Date: Mon, Oct 06, 2025 | 02:50 PM GMT

The cryptocurrency market is showing strength this October, in line with its historical trend of positive monthly performance. Both Bitcoin (BTC) and Ethereum (ETH) have climbed over 10% in the past seven days, sparking optimism across the altcoin sector including Pendle (PENDLE).

While PENDLE’s weekly gains have been modest, its technical setup appears to be forming a pattern that could set the stage for a strong upside continuation soon.

Source: Coinmarketcap

Source: Coinmarketcap

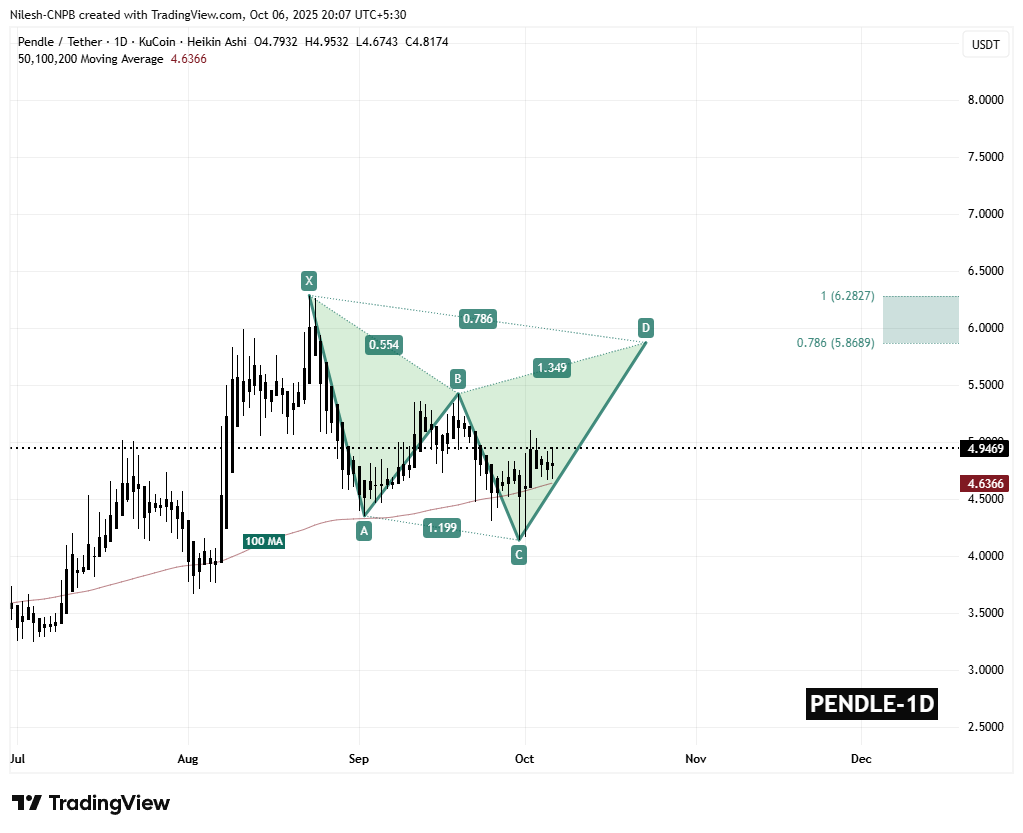

Harmonic Pattern Hints at Potential Upside

On the daily chart, PENDLE has formed a Bearish Butterfly harmonic pattern — but despite its name, this setup often produces a bullish continuation during the CD leg, as price moves toward the Potential Reversal Zone (PRZ).

The pattern began at Point X ($6.2827), declined to Point A, rallied to Point B, and retraced to Point C near $4.1362. From that point, PENDLE regained strength and is now trading around $4.9489, showing consistent accumulation and recovery momentum.

Pendle (PENDLE) Daily Chart/Coinsprobe (Source: Tradingview)

Pendle (PENDLE) Daily Chart/Coinsprobe (Source: Tradingview)

A key development strengthening this view is PENDLE’s successful reclaim of the 100-day moving average ($4.6366). This moving average now acts as a solid support level, increasing the likelihood of sustained upward movement.

What’s Next for PENDLE?

If bulls manage to hold above the 100-day MA, PENDLE could advance toward the PRZ zone between $5.8689 (0.786 Fibonacci extension) and $6.2827 (1.0 Fibonacci extension). These levels mark the potential completion area of the Butterfly pattern — and the next key upside targets for traders watching this setup.

However, traders should also note that the PRZ zone often acts as a profit-taking region, where price might temporarily pause or retrace before continuing its larger trend.

Even so, the broader technical outlook remains bullish, suggesting that PENDLE may continue to build higher highs in the short term before facing its next significant resistance near the upper boundary of the Butterfly pattern.