Trader Says Bitcoin Could Crash by Double Digits, Outlines Path Forward for Ethereum and XRP

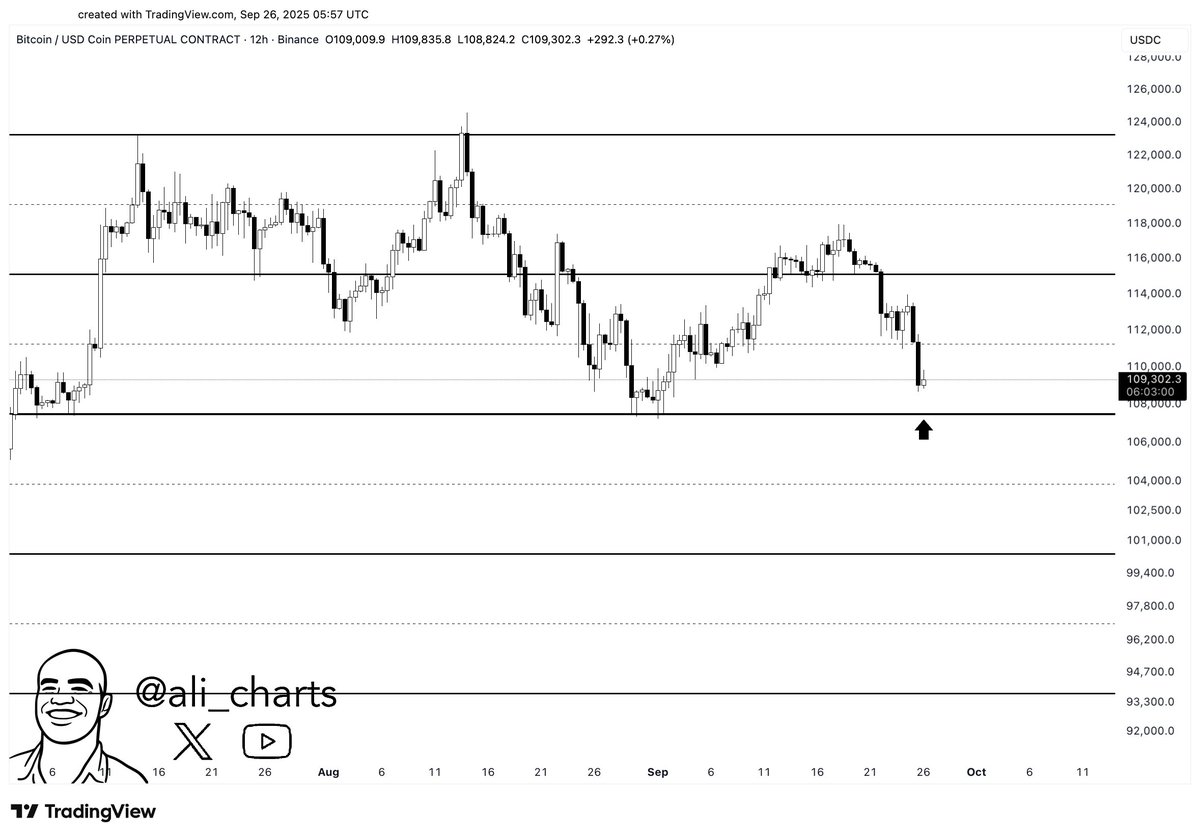

Cryptocurrency analyst and trader Ali Martinez is warning of a massive Bitcoin crash if BTC fails to hold one key level as support amid this week’s market decline.

Martinez tells his 158,100 followers on X that Bitcoin may decrease more than 14% from its current value if the flagship crypto asset fails to hold $107,200 as support.

“$107,200 is the crucial support for Bitcoin. Lose it, and $100,000 or even $93,000 come into play.”

Source: Ali Martinez/X

Source: Ali Martinez/X

Bitcoin is trading for $109,020 at time of writing, down 2% in the last 24 hours.

