that tokenization reduces settlement risk by embedding trust and programmability into ledgers. But it warned that connected blockchains could spread contagion faster during stress if governance lags technology.

Regulators are watching closely. The EBA warned that programmable features may alter deposit behavior in crises. The IMF stressed that new guardrails are needed to balance efficiency with stability. For BNY, the experiment is less about hype and more about infrastructure — proving that tokenized money can move as fast as crypto without losing the credibility of a 240-year-old bank.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.