Blockchain network revenues declined 16% in September: Report

Network revenues across the blockchain ecosystem declined by 16% month-over-month in September, mainly due to reduced volatility in the crypto markets, according to asset manager VanEck.

Ethereum network revenue fell by 6%, Solana’s fell by 11%, and the Tron network recorded a 37% reduction in fees, due to a governance proposal that reduced gas fees by over 50% in August, according to VanEck’s report.

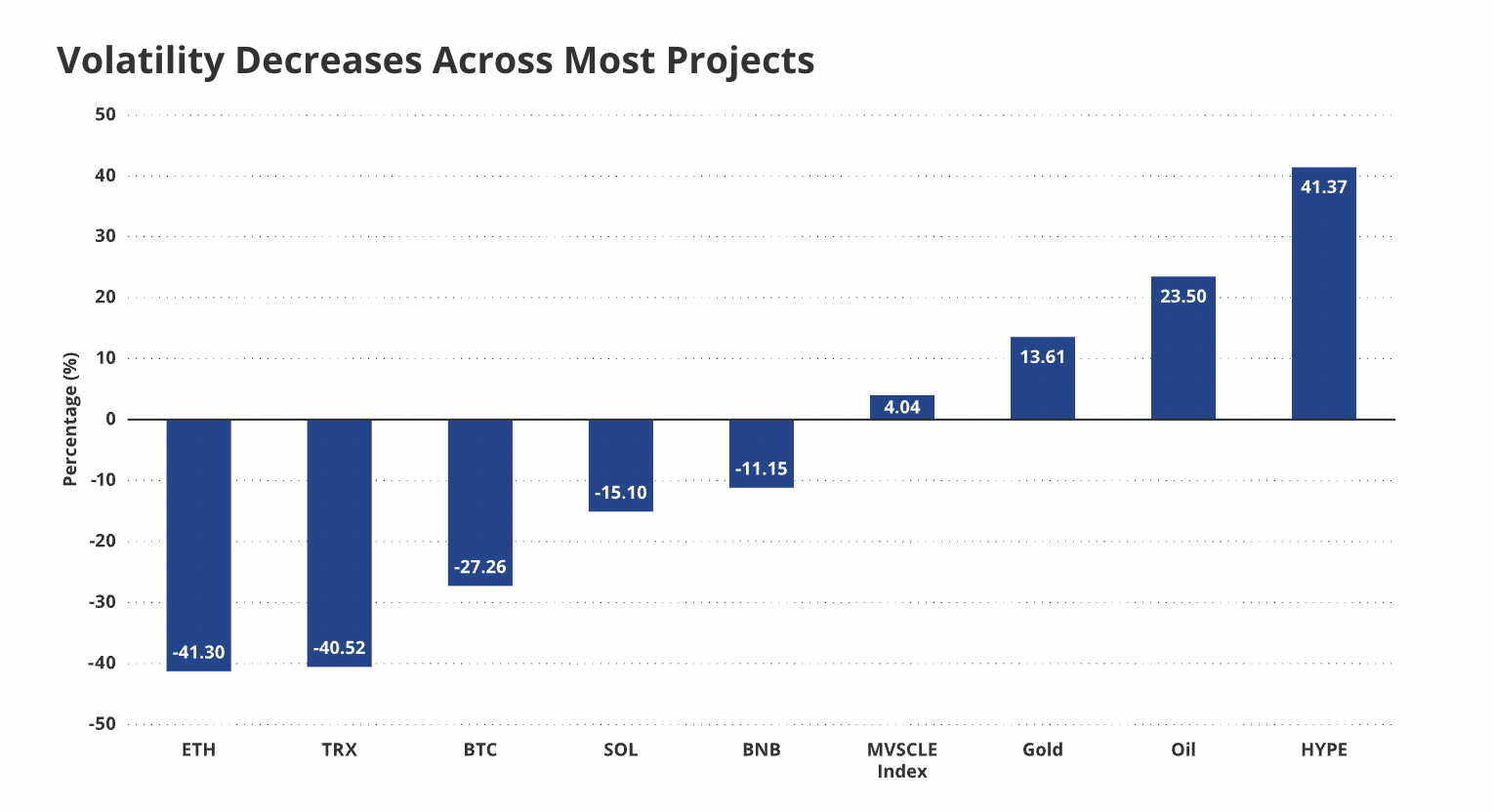

The revenue drop in the other networks was attributed to reduced volatility in the crypto markets and the underlying tokens powering those networks. Ether (ETH) volatility dropped by 40%, SOL (SOL) volatility fell by 16%, and Bitcoin (BTC) fell by 26% in September.

“With reduced volatility for digital assets, there are fewer arbitrage opportunities to compel traders to pay high priority fees,” the writers of the report explained.

Network revenues and fees are a critical metric for economic activity in crypto ecosystems. Market analysts, traders, and investors monitor network fundamentals to gauge the overall health of a particular ecosystem, individual projects, and the broader crypto sector.

