Privacy Coins Quietly Outperform Bitcoin and Ethereum With 71.6% Gains in 2025

While Bitcoin and Ethereum dominated headlines, privacy coins quietly became 2025’s best performers, with Zcash recording major gains.

In a year dominated by headlines about Bitcoin’s (BTC) record highs, Ethereum’s (ETH) rally, meme coins, layer-2 solutions, and more, privacy coins have quietly emerged as the cryptocurrency sector’s top performers.

Despite minimal media attention and subdued public interest, the privacy coin market has outpaced every other sector. The growth has been further propelled by the recent bullish rally in leading privacy tokens.

Privacy Coins Emerge as 2025’s Best-Performing Crypto Sector

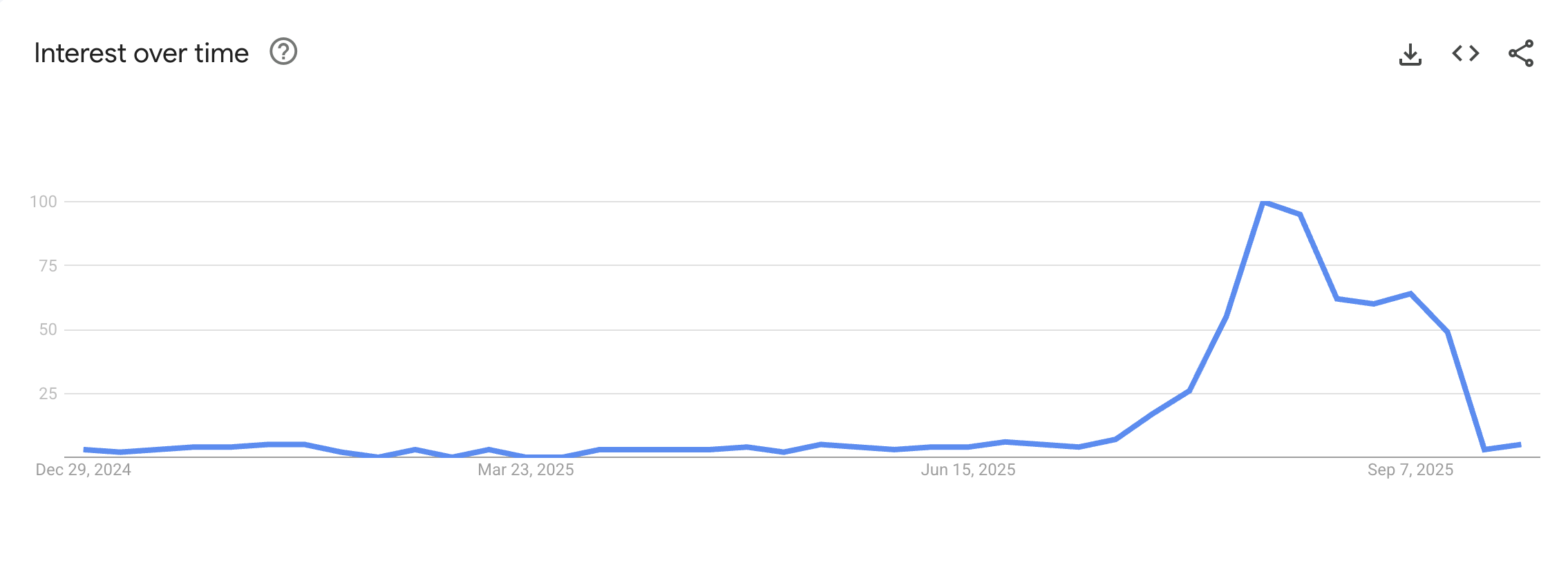

Google Trends data indicated that search interest for the term ‘privacy coin’ remained low through the first half of 2025, only beginning to accelerate in August and reaching a peak. However, this was short-lived as public curiosity faded again and interest dropped.

Search Interest in The Term ‘Privacy Coin.’ Source:

Google Trends

Search Interest in The Term ‘Privacy Coin.’ Source:

Google Trends

In addition, when compared to searches for terms like ‘crypto’ or ‘altcoin,’ interest remained completely flat. This showed a lack of retail interest in the sector.

