Solana Price Pullback Could Halt at $224 as Bullish Pattern Hints at New Highs

Solana’s short-term pullback may not be a setback. Despite mild selling pressure, on-chain metrics and chart signals suggest $224 could act as a strong floor before a potential breakout toward a new cycle high.

Solana’s latest pullback may not be what it seems. Despite a brief Solana price cooldown (0.6% day-on-day), the network’s on-chain and chart structure suggest that the pause could simply be a reset before the next major leg up.

At around $234, Solana is still up nearly 12% in the past week and 16% over the month, showing that momentum hasn’t faded, only softened. With short-term selling pressure meeting steady accumulation, $224 could be the zone where the current correction finds its floor before pushing forth for a new all-time high.

Short-Term Selling Meets Steady Holder Accumulation

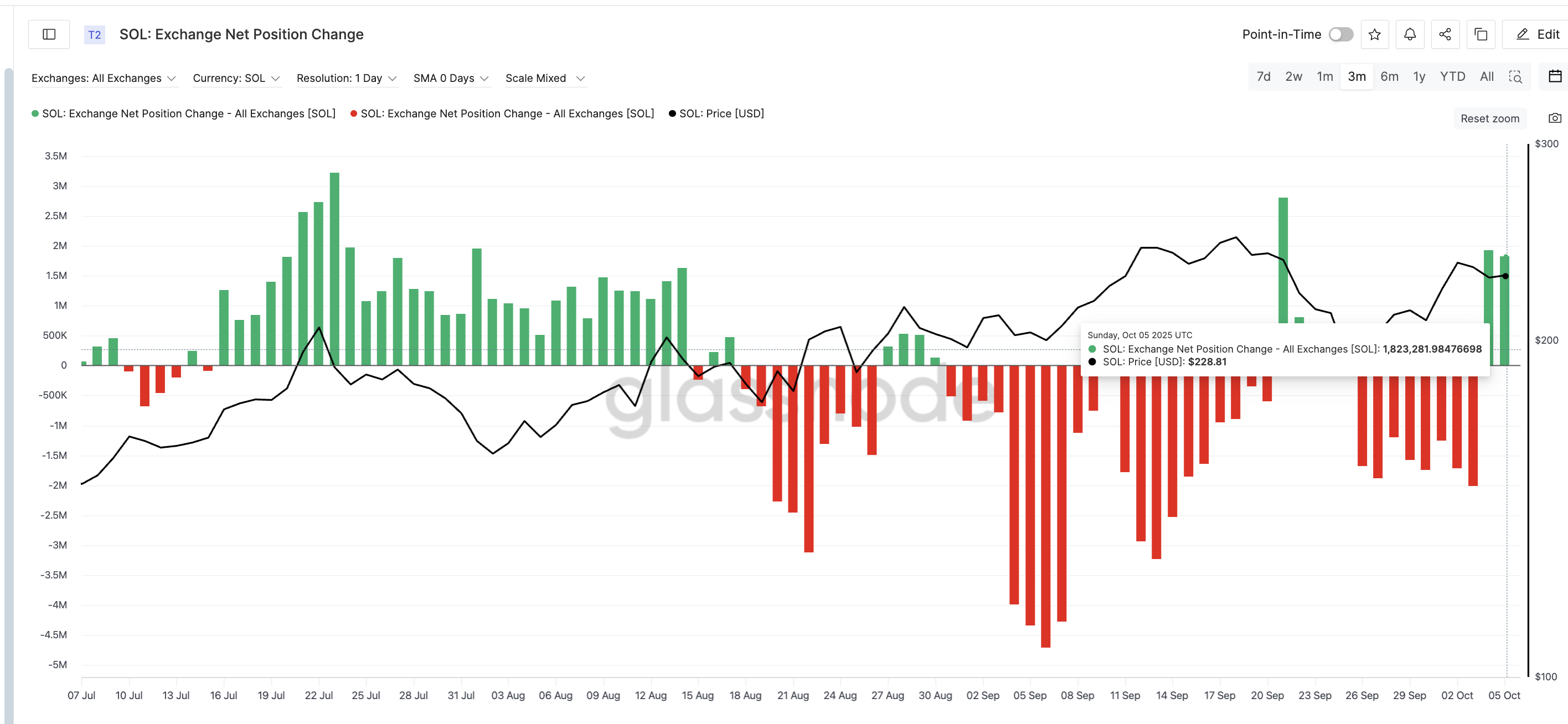

Some profit booking has returned. Solana’s exchange net position change, which tracks the difference between coins entering and leaving centralized exchanges, flipped from –2.01 million SOL on October 3 to +1.82 million SOL on October 5.

