Tether Gold Nears $1.5 Billion After Tokenized Treasury Move

Tether's deepening ties to gold—spanning mining investments and redemption-backed vaults—signal a major strategic shift beyond stablecoins.

Tether Gold (XAUt), the gold-backed digital token issued by stablecoin giant Tether, is closing in on a $1.5 billion market capitalization.

According to data released by the company, Tether Gold’s market capitalization currently stands at about $1.46 billion, supported by 966 gold bars weighing 11,693.4 kilograms.

Digital Gold Rush Pushes Tether’s XAUt Toward $1.5 Billion

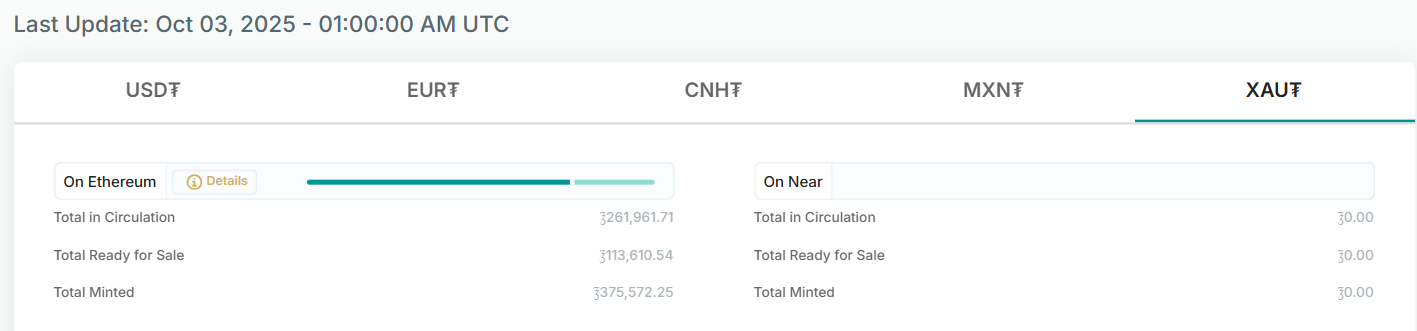

The firm said the token’s total minted supply amounts to 375,572.25 ounces, of which 261,961.71 ounces—worth roughly $1.01 billion—are in circulation, while 113,610.54 ounces remain available for sale.

Tether XAUt Token Supply. Source:

Tether

Tether XAUt Token Supply. Source:

Tether

The token’s market value rise mirrors gold’s record-breaking rally. Indeed, spot gold price recently climbed to an all-time high of $3,896.49, marking its seventh consecutive weekly gain.

Market analysts attribute this climb to investors seeking safety amid fears of a prolonged US government shutdown and mounting expectations of the Federal Reserve cutting interest rates.

As gold prices soar, digital representations like XAUt have benefited from parallel demand. Investors increasingly view tokenized gold as a more liquid, accessible alternative to traditional holdings.

Consequently, Tether Gold has appreciated by nearly 46% over the past year and 10% in the past month, earning it a place among the world’s 100 largest cryptocurrencies by market capitalization.

Tether to Deepen Gold Strategy

Tether’s ambitions in tokenized assets extend well beyond XAUt’s market performance.

The USDT issuer is reportedly working to raise at least $200 million for a new Digital Asset Treasury Company (DATCO) focused on tokenized gold. On this venture, it is partnering with Antalpha, a firm linked to Bitcoin hardware maker Bitmain.

According to the report, the DATCO will hold Tether’s XAUt tokens and open the door for broader institutional participation in tokenized gold.

Meanwhile, this venture builds on a series of earlier collaborations between Tether and Antalpha.

In June, Tether acquired an 8.1% equity stake in the company. By September, the two firms had expanded their partnership to improve access to XAUt through collateralized lending and vault services across major financial centers.

These arrangements allow investors to redeem tokens directly for physical gold bars, reinforcing the token’s real-world value proposition.

Moreover, Tether has also diversified deeper into the gold industry by investing in mining and royalty companies.

The firm has invested over $200 million in Toronto-listed Elemental Altus and is reportedly in talks with other global mining and royalty groups.

Collectively, these initiatives mark one of Tether’s boldest strategic shifts since it established dominance in the stablecoin sector.

As CEO Paolo Ardoino often emphasizes, Bitcoin, gold, and land remain the company’s ultimate hedges “against incoming darker times.” As of June, the firm held over $8.7 billion worth of gold on its balance sheet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Sky Invests $2.5 Billion: Turning to Real-World Assets to Address Stablecoin Volatility

- Sky (formerly MakerDAO) authorizes $2.5B in USDS for Obex, a crypto incubator targeting RWA-backed stablecoins. - Obex focuses on compute credits, energy assets, and fintech loans, offering 12-week programs with access to Sky's $9B reserves. - The initiative addresses synthetic stablecoin volatility by prioritizing institutional-grade RWA collateral like solar infrastructure and loans. - With $37M in initial funding, Obex aims to stabilize yield-generating stablecoins amid a projected $1T market growth.

Bitcoin News Today: KULR Reports 116% Jump in Q3 Revenue While Net Loss Expands, Boosting Investment in R&D and Bitcoin

- KULR's Q3 2025 revenue surged 116% to $6.88M, but net loss widened to $6.97M due to impairment charges and rising operating costs. - The company boosted R&D spending by 88% to $2.32M while launching six CubeSat batteries and a next-gen battery management system. - Strategic partnerships with Molicel and Amprius , plus a 3.3 MW Bitcoin mining deal with Soluna , support KULR's UAS-focused product expansion. - Despite $24.5M in cash reserves and a Bitcoin treasury strategy, KULR faces risks from 69% revenue

Divided Fed and Data Discrepancies Cloud Prospects for December Rate Reduction

- The U.S. Federal Reserve faces pressure to cut rates in December amid stable inflation (2.7%) and cooling labor markets, despite internal divisions and data gaps from the government shutdown. - FOMC dissenters oppose cuts, with officials like Jeff Schmid against reductions and Stephen Miran advocating a 50-basis-point cut, complicating market expectations. - Delayed economic data, including October nonfarm payrolls, and global factors like China's stimulus and Latin American slowdowns, heighten uncertain

Zcash (ZEC) Price Rally: Regulatory Transparency and Growing Institutional Interest Fuel Privacy Coin's Comeback

- Zcash (ZEC) surged 1,175% to $683.14 by November 2025, driven by U.S. regulatory clarity and institutional adoption. - The Clarity Act (H.R.3633) and Genius Act established legal frameworks, classifying digital assets and aligning privacy coins with AML compliance. - Institutional investments totaling $245.88 million from Cypherpunk, Winklevoss, and Grayscale validated Zcash as a privacy-first Bitcoin alternative. - Zcash's optional transparency features, like Zashi Wallet's privacy swap, now meet regula