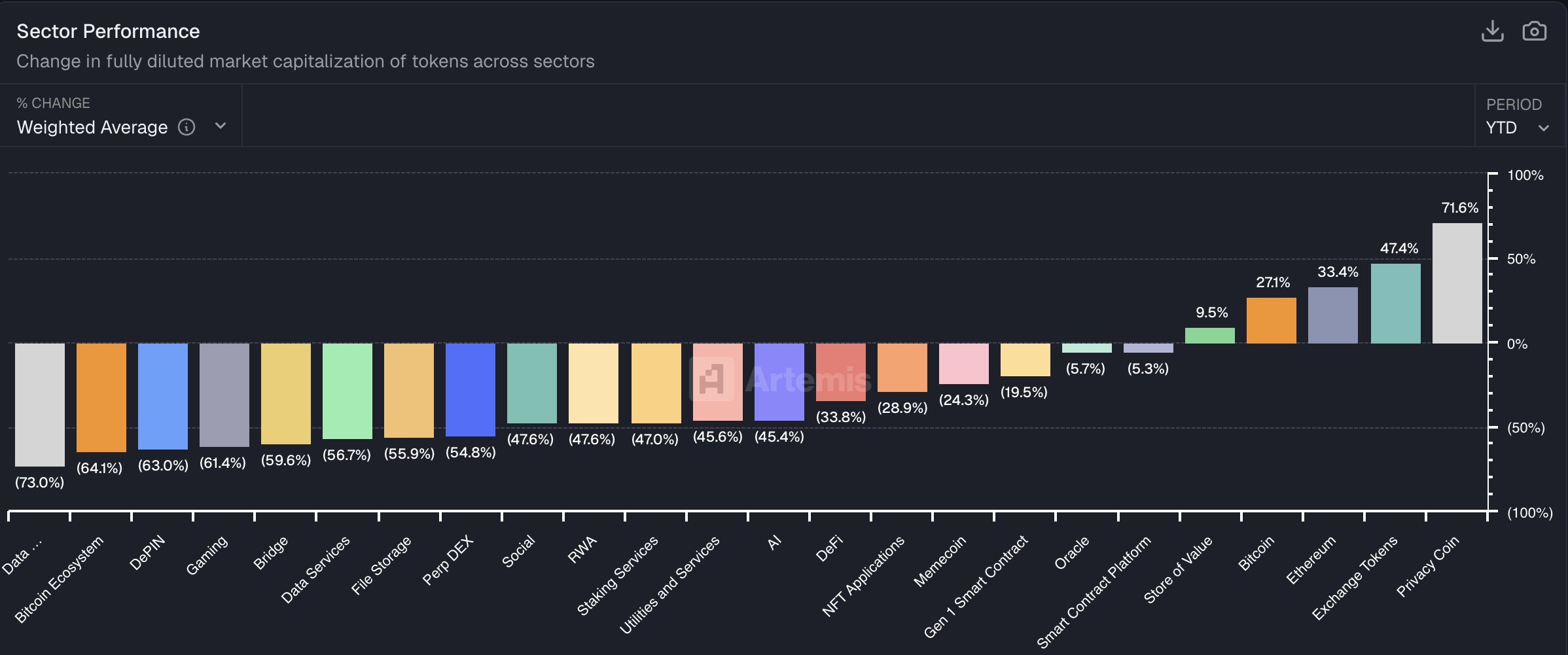

Despite this, privacy-focused cryptocurrencies have continued to grow. According to the latest data from Artemis, the sector has risen 71.6% in 2025, the highest uptick among all crypto sectors.

Privacy Coins Performance. Source:

Artemis

Privacy Coins Performance. Source:

Artemis

In comparison, Bitcoin has seen a 27.1% increase. Additionally, Ethereum, exchange tokens, and store-of-value assets have appreciated 33.4%, 47.4%, and 9.5%, respectively. Meanwhile, the rest of the sectors have all seen losses.

Zcash Leads Privacy Coin Rally in 2025

That being said, retail interest is not entirely absent from privacy coins. The latest rallies in leading tokens show that momentum has intensified recently.

