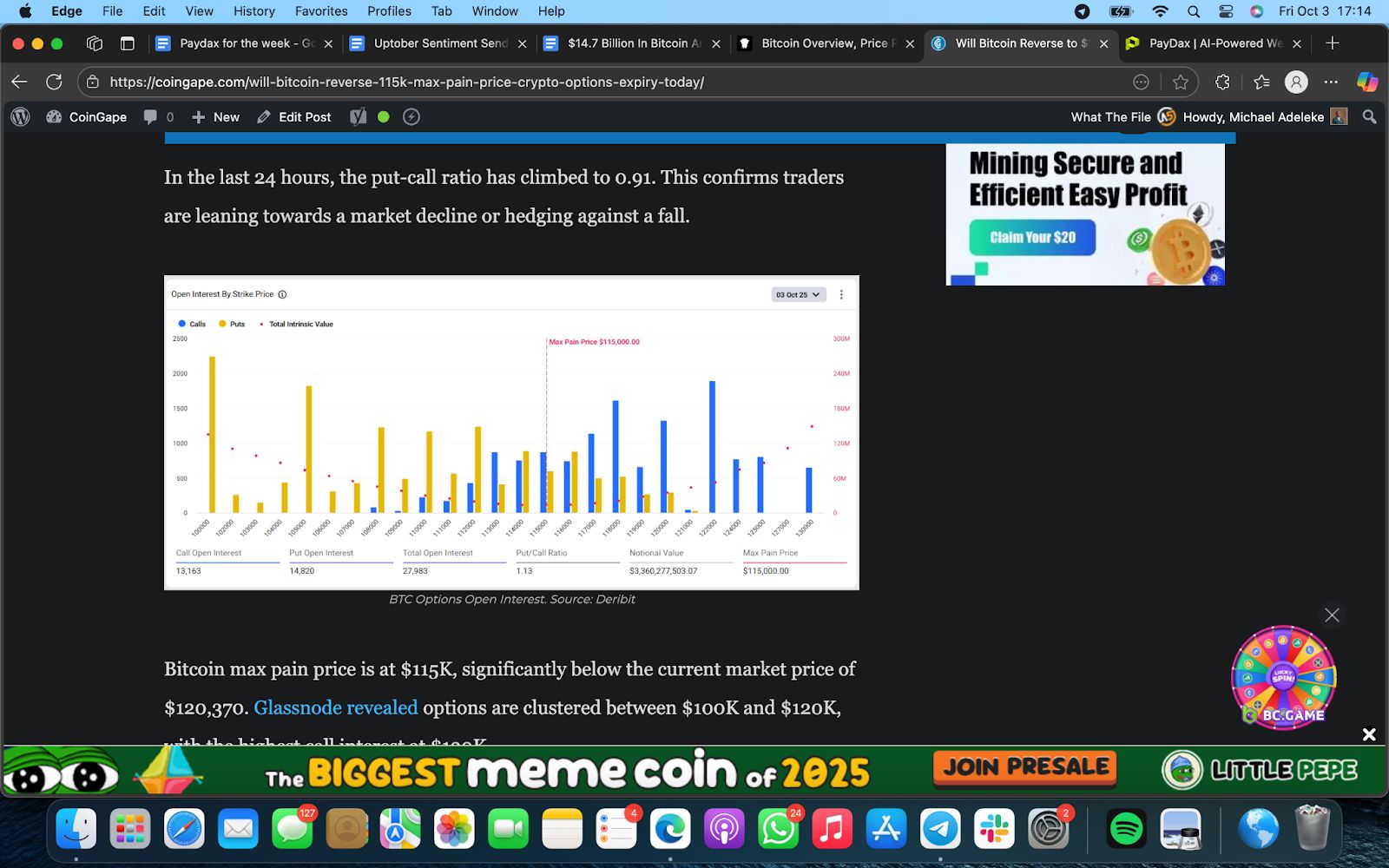

The crypto market opened on Friday on edge as Bitcoin (BTC) traded around $120,091, up 1.2%, while total capitalization hovered near $2.7 trillion. Traders are closely watching the expiry of $3.35 billion in BTC contracts on Deribit , with the “maximum pain” level sitting near $115,000. This expiry event left $14.7 billion in Bitcoin longs at risk.

The put-call ratio of 1.13 indicates that puts outnumber calls, suggesting a bearish market outlook for Bitcoin. Over the past 24 hours, the ratio has risen to 0.91, indicating that BTC traders are positioning for a potential downturn.

However, a breakdown of the Bitcoin price toward $115,000 could trigger cascading liquidations. Coinglass data also suggests a fall to $106,500 could wipe out nearly $15 billion in BTC positions. While Bitcoin long traders brace for impact, Paydax Protocol (PDP) is gaining traction in its new round of funding, recording a massive influx of investments just two weeks after its launch.

Bitcoin Liquidation Risks Highlight the Opportunity in Paydax Protocol (PDP)

While Bitcoin (BTC) faces liquidation risks, a new opportunity is gaining traction in the DeFi space. Typically, decentralized finance aims to create a system where money can be transferred without the need for banks or intermediaries.

However, this system has several problems. Liquidity provider (LP) tokens and governance assets are usually locked in smart contracts and remain unused. Many platforms only support popular tokens, such as BTC, for lending.

This is the challenge that Paydax Protocol (PDP) aims to address. This platform was created to serve as the first community-driven DeFi bank. It transforms real-world assets and cryptocurrency into capital available for borrowing, lending, or staking.

Security You Don’t Have to Second-Guess

Paydax Protocol (PDP) transcends traditional safety protocols with features crafted to convert risk into opportunity. A key illustration is the Redemption Pool, where stakers serve as decentralized insurers. By underwriting loans, they safeguard the system and can earn up to a 20% APY in premiums.

The security layers include:

-

Volatility Buffers: Additional time for borrowers to provide collateral or repay their loans before liquidation occurs.

-

Emergency Shutdowns: A safety mechanism governed by the community that halts operations and secures funds during critical situations.

-

Assure-DeFi, a reputable security firm, has audited Paydax Protocol’s (PDP) smart contract.

-

Multi-Signature Wallets: Transactions necessitate approvals from several trusted individuals using Gnosis Safe, which safeguards funds against errors or misuse.

Paydax Protocol Borrowing Flow: A Secure Path to Liquidity

Paydax Protocol (PDP) introduces a simplified borrowing flow that transforms dormant collateral into active capital, empowering users to invest, expand, and grow with confidence. Here is the step-by-step layout of the process;

| Deposit Collateral |

↓

| Borrow Assets Once collateral is deposited, investors can borrow against it based on the fixed Loan-to-Value (LTV) ratio for that specific asset pair. |

↓

| Maintain Health Factor |

↓

| Repay and Unlock Collateral |