Uptober rally builds as on-chain data confirm crypto market strength

The crypto market is rallying after a turbulent week that erased billions from the total market cap and left traders on edge.

- The crypto market kicked off October on a strong note, lifting total value to $4.17 trillion.

- Bitcoin is up $118,000 on the day with a 4% gain, while Ethereum rose 6% to $4,400.

- Other altcoins rallied as well, with the likes of Zcash and Zora posting stronger double-digit gains.

- Analysts believe the bull cycle is still underway, with room for more upside in Uptober.

The uptrend comes as the crypto market stages a broad rebound, with several coins climbing back from recent lows.

Bitcoin ( BTC ) is leading the rebound, surging past $118,000 and gaining roughly 4% in the past 24 hours. Ether ( ETH ) is also back in focus, jumping over 6% to briefly touch $4,400 after sinking to $3,900 during the latest market pullback.

Other major altcoins like Solana ( SOL ) and Binance Coin ( BNB ) rose as well, with SOL climbing 7% to $225, and BNB trading near $1,040. Some smaller-cap altcoins posted even stronger double-digit gains, with Zcash ( ZCASH ) jumping 73% and Zora ( ZORA ) surging nearly 33%.

This rebound is fueled by both price action and renewed sentiment. The total crypto market capitalization is up 4.6% to $4.17 trillion on the day, turning the broader mood from caution to confidence. The ongoing rally comes as anticipation for “Uptober” picks up among traders and market participants, with hopes high for the momentum to hold and push prices to new highs.