Solana Selling Pressure Increases:

Glassnode

Solana Selling Pressure Increases:

Glassnode

A positive reading means more tokens are being sent to exchanges, usually a sign that traders are preparing to sell.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

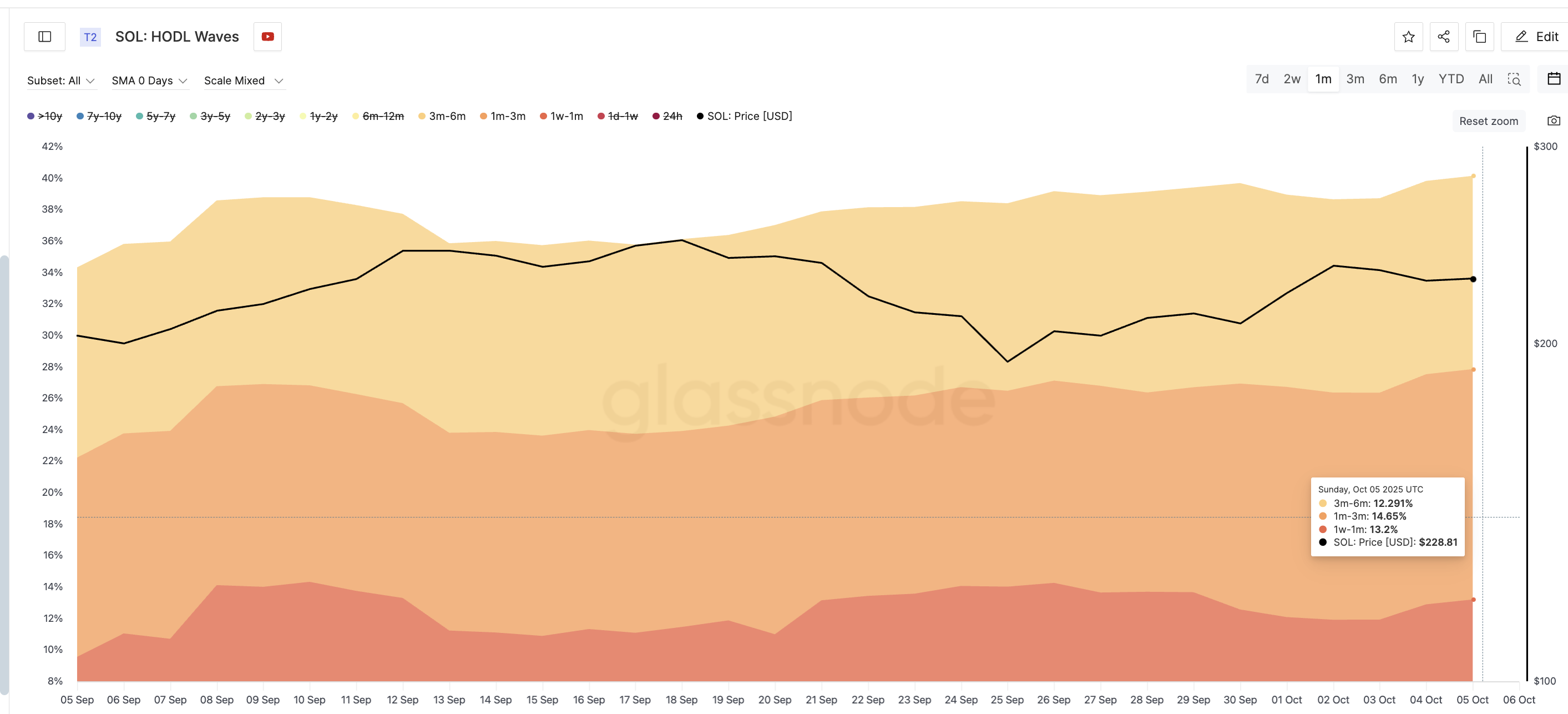

But this pressure is being balanced by mid-term holder conviction. Data from Glassnode’s HODL Waves, which show how long coins stay unmoved, highlight renewed accumulation among short- and mid-term holders.

- 1-week to 1-month holders: up from 9.55% to 13.2% of supply

- 1-month to 3-month holders: up from 12.6% to 14.65%

- 3-month to 6-month holders: up from 11.82% to 12.29%

Solana Buyers Are Still Active:

Glassnode

Solana Buyers Are Still Active:

Glassnode

In simple terms, while some Solana traders are booking profits, smaller and mid-term wallets are quietly adding. This mix of selling and buying often marks a “healthy correction” rather than the start of a trend reversal. To know the correction floor, though, you would need to read through the next section.

Solana Price Breakout Setup Targets $279 and Beyond

On the daily chart, Solana trades within an ascending channel, a pattern characterized by gradually forming higher highs and higher lows. Inside the channel, there is a key Solana price level of $224, which has repeatedly cushioned pullbacks.

The latest dip, if it happens more aggressively, could most likely halt around this point, as despite the supposed selling pressure on exchanges, several cohorts are adding to their SOL stash.

Solana Price Analysis:

TradingView

Solana Price Analysis:

TradingView

Meanwhile, the Relative Strength Index (RSI), which measures momentum, shows a hidden bullish divergence. Between August and late September, the Solana price made a higher low while the RSI made a lower low. This usually confirms that an uptrend still has strength beneath the surface.

If the Solana price closes a daily candle above $245, it could open the way toward $279, the next major resistance. Based on the channel’s height, the potential breakout target from the upper trendline of the channel roughly aligns near $422 — a possible new cycle high if momentum sustains.

For now, the pullback looks less like weakness and more like a deep breath before Solana’s next move higher. Yet, a dip under $190 would invalidate the bullish outlook for now.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.

Bitcoin Under Pressure Despite Fed Optimism