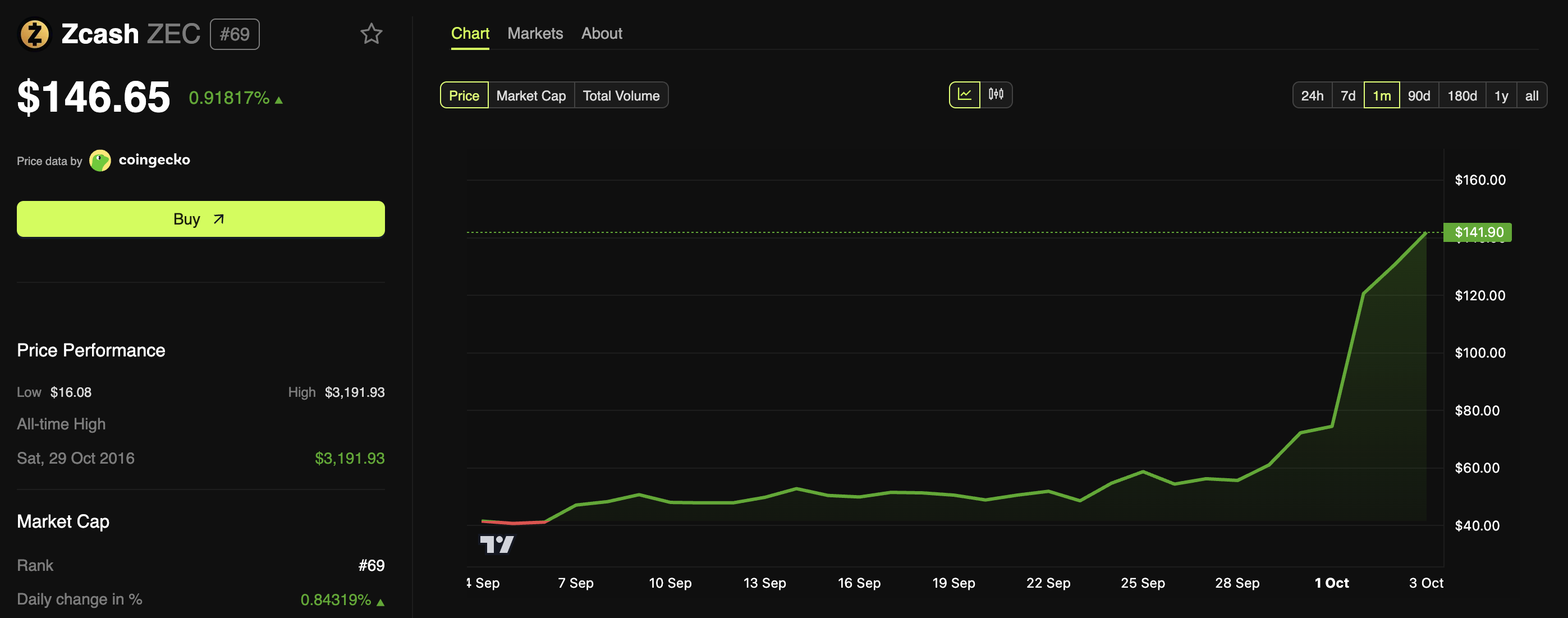

For instance, Zcash (ZEC) has been the standout, surging over 150% in the past week. BeInCrypto recently reported that the altcoin reached a three-year high, with a 247% monthly return.

Bitcoin is insurance against fiat.ZCash is insurance against Bitcoin.

— Naval (@naval) October 1, 2025

The catalyst was Grayscale’s launch of a Zcash Trust, enabling accredited investors to gain exposure without direct token handling and boosting demand. At the time of writing, the privacy coin traded at $146.65, up 0.918% over the past day.

Zcash (ZEC) Price Performance. Source:

BeInCrypto Markets

Zcash (ZEC) Price Performance. Source:

BeInCrypto Markets

Meanwhile, Monero (XMR), the sector’s leader with a market cap of approximately $6.1 billion, has also performed strongly. Over the past week, the coin has gained nearly 14%, less than ZEC but still outperforming the broader crypto market’s gains.