Related: Ethereum revenue dropped 44% in August amid ETH all-time high

Tron network continues to dominate revenue metrics

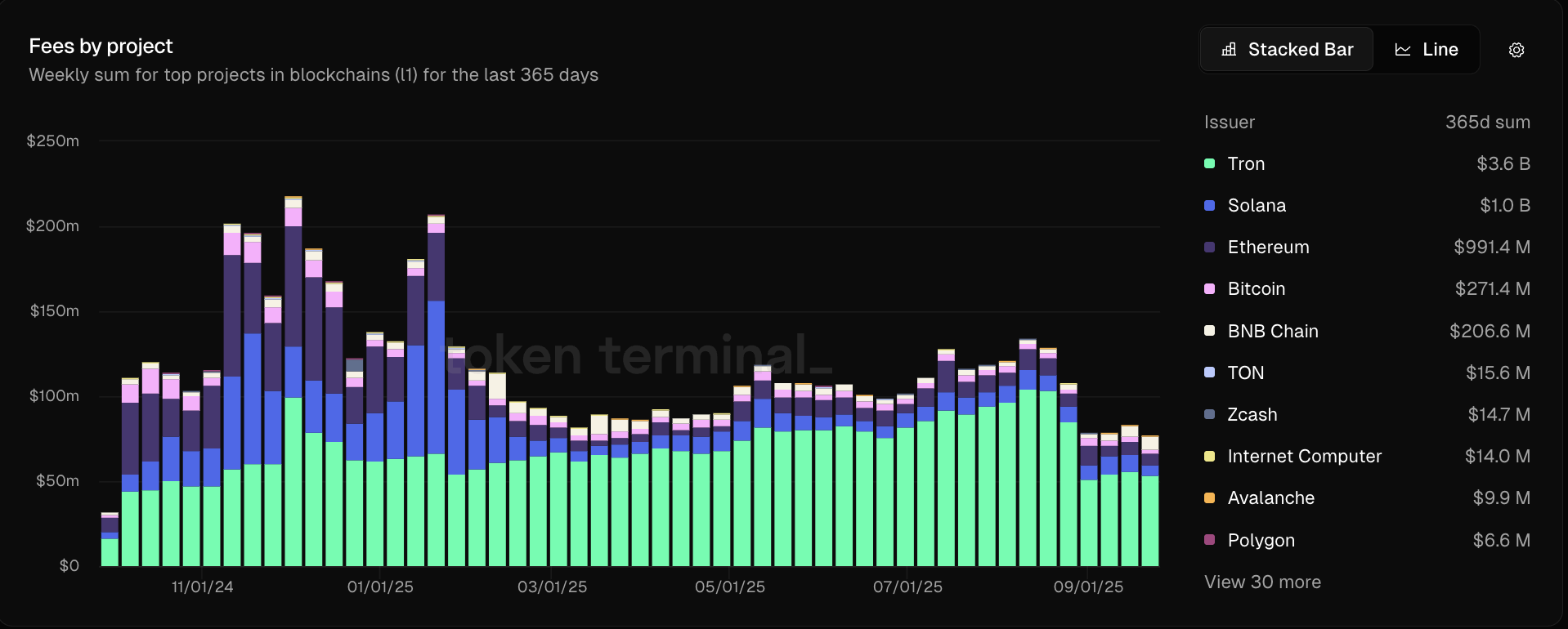

The Tron network is ranked as the number one crypto ecosystem for revenue, generating $3.6 billion in the last year, according to data from Token Terminal.

Ethereum, by comparison, only generated $1 billion in revenue over the last year, despite ETH hitting all-time highs in August, and a market capitalization of about $539 billion — over 16x the TRX (TRX) market capitalization, which is just north of $32 billion.

Tron’s revenue is attributed to its role in stablecoin settlements. 51% of all circulating Tether USDt (USDT) supply has been issued on the Tron network.

The stablecoin market cap crossed $292 billion in October 2025 and has been steadily growing since 2023, according to data from RWA.XYZ.

Stablecoins are a major use case for blockchain technology, as governments attempt to increase the salability of their fiat currencies by placing them on crypto rails.

Blockchain rails allow currencies to flow between borders, with near-instant settlement times, minimal fees, 24/7 trading, and do not require a bank account or traditional infrastructure to access.

Magazine: Ether could ‘rip like 2021’ as SOL traders brace for 10% drop: Trade Secrets

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Halving and Its Potential Impact on Cryptocurrency Market Fluctuations

- Zcash's 2025 halving cut block rewards by 50%, tightening annual inflation to 2%, sparking debates on supply reduction's impact on investor sentiment and institutional adoption. - ZEC surged 1,172% post-halving but faced extreme volatility ($736 to $25.96 in 16 days), driven by speculative trading and liquidity constraints in its $10.3B market cap. - Institutional adoption accelerated with Grayscale's $151.6M investment and Zcash ETF filing, while EU's MiCA regulations challenge privacy coins but Zcash's

