Ethereum Foundation Converts 1,000 ETH to Stablecoins – Here’s Why

The Ethereum Foundation has conducted 17 ETH sales so far in 2025, totaling several thousand ETH across multiple months.

The Ethereum Foundation has announced plans to sell 1,000 ETH, worth roughly $4.5 million, as ETH’s price climbs above $4,500 for the first time since mid-September.

The sale, disclosed on October 4, will be executed using CowSwap’s Time-Weighted Average Price (TWAP) feature. This automated tool spreads large transactions over time to prevent sudden market disruptions.

Ethereum Foundation’s 17th ETH Sale This Year Renews Market Debate

By using TWAP, the Foundation aims to reduce price volatility, minimize slippage, and secure more balanced execution prices.

Institutional investors and crypto treasuries often rely on similar strategies to offload large holdings without triggering sharp price swings.

1/ Today, The Ethereum Foundation will convert 1000 ETH to stablecoins via 🐮 @CoWSwap's TWAP feature, as part of our ongoing work to fund R&D, grants and donations, and to highlight the power of DeFi.

— Ethereum Foundation (@ethereumfndn) October 3, 2025

As a result, the proceeds will be converted into stablecoins to fund ongoing operations such as ecosystem research, developer grants, and community donations.

According to the Foundation, this sale aligns with its broader strategy of managing its treasury more efficiently while leveraging DeFi tools.

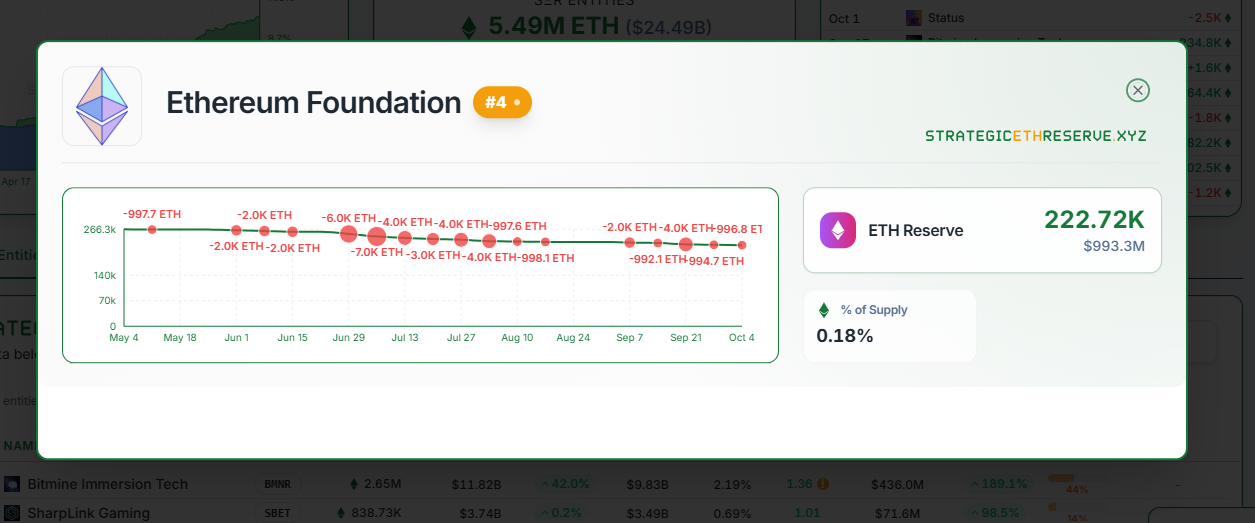

Meanwhile, this marks the Foundation’s 17th ETH sale in 2025. Its remaining balance now stands near 222,720 ETH—worth approximately $1 billion at current prices.

Ethereum Foundation ETH Holdings. Source:

Strategic ETH Reserve

Ethereum Foundation ETH Holdings. Source:

Strategic ETH Reserve

The frequent sales have raised concerns among community members, who argue that such activity can create bearish sentiment and weaken investor confidence.

While some critics have questioned the optics of repeated sales during bullish momentum, others view the move as a necessary step toward responsible treasury management.

Crypto researcher Naly suggested that the Foundation could “highlight the power of DeFi” by using decentralized tools to generate liquidity rather than selling tokens outright.

Naly proposed an alternative: “Supply ETH on Aave, earn interest, borrow stablecoins, and fund operations using DeFi-generated capital.”

Advocates say this method would allow the Foundation to maintain exposure to ETH’s potential upside while still accessing liquidity for expenses.

Still, not all feedback has been negative.

Several community members have praised the Foundation’s transparency for announcing its sales publicly. According to them, this practice is uncommon among large crypto organizations.

As of press time, Ethereum trades around $4,500, up 12% from last week’s low near $4,000, according to BeInCrypto data.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ICP Value Jumps 30% Following Significant Network Update: Enhanced On-Chain Governance and Layer 1 Expansion Drive DeFi Advancement

- ICP's token price surged 30% in 2025 due to transformative upgrades in on-chain governance and Layer 1 scalability. - Fission and Knot upgrades enabled 1,200+ TPS with reverse gas model, outperforming Ethereum's scalability limitations. - Active Liquid Democracy governance and Neuron Fund attracted 2,155+ developers, boosting TVL by 22.5% in one day. - Price gains correlate with DeFi adoption, institutional staking, and cross-chain integrations via Chain Fusion technology.

Solana News Update: Major Investors Place Significant Bets on Solana ETFs Amid 30% Price Drop, Challenging the Strength of $130 Support

- Solana's ETFs (BSOL/FSOL) drew $476M in 17 days despite SOL's 30% price drop to $130, signaling institutional confidence. - $130 support level shows buying pressure with RSI rising to 50, though $160 EMA remains a key reentry target for bulls. - On-chain growth (18% active address rise) and projects like GeeFi reinforce Solana's infrastructure, but $140 resistance remains fragile. - Mixed futures signals (5% higher OI, positive funding rates) highlight uncertainty, with $120 as next potential downside ri

PEPE Balances on a Fine Line: Key Support at $0.0547 and Resistance at $0.05504 Under Scrutiny

- PEPE cryptocurrency stabilized above $0.0547 support, trading within a narrow range as of mid-November 2025. - Technical indicators show neutral sentiment with RSI at 50.62 and MACD near zero, per xt.com and BitGet analyses. - Whale movements and exchange flows drive volatility, while long-term forecasts range from 140,000% to 28.6 million% gains by 2030-2050. - Market depends on meme culture relevance, institutional adoption, and broader crypto trends like Ethereum's price and ETF regulations.

Bitcoin Updates Today: Kiyosaki Turns Bitcoin Profits into Ongoing Income, Living by His Own Advice

- Robert Kiyosaki sold $2.25M in Bitcoin at $90,000/coin, reinvesting in surgical centers and billboards for tax-free income. - He aims for $27,500 monthly cash flow by 2026, aligning with his passive-income strategy while maintaining Bitcoin's $250K/2026 price target. - Bitcoin's 33% drop from $126K peaks reflects broader market slump driven by Fed rate uncertainty and offshore trading pressures. - Kiyosaki advocates gold/silver and warns of systemic risks, contrasting with analysts who see intact fundame