Grayscale Ranks The Top 20 Tokens That Offered The Best Returns In Q3

Grayscale’s Q3 2025 index revealed altcoins outperformed Bitcoin, with BNB Chain, Prometeus, and Avalanche emerging as top risk-adjusted performers.

Grayscale revealed in an index that altcoins provided the best returns in the third quarter of 2025. Bitcoin’s underperformance became the quarter’s most defining characteristic, while BNB Chain, Prometheus, and Avalanche led the ranking for top risk-adjusted performers.

The index was generally dominated by tokens used for financial applications and smart contract platforms. Thematic narratives centered on stablecoin adoption, exchange volume, and Digital Asset Treasuries (DATs) overwhelmingly drove this outperformance.

Altcoins Dominated Q3 Performance

The third quarter of 2025 proved to be a period of broad-based strength in the digital asset market. According to an index developed by Grayscale Research, some distinct winners generated the best volatility-adjusted price returns.

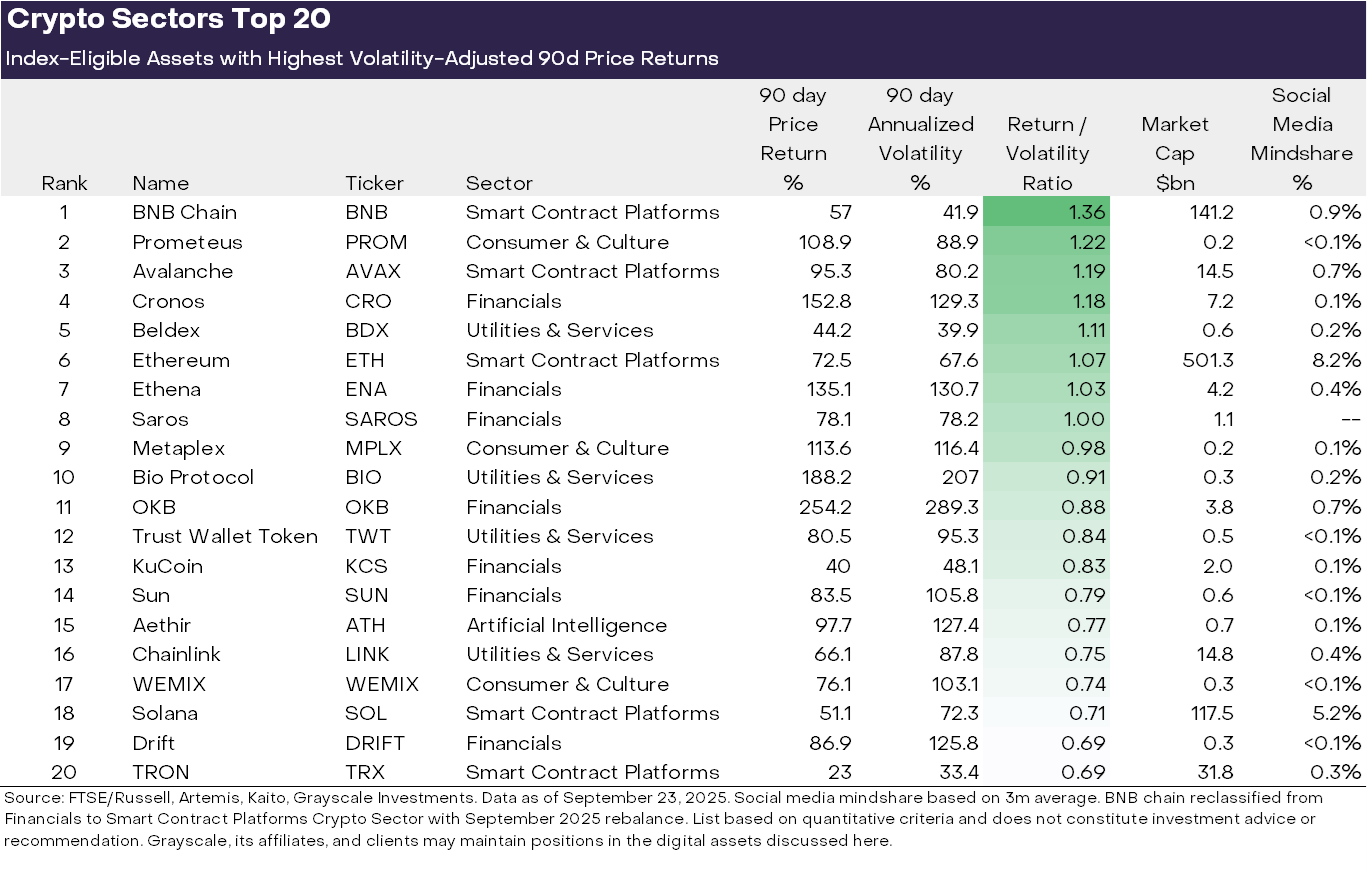

In a ranking of the top 20 best-performing tokens, BNB Chain took the lead, delivering the most favorable returns with relative stability compared to those whose gains were outweighed by excessive risk.

Prometeus, Avalanche, Cronos, Beldex, and Ethereum followed behind it.

Top 20 Performing Tokens. Source:

Grayscale Research.

Top 20 Performing Tokens. Source:

Grayscale Research.

Grayscale organizes the digital asset market into six segments based on the protocol’s core function and use case: Currencies, Smart Contract Platforms, Financials, Consumer and Culture, Utilities and Services, and Artificial Intelligence.