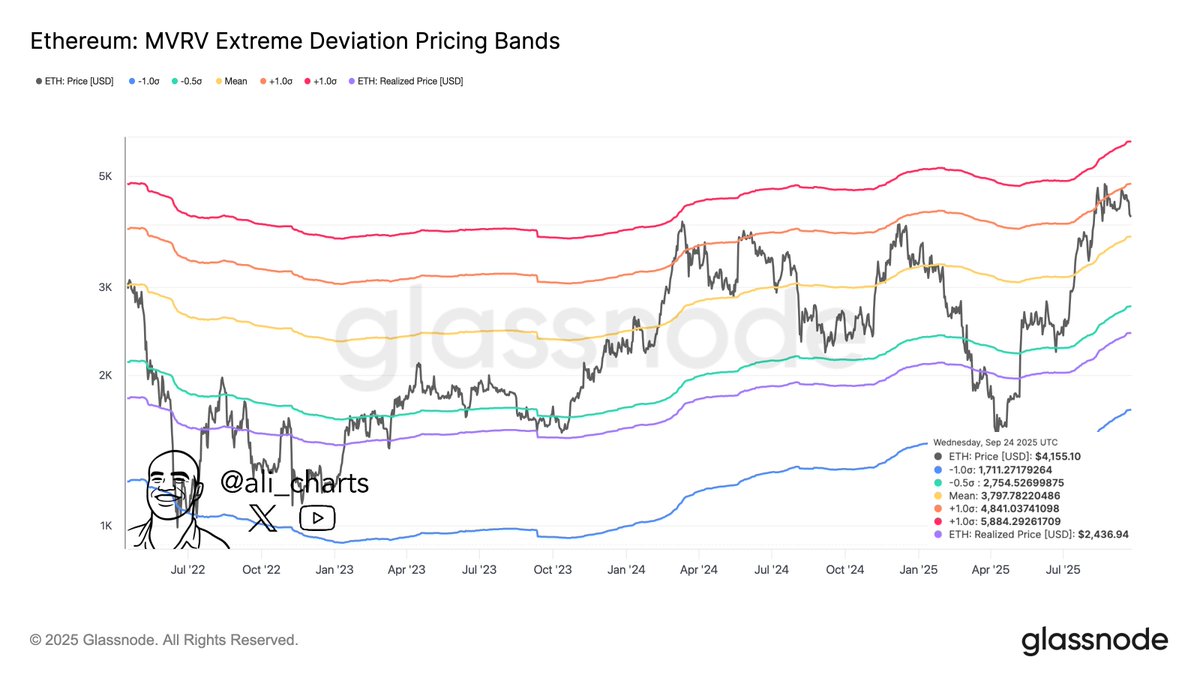

Next up, the analyst says that based on the MVRV (Market Value to Realized Value) Extreme Deviation Pricing Bands, if Ethereum holds $4,841 as a support level ETH may soon hit a new all-time high.

The MVRV Extreme Deviation Pricing Bands are used in on-chain analysis to identify potential market tops and bottoms.

“Ethereum must break $4,841 to reverse the downtrend and aim for $5,864. Fail, and a correction to $2,750 comes into play.”

Source: Ali Martinez/X

Source: Ali Martinez/X

ETH is trading for $3,953 at time of writing, down 1.2% in the last 24 hours.

