South Korea's leading shared power bank service, Piggycell: Driving Global Expansion through Blockchain

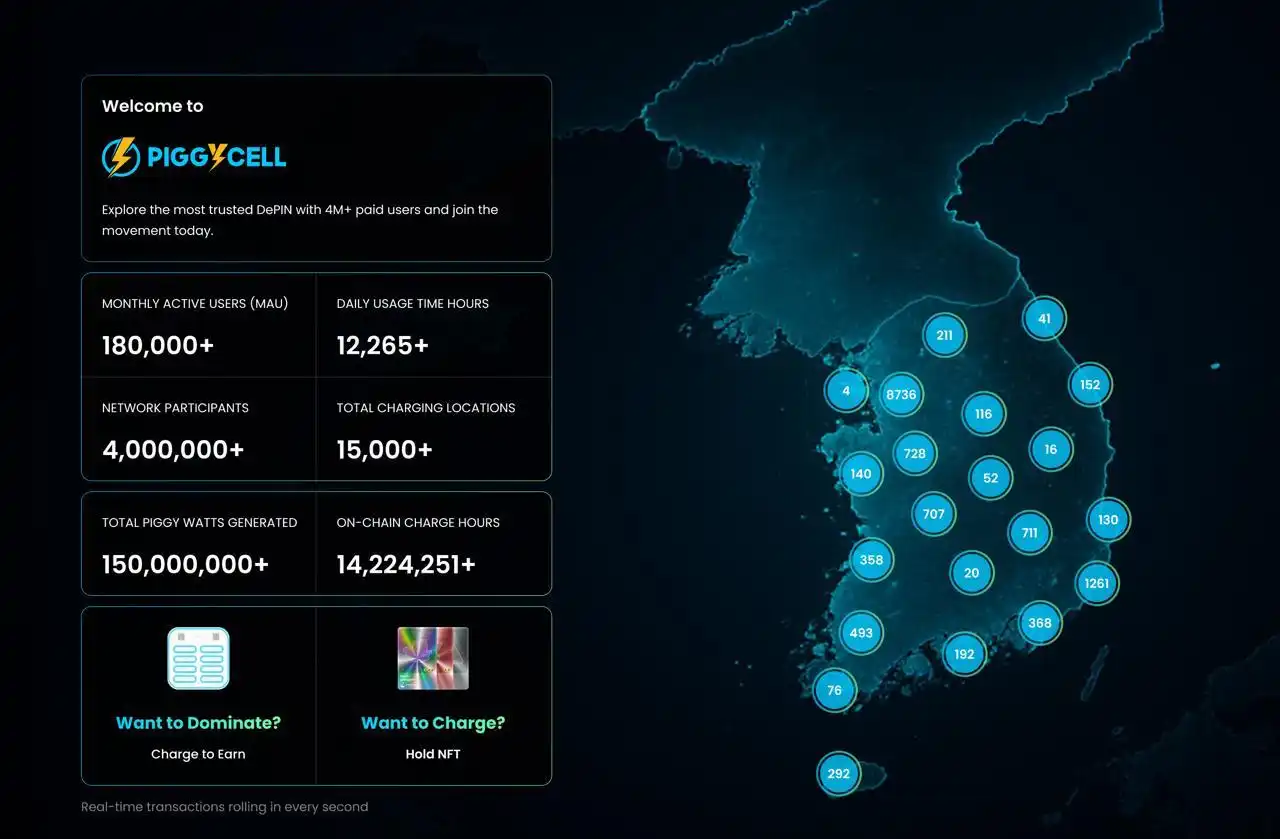

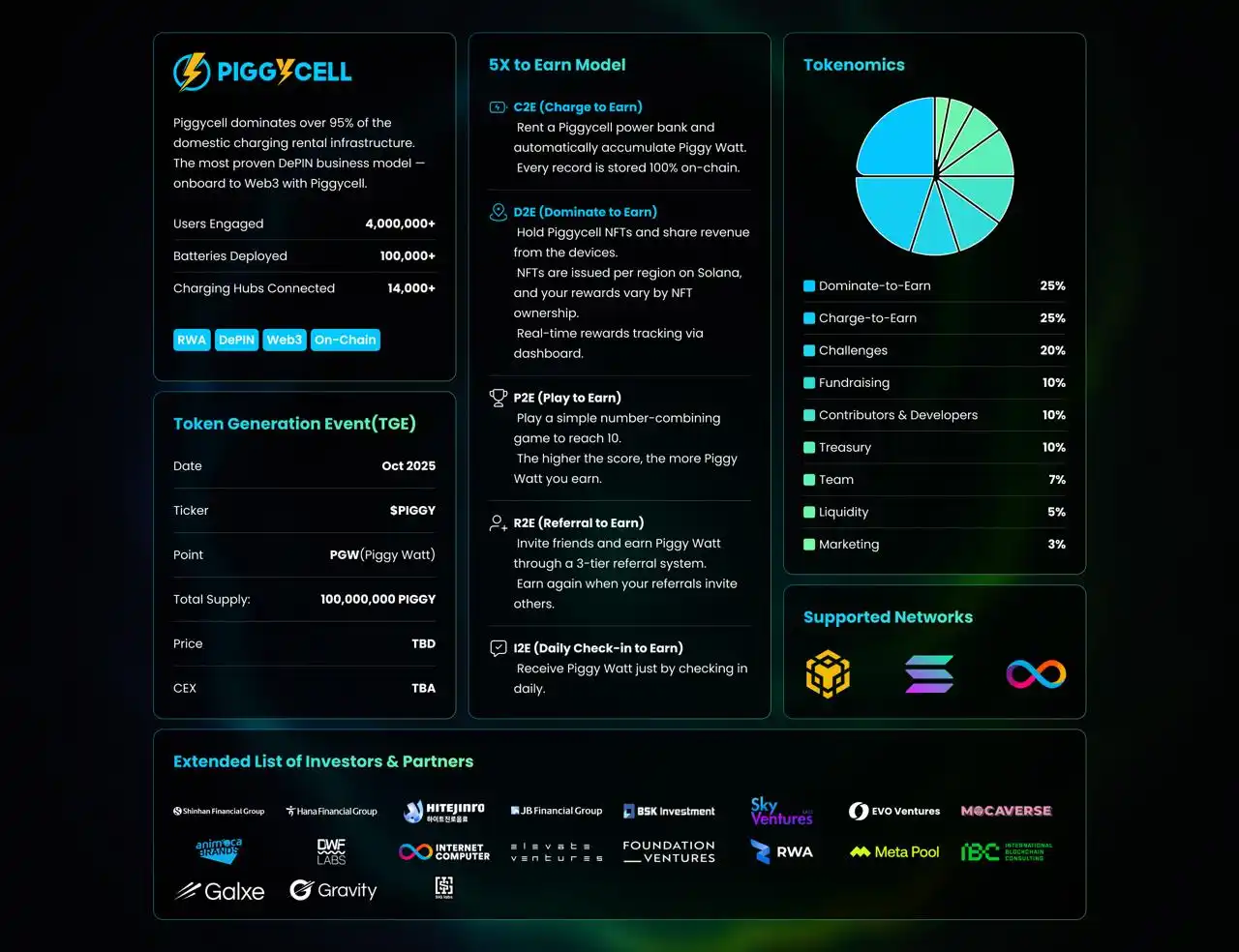

1. Piggycell is the leading company in the South Korean shared power bank market, with a 95% market share, over 14,000 stations, and more than 4 million users. 2. Piggycell utilizes the DePIN + RWA model to transform charging devices into on-chain assets, enabling automatic yield distribution. The core gameplay includes Charge-to-Earn, Occupy-to-Earn, and Challenge-to-Earn. 3. Piggycell has secured a $10 million seed funding round from investors including Animoca Brands, ICP Hubs, and DWF Labs, and receive

Source: Piggycell

South Korea's Leading Shared Power Bank Provider Piggycell: Driving Global Expansion with Blockchain

In South Korea, when it comes to borrowing a power bank on the go, most people turn to Piggycell. This well-established company has captured a 95% market share, with 14,000+ locations and over 4 million users, nearly monopolizing the South Korean shared charging market. Recently, Piggycell has also successfully attracted a new $11 million investment round, which includes participation from large South Korean corporations and banks.

