HBAR Nears 3-Month Breakout — But Liquidity Outflows Could Spoil It

HBAR is on the verge of a breakout from a three-month pattern, but fading inflows and hesitant investors could stall its bullish progress.

HBAR’s recent rally has placed the altcoin within striking distance of breaking out from a critical three-month pattern. Despite the market’s bullish momentum, investor behavior may hinder its progress.

While the broader crypto market shows renewed optimism, HBAR holders appear hesitant, creating a disconnect between sentiment and price action.

Hedera Investors Are Losing Confidence

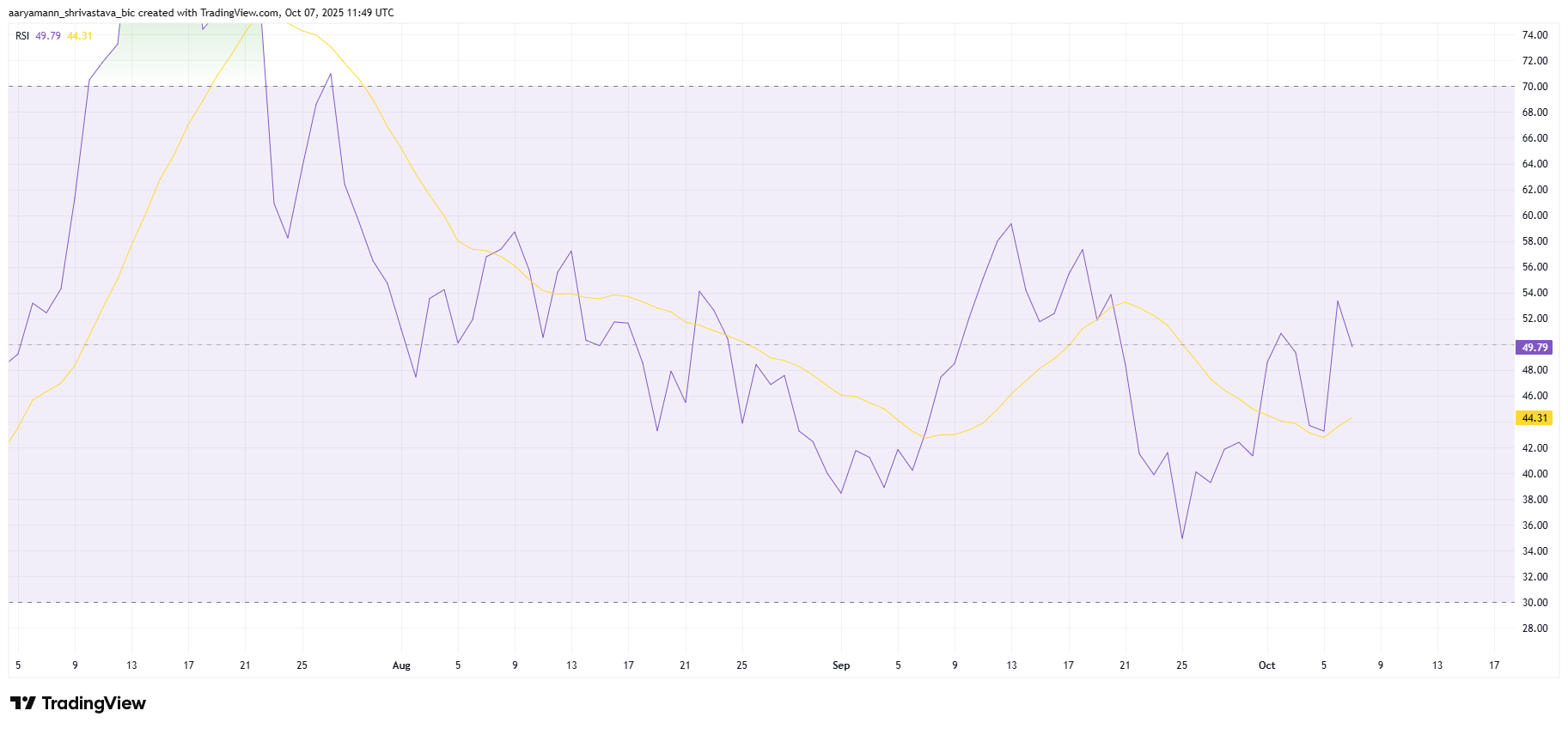

The Relative Strength Index (RSI) for HBAR is climbing steadily, reentering the bullish zone above the neutral 50.0 mark. This shift signals renewed buying interest and improving technical strength. As market-wide sentiment turns positive, indicators suggest that HBAR could soon regain upward momentum if sustained demand persists.

