Bitcoin Exchange Flows Hit Multi-Year Lows —Is $130,000 Next?

Bitcoin’s steady October climb may be more than momentum. With exchange net flows at multi-year lows and a key breakout pattern in play, on-chain data suggests $130,000 could be the next major milestone if bullish momentum holds.

Bitcoin has started October on a steady climb. It’s up nearly 9% week-on-week and still holding firm above $124,000, even after a mild cooldown from its recent all-time high. The Bitcoin price move isn’t just about momentum — it’s supported by deep shifts in on-chain activity that signal conviction from both long-term and short-term holders.

One number stands out: $130,000 — the next major target hinted by both pattern and data.

Exchange Net Flow Hits Multi-Year Low As Holders Step In

One of the clearest signs of confidence comes from Bitcoin’s exchange net flow, which measures the difference between coins entering and leaving centralized exchanges. A negative value means more BTC is being withdrawn than deposited — typically a sign that holders prefer to store, not sell.

As of October 4, Bitcoin’s 14-day Simple Moving Average (SMA) for net flow sits at –7,210 BTC, its lowest level in nearly three years. The last time net flows dropped this deep was in November 2022, just before Bitcoin began its massive rise from $16,000 to over $72,000 in the following months.

Bitcoin Exchange Netflow:

CryptoQuant

Bitcoin Exchange Netflow:

CryptoQuant

That backdrop makes the current reading even more compelling — it reflects a market quietly leaning toward accumulation, not distribution.

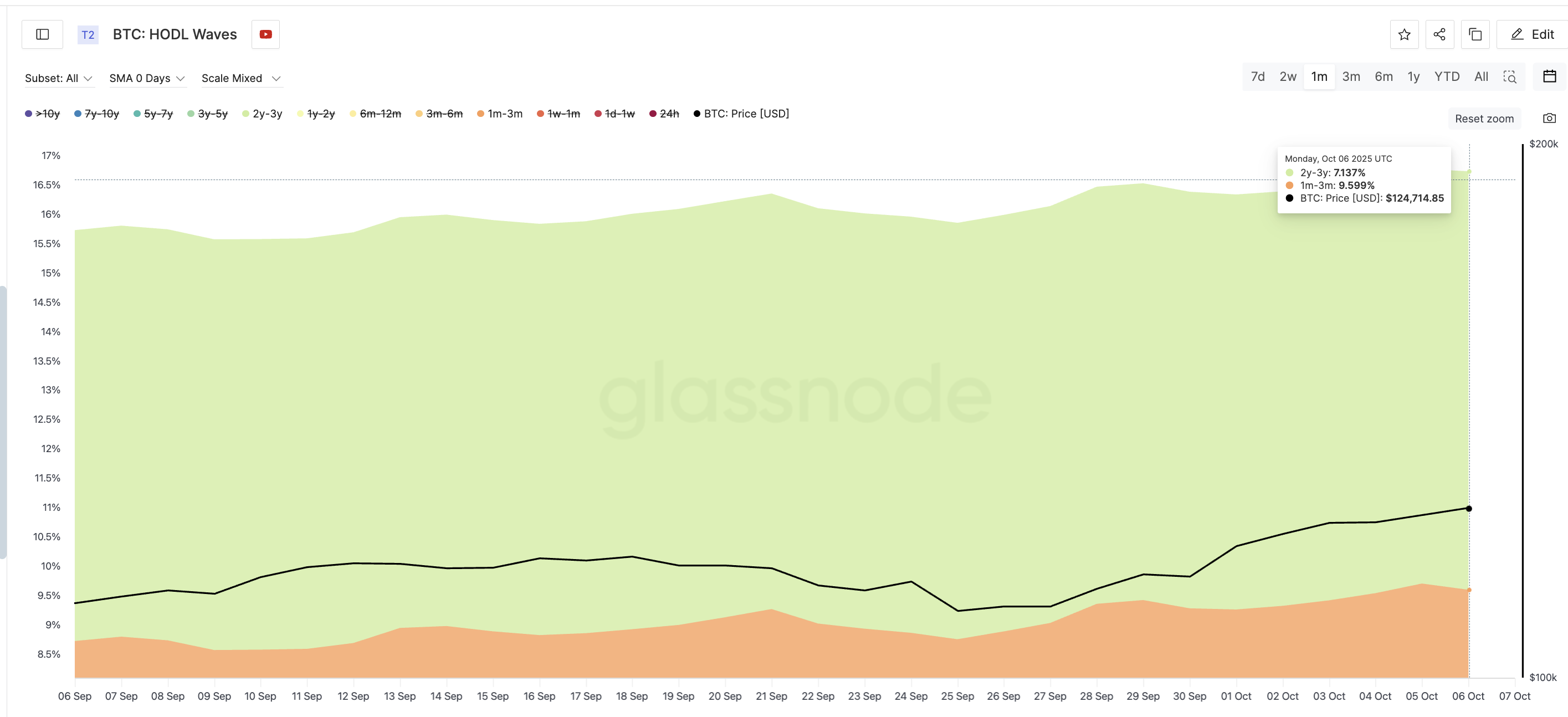

To confirm this, we look at HODL Waves, which show how long coins have stayed unmoved. Over the past month, both short-term and long-term holders have added to their holdings. The 1–3 month cohort grew from 8.75% to 9.59% of supply, while 2–3 year holders ticked up from 7.00% to 7.13%.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Even though the 0.13% rise may look minor, it represents tens of thousands of BTC — a meaningful shift when viewed against Bitcoin’s total supply and a clear signal of renewed conviction from long-term holders.

Key Bitcoin Cohorts Adding To Their BTC Stash:

Glassnode

Key Bitcoin Cohorts Adding To Their BTC Stash:

Glassnode

This dual participation matters — if only one side (short- or long-term) were accumulating, the rally would appear fragile. Instead, both are showing conviction, creating a stronger base for a sustained move higher.

Pattern Breakout Targets $130,100 As Volume Backs The Bitcoin Price Move

On the daily chart, the Bitcoin price recently confirmed an inverse head-and-shoulders breakout, closing firmly above the $122,100 neckline. The pattern projects an immediate upside target above $130,000 if momentum holds.

Bitcoin Price Analysis:

TradingView

Bitcoin Price Analysis:

TradingView

The Wyckoff Volume indicator also adds context. This tool tracks whether buyers (blue bars) or sellers (orange bars) dominate trading sessions. During the last correction in September, a shift from blue to orange preceded a price dip from $117,900 to $108,400.

That shift hasn’t happened this time — blue bars still dominate, showing that buyer demand remains intact.

If the Bitcoin price manages to stay above the $122,100 level, the move to $130,100 looks highly likely. A breakout beyond that could open the door to fresh cycle highs later this quarter.

Still, a dip below $117,900 and $108,400 would temporarily invalidate this bullish setup, though on-chain metrics suggest the bias remains upward for now.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.

The Structural Impact of the Next Federal Reserve Chair on the Cryptocurrency Industry: Policy Shifts and Regulatory Reshaping

The change of the next Federal Reserve Chair is a decisive factor in reshaping the future macro environment of the cryptocurrency industry.