Visa’s stablecoin pilot lets banks pre-fund Visa Direct payouts with USDC and EURC, enabling near‑instant cross‑border payouts and freeing treasury capital by treating these stablecoins as cash equivalents for initiating payouts.

-

Stablecoin pre-funding reduces liquidity needs and speeds payouts.

-

Visa treats USDC and EURC as cash equivalents for initiating Visa Direct payouts.

-

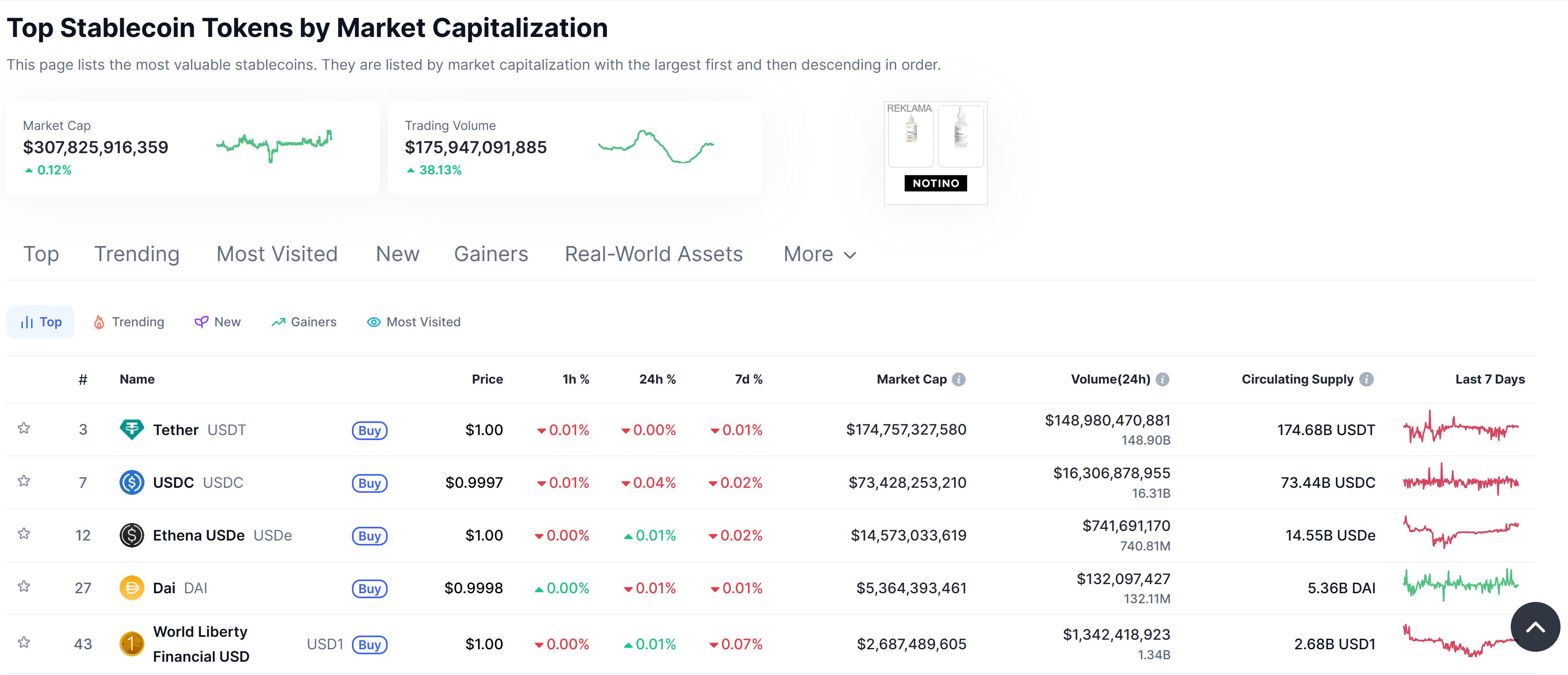

Visa reported over $225 million in stablecoin settlements to date; stablecoin market cap exceeds $307 billion (CoinMarketCap).

Visa stablecoin pilot: Visa launches a USDC and EURC pilot to enable near‑instant cross‑border payouts and modernize treasury operations—read the full update.

What is the Visa stablecoin pilot?

Visa stablecoin pilot is a select-partner program that lets banks and payment firms pre-fund cross‑border payouts on Visa Direct using USDC and EURC stablecoins. The pilot aims to accelerate settlement times, reduce parked fiat, and improve treasury predictability for participating institutions.

How does Visa use USDC and EURC for cross‑border payouts?

Visa enables participating banks and remittance services to deposit USDC or EURC as pre-funded assets into Visa Direct, which Visa treats as cash equivalents for payout initiation. This approach can reduce the need for multiple fiat accounts across corridors and allows near‑instant payout execution, including outside traditional banking hours.

Stablecoin market cap stands at over $307 billion. Source: CoinMarketCap

Stablecoin market cap stands at over $307 billion. Source: CoinMarketCap

Why does Visa say stablecoins can modernize treasury operations?

Visa positions stablecoin pre-funding as a tool to unlock working capital and reduce FX volatility exposure. For treasury teams, using stablecoins allows predictable payout rails during weekends and off-hours and limits the amount of fiat that must be parked in multiple jurisdictions.

When did Visa announce the pilot and who can participate?

Visa announced the pilot during SIBOS 2025. Participation is initially limited to selected banks, remittance firms and financial institutions that meet Visa’s internal eligibility criteria, with a broader rollout planned into 2026.

Frequently Asked Questions

Which stablecoins are used in the Visa pilot?

Visa’s program uses USDC and EURC as the pre-funded stablecoin assets for pilot participants. These tokens are treated as cash equivalents by Visa for the purpose of initiating Visa Direct payouts.

How does stablecoin pre-funding affect treasury liquidity?

Stablecoin pre-funding can free up working capital by reducing the need to maintain multiple fiat balances across corridors. It also provides more predictable payout timing during weekends and after banking hours.

What are the risks and oversight requirements?

Participants must address custody risk, counterparty controls and regulatory compliance. Visa requires selected partners to meet internal risk and compliance standards before joining the pilot.

Key Takeaways

- Faster payouts: Stablecoin pre-funding enables near‑instant Visa Direct payouts, including off‑hours.

- Liquidity efficiency: Using USDC and EURC reduces the need to park fiat across multiple corridors.

- Careful rollout: Pilot limited to eligible partners with plans to expand in 2026 pending results and regulatory clarity.

Conclusion

Visa’s stablecoin pilot represents a measured step toward integrating digital‑asset rails into mainstream payment infrastructure. By allowing USDC and EURC to be treated as cash equivalents for Visa Direct payouts, the pilot aims to improve treasury efficiency and speed cross‑border flows while preserving regulatory controls. Market participants and treasury teams should monitor pilot outcomes and industry initiatives—such as parallel settlement projects led by SWIFT and Consensys—to gauge adoption and future interoperability.