Is OpenAI Using its AMD Deal to Prevent a Chip Maker Monopoly?

OpenAI’s twin investments in AMD and Nvidia may reshape the US chip landscape, balancing power across rivals and preventing monopolistic stagnation in the booming AI sector.

OpenAI made a huge investment in AMD this morning, prompting the company’s market cap to rise by around $100 billion. This may help the manufacturer remain competitive next to Nvidia’s rapid gains.

The AI developer also plans to invest $100 billion into Nvidia, one of the world’s largest tech companies. By favoring both firms, OpenAI could prevent monopoly-like conditions from harming innovation.

OpenAI’s AMD Deal

This morning, OpenAI announced a massive deal with AMD, a US chip manufacturer, to deploy 6 gigawatts of its GPUs. This arrangement brought a huge boost to AMD’s stock, causing some observers to speculate that it caused a major Robinhood outage.

At this rate, the company may break impressive stock trading records:

This is insane:AMD stock, $AMD, extends gains to +35% on the day after its deal with OpenAI.AMD is on track for its biggest single-day market cap gain in history.

— The Kobeissi Letter (@KobeissiLetter) October 6, 2025

However, some analysts have looked a little deeper into this deal. OpenAI CEO Sam Altman called the AMD deal “a major step” in “[realizing] AI’s full potential,” but there may be an unspoken motive too.

AMD and Nvidia have been competing for years in the US chip industry. Is OpenAI trying to keep Nvidia’s competitor viable?

So basically OpenAI wants AMD to stick around so it doesn’t become dependent on NVIDIA? When they did their NVIDIA deal, NVIDIA bought OpenAI shares, now this time OpenAI is getting AMD warrants

— Matthew Zeitlin (@MattZeitlin) October 6, 2025

Nvidia On the Rise

Specifically, less than two weeks ago, the AI company announced a $100 billion deal with Nvidia, boosting its market cap by around $177 billion. The chip maker has also been making crucial inroads with other partners in the AI space, aiming to dominate the sector long term.

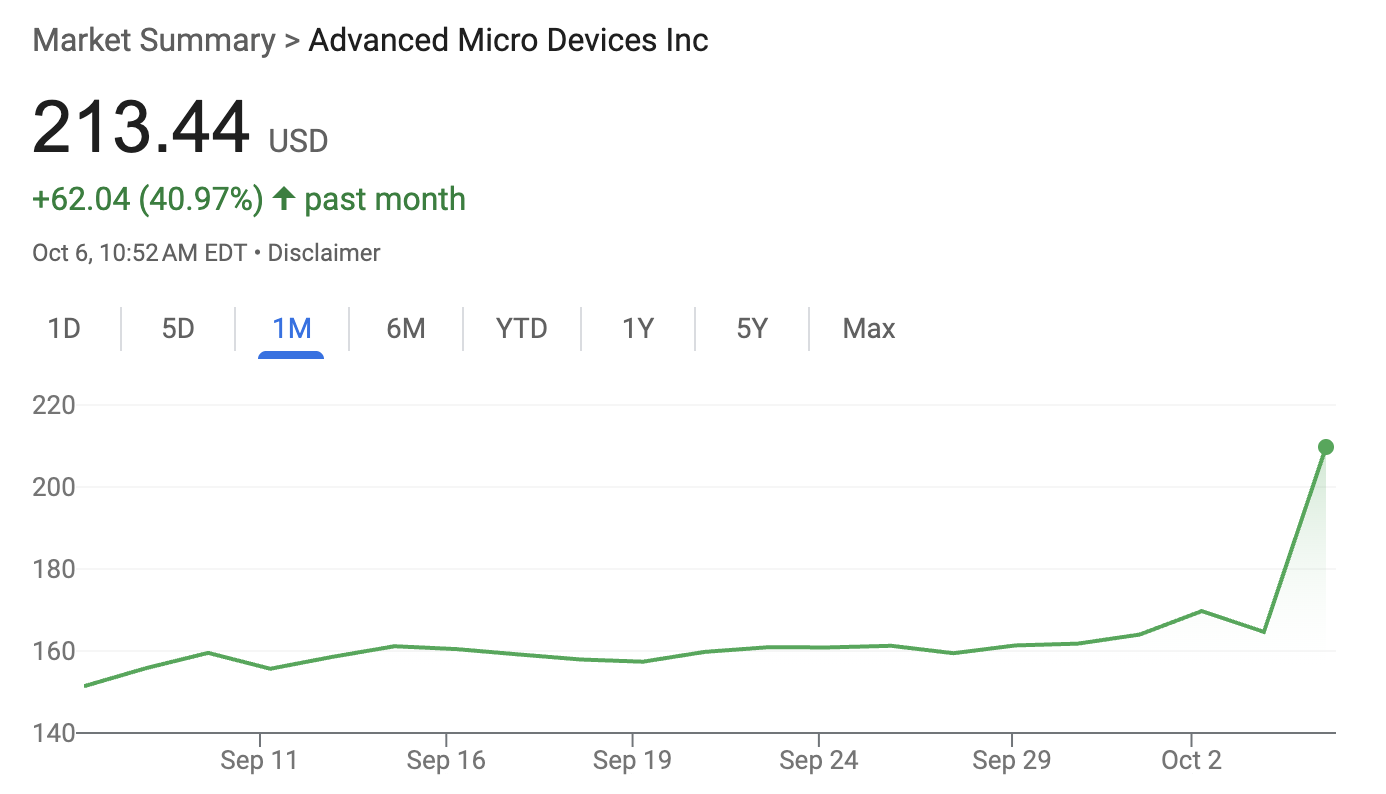

Nvidia is one of the famed “Magnificent 7” stocks, while AMD’s share price has been stagnating for the past month. That is, until OpenAI juiced its valuation with a major partnership:

AMD Price Performance. Source:

AMD Price Performance. Source:

In other words, OpenAI’s investment may be a much-needed boost to AMD, preventing Nvidia from outcompeting it. Sure, the chip maker has been working steadily, but it needs a healthy share of the astronomical AI capex to stay relevant in today’s market.

Dangers of a Monopoly

Furthermore, Chinese chip manufacturers have been making hardware breakthroughs, pushing Nvidia entirely out of China’s domestic market.

If the American chip industry approaches monopoly-like conditions, failure to innovate could have catastrophic consequences for the AI supply chain.

In other words, OpenAI’s investment in AMD can help prevent that scenario. The AI firm will not be reliant on one company for its hardware requirements, and this industry can maintain fierce competition within the US. Although there is a lot of speculation about a dangerous AI bubble right now, OpenAI might have defused a trigger to pop it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.

Bitcoin Under Pressure Despite Fed Optimism

Kiyosaki Trades BTC Gains For Long-Term Cashflow Assets