On-chain data back Uptober crypto market rally

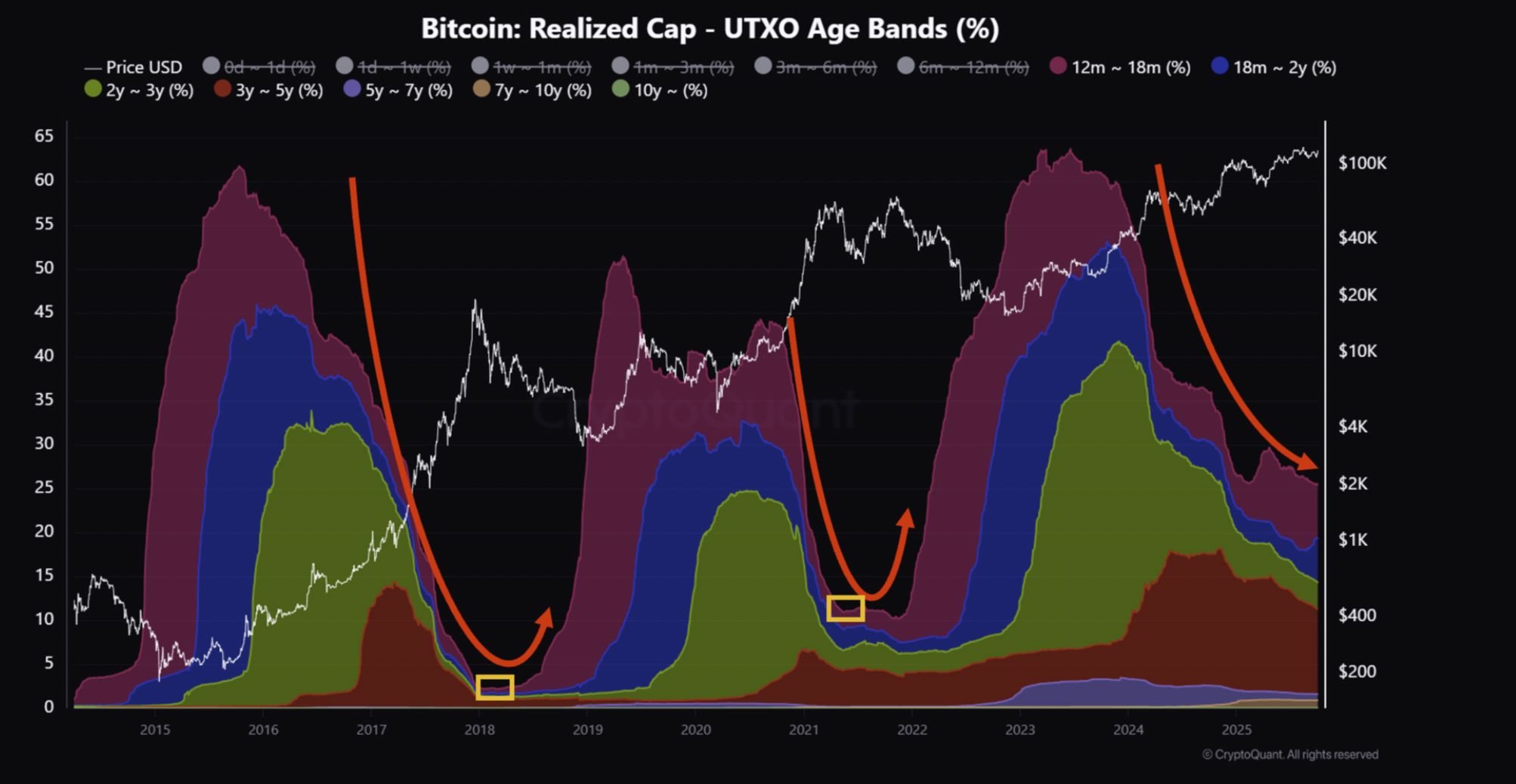

Supporting the outlook, a new CryptoQuant analysis suggests that the crypto market rally may still have room to run. Per the report , the current bull cycle is “slow but still in progress,” with long-term Bitcoin holders gradually reducing their positions but not yet signaling a market top.

Historically, the late stage of a bull run has been marked by a sharp drop in the share of BTC held for more than a year, as early investors sell into strength and new capital flows into the market. That shift has typically signaled the beginning of a transition from bullish momentum to the early stages of a bear cycle.

At present, the share of Bitcoin held long-term is declining at a much slower pace. This suggests the cycle is maturing but has not yet reached its peak.

Bitcoin Realized Cap chart | Source: CryptoQuant

Bitcoin Realized Cap chart | Source: CryptoQuant

“The current market is progressing slowly within the bull cycle, but there are no signs of an imminent end,” the report noted, adding that a stronger upward move could still be ahead.

Price action and on-chain trends together point to a market with more room to grow. While volatility is likely to persist, signals suggest October’s rally is supported by long-term strength rather than short-term speculation.

If history holds, this month could again prove to be a major one for Bitcoin and altcoins, with the potential to push the market toward new highs in the weeks ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Investing in Educational Institutions Emphasizing STEM as an Indicator of Future Workforce Developments

- U.S. higher education sees surging STEM enrollment, driven by workforce shortages and tech demand, with 3.46% of undergrads majoring in computer science/engineering in 2024. - Investors increasingly target STEM-focused institutions, aligning with 10.4% projected job growth by 2030, as K-12 STEM markets expand at 13.7% CAGR fueled by EdTech and private equity. - Persistent diversity gaps (26% women in STEM workforce) and financial strains highlight the need for inclusive programs and industry partnerships

Zcash Halving and Its Potential Impact on Cryptocurrency Market Fluctuations

- Zcash's 2025 halving cut block rewards by 50%, tightening annual inflation to 2%, sparking debates on supply reduction's impact on investor sentiment and institutional adoption. - ZEC surged 1,172% post-halving but faced extreme volatility ($736 to $25.96 in 16 days), driven by speculative trading and liquidity constraints in its $10.3B market cap. - Institutional adoption accelerated with Grayscale's $151.6M investment and Zcash ETF filing, while EU's MiCA regulations challenge privacy coins but Zcash's

ICP Price Jumps 30%: Exploring the Driving Forces and Long-Term Investment Outlook

- ICP token surged 30% in Nov 2025 to $4.71, driven by ICP 2.0 upgrades and institutional partnerships with Microsoft , Google, and SWIFT. - Price retreated to $3.50 by Dec 2025 amid waning AI hype, macroeconomic pressures, and speculative trading volatility. - NVT ratio and DCF analyses highlight valuation challenges, with optimistic 2026 price projections ($11.15–$31.89) contingent on real-world adoption and institutional traction. - Market dynamics reveal a duality: innovative infrastructure potential v

AI and Financial Stability in 2025: The Role of ICP Caffeine AI in Transforming Risk Management Amid Market Uncertainty

- ICP Caffeine AI, DFINITY's blockchain-AI platform, reduces AI inference costs by 20-40% while enabling real-time financial risk analysis through hybrid cloud-decentralized infrastructure. - AI-driven risk tools outperform traditional VaR models by 10% in predictive accuracy, achieving 60% efficiency gains for institutions through real-time data processing and regulatory integration. - Despite $237B TVL and 56% ICP price growth, the platform faces challenges including 22.4% dApp activity decline, token vo