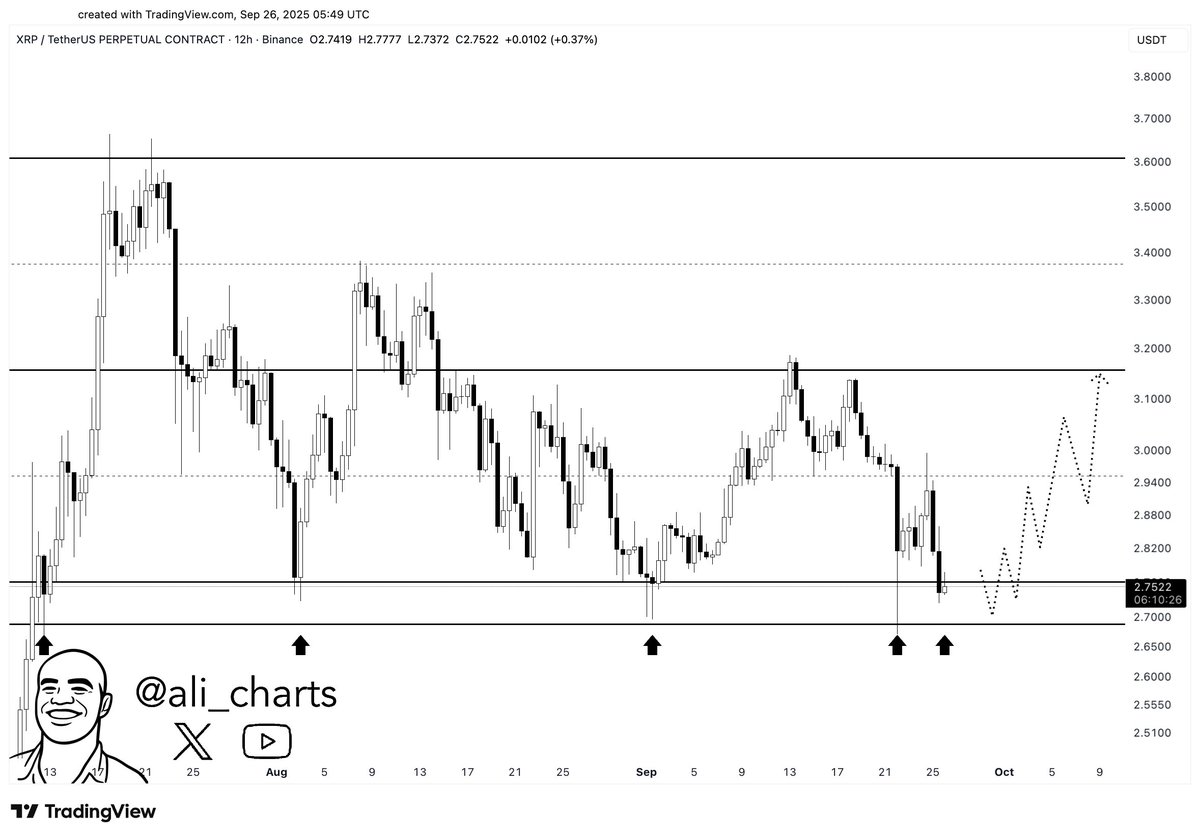

Looking at XRP , the analyst says that the payments token must hold $2.70 as support to potentially regain bullish momentum in the near term.

“XRP must hold $2.70 support to keep the chance of a rebound to $3.20 alive!”

Source: Ali Martinez/X

Source: Ali Martinez/X

XRP is trading for $2.74 at time of writing, down 3.2% on the day.

Featured Image: Shutterstock/IgorZh

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Momentum ETF (MMT) and the Intersection of Retail Hype and Institutional Backing in November 2025

- Momentum ETF (MMT) surged 1,330% in Nov 2025 due to retail frenzy and institutional validation. - Binance airdrop and Sui-based perpetual futures DEX boosted retail demand through liquidity and yield incentives. - $10M HashKey funding and $600M TVL validated MMT's institutional credibility under CLARITY Act/MiCA 2.0 frameworks. - ve(3,3) governance model and token buybacks created flywheel effects, aligning retail/institutional incentives. - Q1 2026 Token Generation Lab aims to expand Sui ecosystem proje

Fed Cuts Rates, Announces $40B T-Bill Program, Crypto Dips

U.S. Marine Policy and Blue Economy Prospects: Key Infrastructure and Geostrategic Roles in Oceanic Commerce

- U.S. oceans policy balances geopolitical strategy, deep-sea tech investments, and UNCLOS ratification challenges to secure maritime influence. - Executive actions accelerate seabed mineral extraction while facing environmental criticism and legal risks from bypassing international seabed authority rules. - Offshore energy partnerships with Australia, Japan, and Saudi Arabia aim to diversify supply chains but face geopolitical tensions in chokepoints like the Red Sea. - Maritime security contracts expand

Aster DEX's On-Chain Momentum: Signaling the Future of DeFi

- Aster DEX reported $27.7B daily volume and $1.399B TVL in Q3 2025, outpacing DeFi benchmarks with 2M users. - Institutional whale activity, including CZ's $2M ASTER purchase, drove $5.7B inflows and 800% volume spikes. - Hybrid AMM-CEX model and ZKP privacy tech enabled 40.2% TVL growth, 77% private transactions, and 19.3% perpetual DEX market share. - ASTER's margin trading upgrades and Stage 4 airdrops fueled 30% price surges, while Aster Chain's 2026 launch will integrate privacy-preserving ZKPs. - On