Bringing a Mature Offline Network onto the Chain

Utilizing the DePIN + RWA model, Piggycell has transformed mobile power banks, shared charging stations, and other charging devices into measurable, settleable, and tradable on-chain assets.

Users do not need to understand complex blockchain processes; they simply rent a power bank as usual, and the backend automatically handles profit distribution.

Three Core Gameplay Mechanics that are Intuitive and Easy to Understand:

Charge-to-Earn: Earn token rewards through charging;

Occupy-to-Earn: Hold device NFTs and receive a share based on actual usage;

Challenge-to-Earn: Complete tasks to receive additional incentives.

This model integrates ownership, profit-sharing, and community participation, allowing users to not only be one-time consumers but also directly engage in real cash flow.

Backed by Strong Capital and Data

Piggycell is not concept-driven but is an upgraded solution built on real business and cash flow:

Has received a $10 million seed round investment, with investors including Animoca Brands, ICP Hubs, and DWF Labs;

Operates over 100,000 high-quality batteries and 14,000+ offline service stations;

Annual revenue has been stably above $20 million, validating the sustainability of the business model;

In its latest funding round, received a total of $11 million in support from large South Korean corporations and banks.

Key Sprint Towards TGE

Piggycell has set a clear target to launch its TGE in Q4 of 2025 and plans to debut on a tier-one exchange in mid-October. Currently, the final round of community task activities before the TGE is taking place on the Galxe platform, providing a pre-participation opportunity for global users.

One-sentence Summary

Piggycell combines South Korea's leading shared charging network with blockchain technology, integrating real users and real-world scenarios onto the chain, and sharing the benefits with every participant.

With this step, Piggycell's story is transitioning from Korea to the global stage.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

X Financial Shifts to Risk-First Approach: Third Quarter Revenue Drops 13.7% Amid Strategic Change

- X Financial reported 23.9% YoY revenue growth to RMB1.96B in Q3 2025, but saw 13.7% sequential decline due to cautious lending and risk prioritization. - Net income rose 12.1% annually to RMB421M but fell 20.2% sequentially, driven by higher credit provisions and operating costs. - Share repurchases under $100M buyback program totaled $67.9M, with $48M remaining as the company emphasizes disciplined risk management. - Strategic pivot to risk mitigation contrasts with broader fintech sector caution, refle

Ethereum News Today: Ethereum Faces $2,800 Test—Will It Surge to $3,000 or Retreat to $2,300?

- Ethereum tests $2,800 resistance, key threshold for November, with potential to rebound toward $3,000 if breakout succeeds. - Recent $55.7M inflow into ETH ETFs, led by Fidelity’s FBETH, signals cautious institutional interest after nine-day outflow streak. - Technical indicators show improved momentum with RSI rebound and MACD stabilization, but $2,800 remains critical for further gains. - Derivatives data and Coinbase’s ETH-backed lending expansion hint at conditional recovery, though liquidation risks

Ethereum Updates: Centralized DNS Compromise Highlights DeFi Weaknesses as Aerodrome Suffers $1 Million Loss

- Aerodrome Finance suffered a DNS hijacking attack on Nov 22, 2025, redirecting users to phishing sites that siphoned over $1M in assets through deceptive transaction approvals. - Attackers exploited vulnerabilities in centralized domain registrar Box Domains, forcing users to approve unlimited access to NFTs and stablecoins via two-stage signature requests. - The protocol shut down compromised domains, urged ENS-based access, and revoked recent token approvals, marking its second major front-end breach i

Trump and Mamdani’s Bet on Affordability: Uniting Opposing Ideologies

- Trump and Mamdani's Nov. 21 meeting highlights clashing ideologies on affordability and governance, with New York's $1.286T economy at stake. - Both leaders share focus on cost-of-living crises but differ sharply on solutions, with Trump threatening federal funding cuts and Mamdani advocating rent freezes. - Experts see the dialogue as critical for redefining strained city-federal relations, emphasizing urban centers' role as economic engines. - Mamdani's corporate tax proposals clash with Trump's deregu