ICP Price Jumps 30%: Exploring the Driving Forces and Long-Term Investment Outlook

- ICP token surged 30% in Nov 2025 to $4.71, driven by ICP 2.0 upgrades and institutional partnerships with Microsoft , Google, and SWIFT. - Price retreated to $3.50 by Dec 2025 amid waning AI hype, macroeconomic pressures, and speculative trading volatility. - NVT ratio and DCF analyses highlight valuation challenges, with optimistic 2026 price projections ($11.15–$31.89) contingent on real-world adoption and institutional traction. - Market dynamics reveal a duality: innovative infrastructure potential v

AI and Financial Stability in 2025: The Role of ICP Caffeine AI in Transforming Risk Management Amid Market Uncertainty

- ICP Caffeine AI, DFINITY's blockchain-AI platform, reduces AI inference costs by 20-40% while enabling real-time financial risk analysis through hybrid cloud-decentralized infrastructure. - AI-driven risk tools outperform traditional VaR models by 10% in predictive accuracy, achieving 60% efficiency gains for institutions through real-time data processing and regulatory integration. - Despite $237B TVL and 56% ICP price growth, the platform faces challenges including 22.4% dApp activity decline, token vo

Why is Internet Computer (ICP) Experiencing Rapid Growth in Late 2025: An In-Depth Examination of Blockchain Expansion and the Evolution of Decentralized Web Systems

- Internet Computer Protocol (ICP) surges in late 2025 due to protocol upgrades, institutional adoption, and alignment with AI-driven finance trends. - Chain Fusion enables cross-chain interoperability with Bitcoin/Ethereum, while Caffeine AI democratizes dApp development via natural language prompts. - Institutional adoption grows with 2,000+ new developers, $1.14B TVL, and zero-fee transactions attracting financial institutions seeking cost-efficient solutions. - ICP's hybrid cloud/Web3 model addresses e