The improving macro environment is also aiding HBAR’s short-term outlook. With Bitcoin and other major cryptocurrencies posting fresh gains, overall market conditions have strengthened considerably.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

HBAR RSI. Source:

TradingView

HBAR RSI. Source:

TradingView

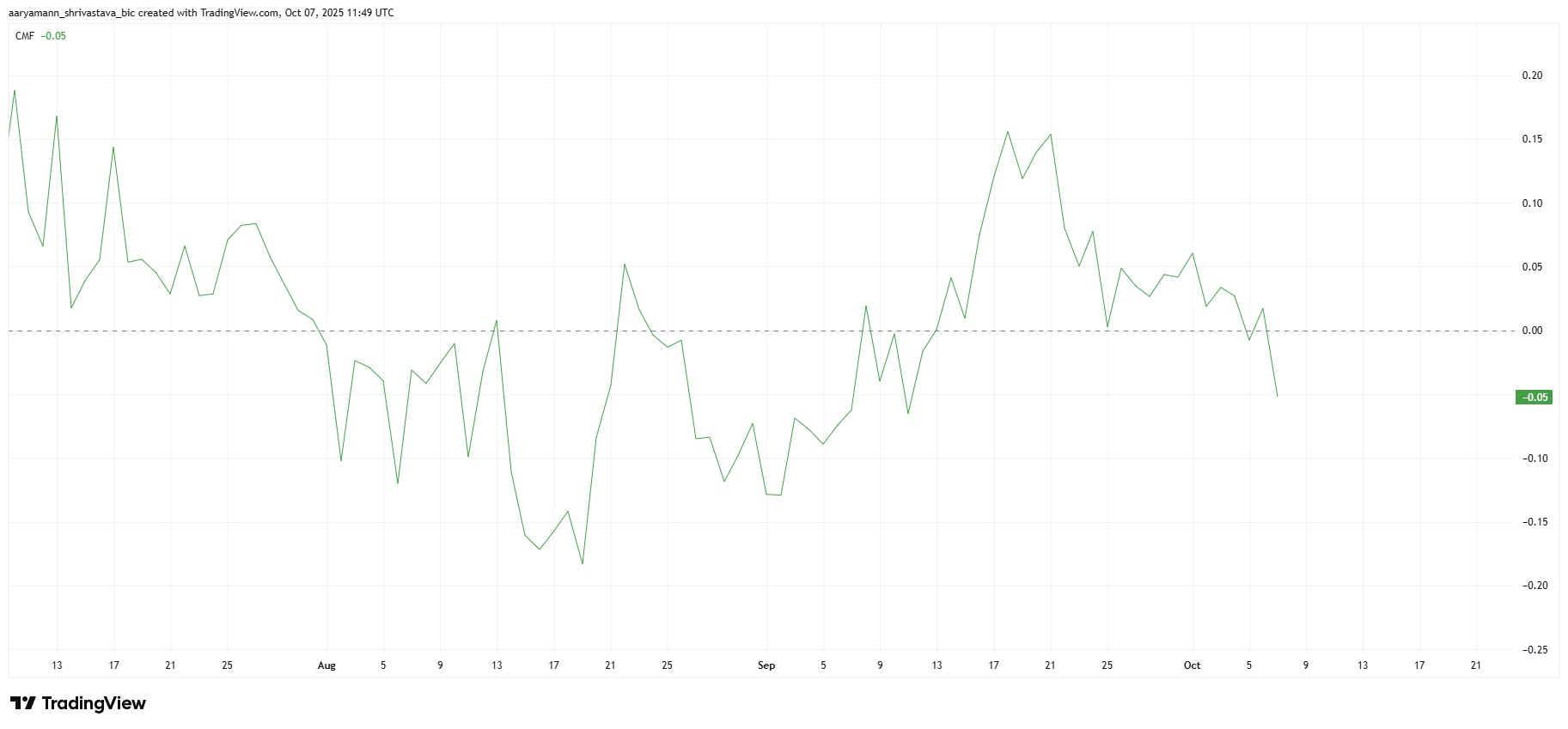

However, not all signs point to an easy rally. The Chaikin Money Flow (CMF), a key measure of capital inflow and outflow, recently dipped below the zero line, marking a monthly low. This decline reveals that investors are withdrawing liquidity from HBAR, signaling uncertainty around its ability to sustain a breakout.

The weakening CMF highlights an imbalance between growing market optimism and cautious investor participation. While bullish sentiment dominates much of the crypto market, HBAR’s holders remain wary of potential short-term reversals.

HBAR CMF. Source:

TradingView

HBAR CMF. Source:

TradingView

HBAR Price May Not Breakout

HBAR is trading at $0.224, sitting just below the crucial $0.230 resistance level — the breakout point from its descending wedge pattern that has persisted for three months. A decisive move above this level could trigger renewed bullish momentum.

Historically, HBAR has struggled to break free from this setup, and a failed attempt could push prices lower. If rejection occurs, the token might slip toward $0.219 or $0.213, with further downside potential to $0.205.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

Conversely, if broader market strength outweighs investor skepticism, HBAR price could breach $0.230 and confirm a breakout. This move could propel the price toward $0.242, invalidating the bearish outlook and marking the start of a new bullish phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.