Investor Dan Tapiero Says Bitcoin Bull Market Has Not Started, Names Eight Catalysts for BTC Rallies

Macro and crypto investor Dan Tapiero believes that Bitcoin’s ( BTC ) bull market has yet to begin.

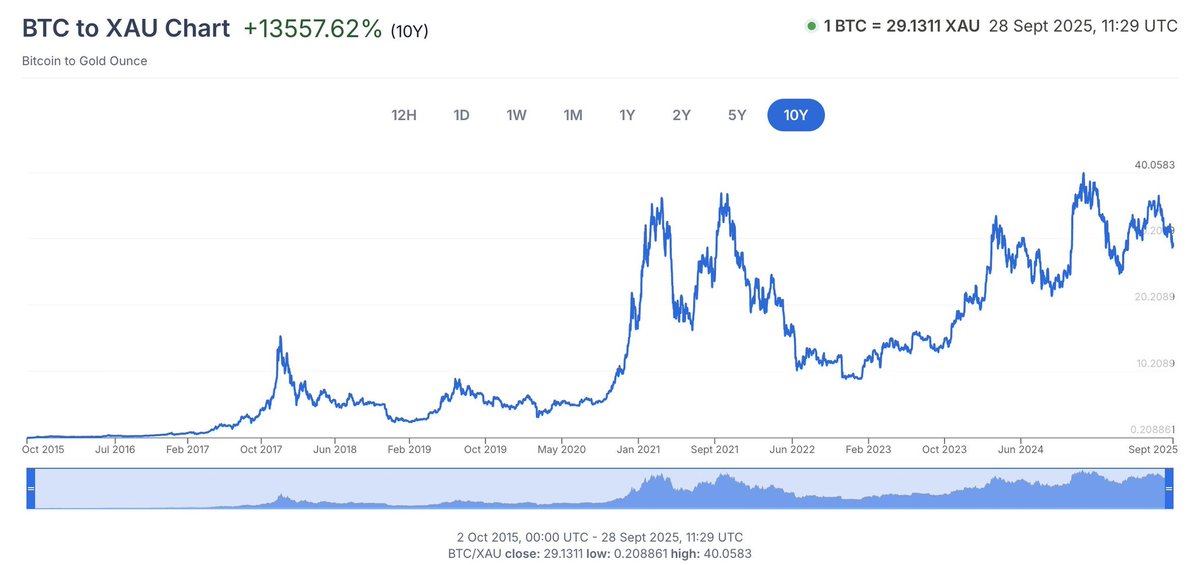

Tapiero tells his 134,800 followers on the social media platform X that Bitcoin is printing a bullish cup-and-handle pattern against gold (BTC/XAU) that will likely lead to price discovery.

A cup-and-handle pattern typically indicates that an asset is ready to spark a new uptrend after a period of consolidation, while price discovery in trading generally refers to an asset soaring to uncharted territory and new all-time high levels.

Tapiero lists eight bullish catalysts that make Bitcoin primed for an explosive move to the upside, including a weakening dollar and the US government’s pro-crypto regulations.

“Wake up. Bull market in Bitcoin has not started yet. Same price in gold terms as five years ago. Massive cup and handle leads to new upside price discovery. 4% short rates too high, USD bear now, [Washington] D.C. reg (regulatory) wind at back, DATs (digital asset treasuries), ETFs (exchange-traded funds), Stables (stablecoins), DeFi (decentralized finance), RWAs (real-world assets), etc. New world.”

Source: Dan Tapiero/X

Source: Dan Tapiero/X

He also predicts Bitcoin will eventually hit seven figures as adoption continues to increase in the coming years.

“Imagine. Physical gold only being re-monetized for real now. Bitcoin as digital gold still just narrative. TradFi (traditional finance) far away from actually implementing narrative. Yes. It is still that early. BTC to $1 million in 10 years is $20 trillion value, just 2% of total world assets. Still so early.”

Bitcoin is trading for $114,126 at time of writing, up 4.1% on the day.

The analyst previously said that the altcoin market now has bullish fundamentals that didn’t exist seven years ago.

“Seven years ago, there were no stables, no DeFi, no yield, no Solana, no [non-fungible tokens] NFTs, no decentralized exchanges, no real-world assets, no AI (artificial intelligence), no prediction market, etc. DAE (digital asset ecosystem) growth not priced in.”

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chainlink's cross-chain bridges drive a $35 billion boom in tokenized finance

- Grayscale files to convert its $29M Chainlink Trust into a staking-enabled ETF (GLNK), positioning LINK as crypto infrastructure. - Chainlink's CCIP bridges traditional finance and blockchain via cross-chain interoperability, recently collaborating with J.P. Morgan and Ondo Finance. - The tokenized assets market is projected to grow to $35B, with Chainlink addressing compliance and data transfer challenges in decentralized finance. - Strategic integrations with S&P Global and Bittensor's AI networks high

Bitcoin Updates: Trump Urges Rate Cuts While Fed Remains Cautious—Bitcoin Drops Into Bear Market

- Trump pressures Fed for aggressive rate cuts, joking about firing Bessent if rates remain high, risking policy instability. - Bitcoin enters "most bearish" phase with Bull Score at 20/100, price below $102,600 as institutional demand wanes. - Fed chair replacement process nears conclusion, with potential impacts on crypto markets and global capital flows. - India debates stablecoin regulation while Leverage Shares plans 3x crypto ETFs, reflecting volatile market dynamics. - Bitcoin's $200,000 trajectory

Fed's Change in Liquidity Fuels Debate: AI Breakthrough or Speculative Frenzy?

- The Fed's halt of QT by December 1, 2025, risks injecting trillions into AI markets, reigniting speculative concerns amid record $57B Nvidia quarterly revenue. - AI infrastructure spending surges with FEDGPU's GPU clusters and Gartner projecting $2 trillion global AI spending by 2026. - Skeptics warn of debt-driven overinvestment, citing Meta/Oracle stock declines and unproven economic returns despite "depth and breadth" of AI innovation claims. - Historical parallels to the dot-com bubble emerge as anal

XRP News Today: Grayscale’s Altcoin ETFs Transform Market Liquidity, Connecting Digital Assets with Conventional Finance

- NYSE approves Grayscale's XRP and Dogecoin ETFs for Nov 24 trading, expanding regulated crypto access in the U.S. - ETFs convert private trusts to public structures under SEC's post-shutdown regulatory clarity, targeting major altcoins. - Products charge 0.35% fees with direct asset holdings, attracting $12.7B XRP and $7.2B Dogecoin derivatives pre-launch. - Competitors like Bitwise and Franklin Templeton also launch XRP ETFs, signaling growing institutional confidence amid Bitcoin outflows. - Regulatory