Standard Chartered Predicts $1 Trillion Stablecoin Expansion by 2028

- $1 trillion could migrate from banks to stablecoins

- Emerging markets lead growth in digital savings

- Dollar-pegged stablecoins attract businesses and families

Standard Chartered projects that up to $1 trillion could flow from emerging market bank deposits into stablecoins by the end of 2028. According to the bank, the combination of local instability, the search for liquidity, and the appeal of digital currencies pegged to the US dollar will drive a new wave of adoption in countries outside the developed world.

Stablecoins—dollar-pegged tokens backed by cash and U.S. Treasury bonds—are emerging as accessible, low-cost alternatives for families and businesses seeking protection against currency devaluation. According to Geoffrey Kendrick, global head of digital asset research at Standard Chartered, and global economist Madhur Jha, these tokens already function, in practice, as "U.S. dollar-based bank accounts" in many emerging markets.

According to the study, the global market value of stablecoins is expected to reach $2 trillion by 2028, with two-thirds of that amount functioning as digital savings accounts in emerging markets. The bank estimates that these "savings accounts" could jump from the current $173 billion to $1,22 trillion, redirecting capital previously held in local banks.

Even with the US GENIUS Act, which prohibits regulated stablecoin issuers from paying direct yields, analysts believe demand will continue to grow.

“Return on capital matters more than return on capital,”

Kendrick and Jha highlighted, emphasizing investors' preference for the security of the tokenized dollar.

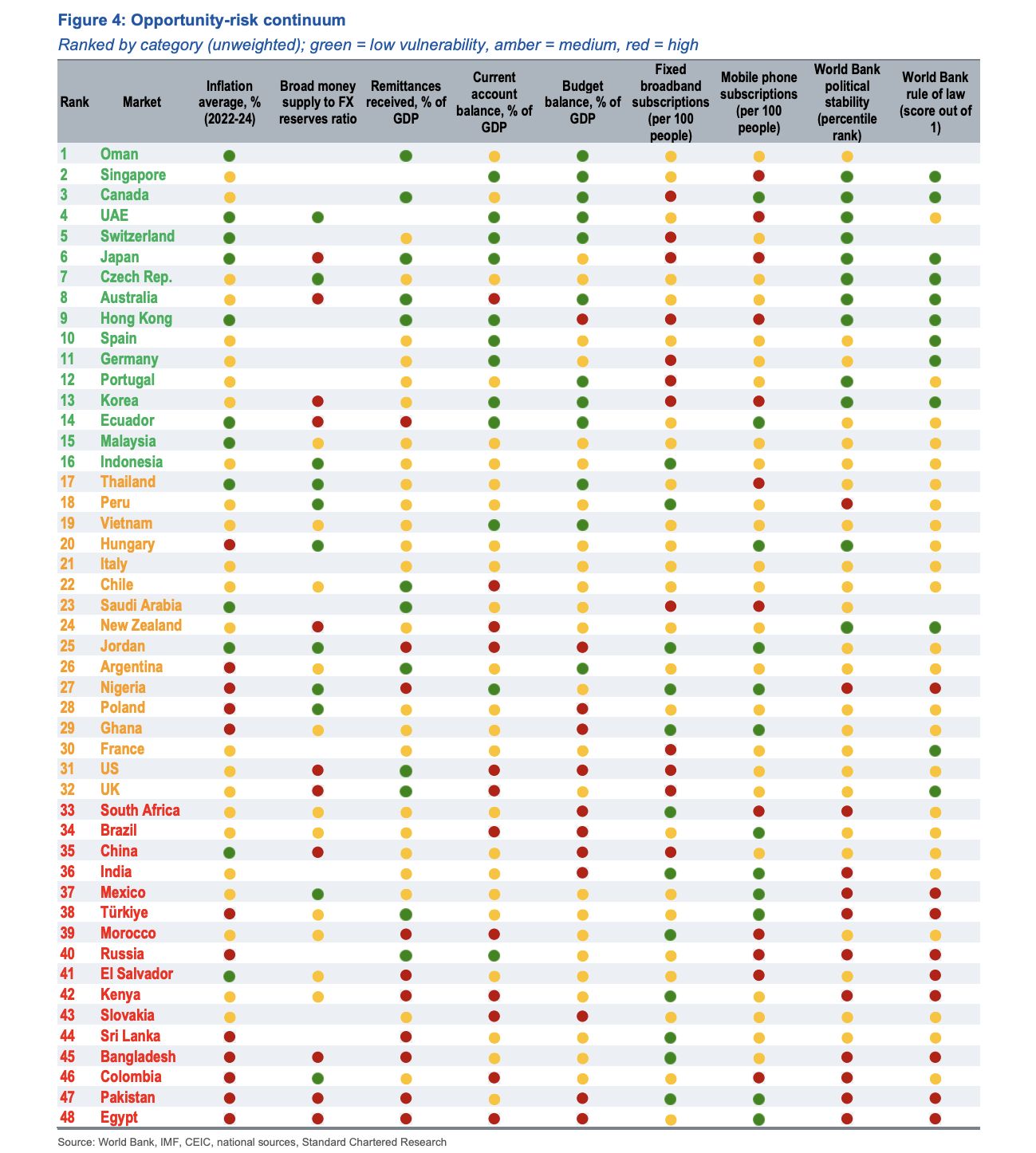

The research identifies Egypt, Pakistan, Colombia, Bangladesh, and Sri Lanka as the countries most vulnerable to bank deposit outflows, followed by Turkey, India, China, Brazil, South Africa, and Kenya. The report suggests that the impact may vary depending on factors such as inflation, monetary stability, and access to digital payment infrastructure.

Image: Standard Chartered

Image: Standard Chartered

The bank also warns that the growth of stablecoins could put pressure on traditional banking revenues, especially in international payments and foreign exchange. However, financial institutions could mitigate the impact by acting as reserve custodians for issuers or incorporating stablecoins into their treasury and settlement operations.

The study was published amid the global expansion of the sector, whose capitalization has surpassed US$300 billion, driven by USDT and USDC, and reinforces the prediction that stablecoins are becoming a structural part of the global digital economy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.