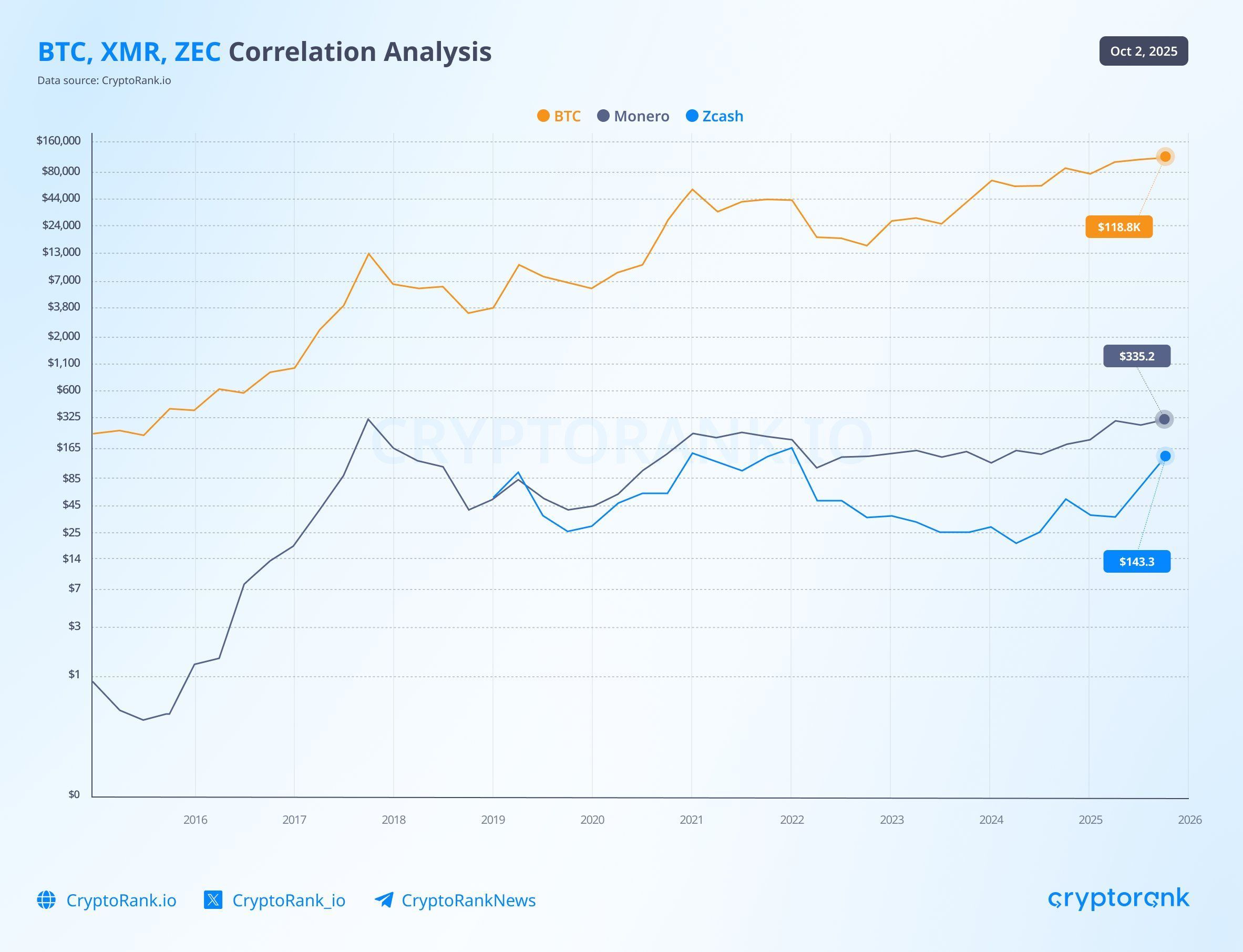

CryptoRank pointed to a mix of factors behind the recent upswing in privacy coins. One explanation is capital rotation, typically seen in crypto markets.

Another is the theory that privacy tokens often see stronger runs closer to the later stages of a market cycle. At the same time, tightening regulations and accelerating adoption have renewed attention on privacy as a potential growth theme.

“Privacy coins don’t just pump at cycle tops. Data shows they grow across different stages – XMR & ZEC moving in sync with BTC prove it,” CryptoRank added.

XMR, ZEC, and BTC Correlation. Source:

X/CryptoRank_io

XMR, ZEC, and BTC Correlation. Source:

X/CryptoRank_io

Thus, with momentum building, privacy tokens are positioning themselves as a core narrative in the ongoing bull market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO Falls 1.74% as 1-Month Results Remain Subdued

- Algorand (ALGO) dropped 1.74% on Nov 24, 2025, extending its 1-month decline to 20.35% amid sustained bearish sentiment. - The token’s annual price has fallen 57.76% from its peak, driven by macroeconomic volatility and uncertainty over potential interest rate cuts. - No ALGO-specific news or on-chain developments were reported, with price movements linked to broader economic factors and risk appetite shifts. - Analysts warn the bearish trend may persist unless major upgrades emerge, urging investors to

DOGE drops 53.85% over the past year after early dissolution of federal agency

- Trump's DOGE department, aimed at cutting federal spending, was disbanded early, with functions absorbed by OPM. - DOGE's aggressive cost-cutting, including $1.9B in canceled contracts, faced scrutiny over lack of transparency and legal concerns. - The DOGE cryptocurrency token fell 53.85% in a year, while Grayscale launched spot ETFs as the department dissolved. - Former DOGE staff now hold federal roles, but its legacy raises ongoing questions about executive authority in reform efforts.

YFI Value Increases by 1.18% During Market Fluctuations

- YFI rose 1.18% in 24 hours to $4,036 but fell 49.49% annually, highlighting extreme volatility. - Short-term gains lack clear catalysts, with analysts noting broader market dynamics drive fluctuations. - Long-term bearish trends persist despite temporary rebounds, urging caution amid macroeconomic pressures.

Aave News Today: The Two Sides of DeFi: Aave's Expansion Increases Volatility Concerns

- Aave's AAVE token faces volatility risks near 0.57 support level, with whale accumulation and leveraged positions amplifying short-term instability. - A major Aave whale added 24,000 AAVE tokens (total 276,000) at $165 average cost, but remains vulnerable to repeat October 11 liquidation risks. - A $80M WBTC long position on Aave approaches $65,436 liquidation threshold, threatening forced selling and downward price pressure. - Tangem's Aave-integrated stablecoin yield feature highlights protocol's DeFi