- Polygon scales Ethereum with fast, low-cost transactions and strong brand partnerships.

- Aave is a leading DeFi protocol offering lending, borrowing, and innovative cross-chain features.

- Uniswap is a dominant decentralized exchange with governance power and growing trading activity.

The crypto market moves fast, but some projects stand out as long-term opportunities. They combine real adoption, strong technology, and growing communities. While many tokens rely only on hype, others build lasting ecosystems that support real-world use cases. Here are three standout tokens worth attention today — Polygon, Aave, and Uniswap.

Polygon (POL)

Source: Trading ViewPolygon has grown into more than a scaling tool for Ethereum. The Polygon Network makes transactions faster and cheaper, giving developers an easy way to launch applications without high fees. From DeFi platforms to NFT marketplaces, projects can thrive on Polygon’s infrastructure. Adoption tells the story. Major brands like Reddit, Nike, and Instagram already use Polygon for blockchain-based projects.

That kind of recognition highlights confidence from both developers and global companies. With each partnership, Polygon proves its value as a scalable and dependable ecosystem. The community keeps expanding as well. Supporters rally behind new updates, making the project stronger over time.

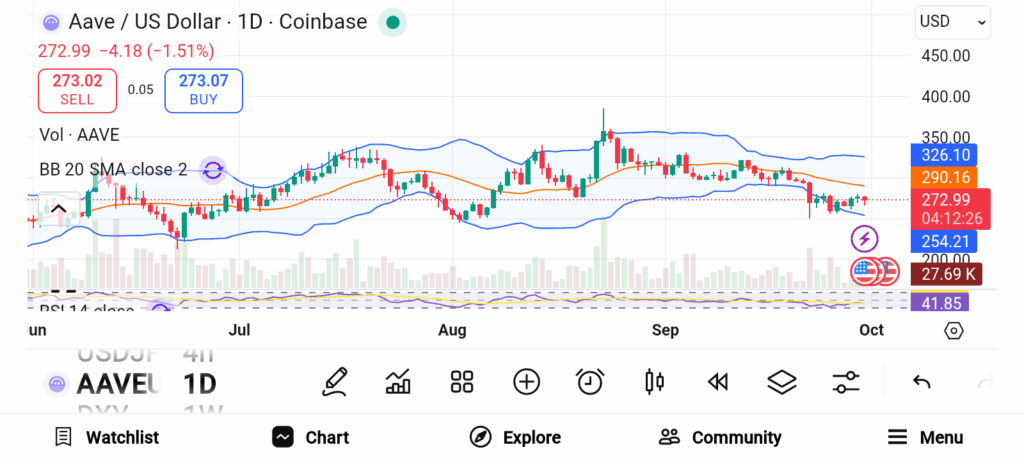

Aave (AAVE)

Source: Trading View

Source: Trading View

Aave has emerged as one of the key pillars of decentralized finance. The protocol allows users to lend and borrow without needing to interact with banks. The liquidity providers earn interest and the borrowers gain access to collateralized loans with increased transparency and efficiency. The protocol’s uniqueness comes from innovation.

Flash loans give users instant access to unsecured loans during a single transaction, for example. Stable rate borrowing provides more predictability for users, which makes the platform more attractive to both one-off and professional use. Aave V3 takes things even further with cross-chain lending and enhanced risk controls.

Uniswap (UNI)

Uniswap is the most widely adopted platform for decentralized trading on Ethereum. As the leading decentralized exchange on the platform, Uniswap facilitates millions of dollars in daily trading volume without utilizing centralized intermediaries. Traders can easily swap tokens, while liquidity providers generate fees based on market activity. The UNI token provides additional strength to the platform.

Governance rights allow UNI holders to vote on important upgrades and relevant policy changes. Investors receive not only exposure to the growth of trading volume but also the ability to impact the future of the exchange. Uniswap grows directly with DeFi. As more users flock toward non-custodial trading options, Uniswap receives additional volume.

Polygon has a significant degree of scalability and genuine adoption through noteworthy partnerships. On the other hand, Aave brings innovation and leadership to the forefront of decentralized lending. Uniswap requires no introduction, providing access to decentralized trading like no other without hesitation and offering great governance value as well.