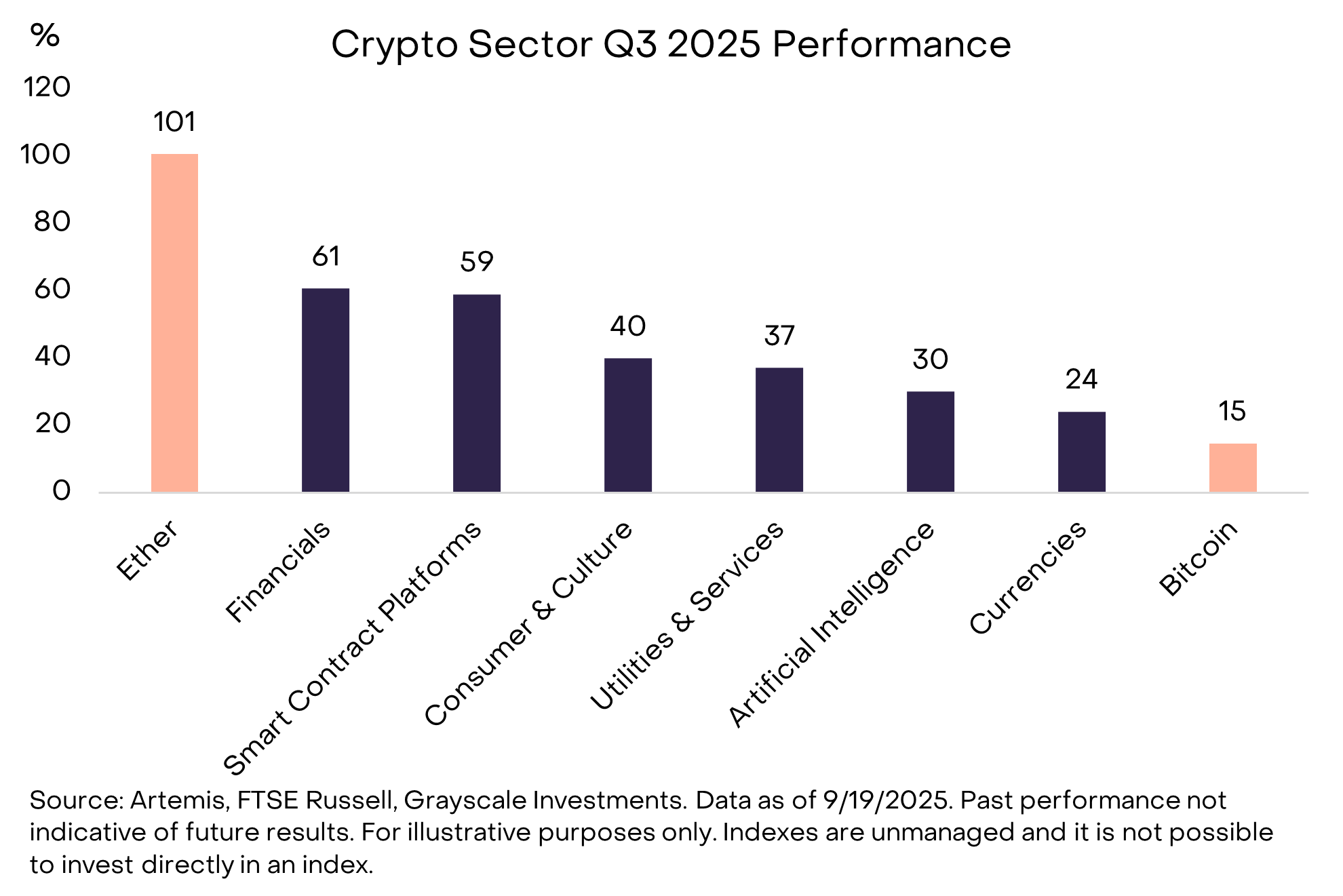

Seven top-performing tokens formed part of the Financials segment, while five came from Smart Contract Platforms. These results effectively quantified the shift away from Currencies. Most notably, Bitcoin did not make the cut.

Why Bitcoin Lagged Behind

The most telling data point of Grayscale’s research was not so much who made the list as who was conspicuously absent: Bitcoin.

While all six sectors produced positive returns, Currencies notably lagged, reflecting Bitcoin’s relatively modest price gain compared to other segments. When measuring performance by risk, Bitcoin did not offer a compelling profile.

Crypto Sector Q3 2025 Performance: Source:

Grayscale Research.

Crypto Sector Q3 2025 Performance: Source:

Grayscale Research.

The assets that made the list were overwhelmingly driven by thematic narratives related to new utility and regulatory clarity. These narratives specifically centered on stablecoin adoption, exchange volume, and DATs.

According to Grayscale Research, the rising volume on centralized exchanges benefited tokens like BNB and CRO. Meanwhile, increasing DATs and widespread stablecoin adoption fueled demand for platforms like Ethereum, Solana, and Avalanche.

Specific decentralized finance (DeFi) categories also showed strength, such as decentralized perpetual futures exchanges like Hyperliquid and Drift, which contributed to the strength of the Financials sector.

Bitcoin was less exposed to these specific catalysts as a peer-to-peer electronic cash and store-of-value asset. This lack of exposure allowed altcoins tied to functional platforms and financial services to surge in risk-adjusted performance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU Token Technical Review: Managing Immediate Market Fluctuations and Blockchain Indicators

- PENGU token faces critical juncture with conflicting technical indicators and accumulating on-chain activity in November 2025. - Short-term bearish signals (RSI 38.7, 12 sell signals) clash with bullish MACD/OBV divergence and whale accumulation ($273K acquired). - On-chain patterns suggest potential breakout above $0.0235 resistance, with $0.026 target if volume supports, but $0.01454 support remains vulnerable. - Risks persist due to unquantified NVT score and bearish pressure from broader indicators,

Bitcoin News Update: Retail Investors Panic While Whales Remain Confident as Bitcoin Hits Lowest Point in Seven Months

- Bitcoin fell to a seven-month low near $89,250, sparking debates over a potential bottom or prolonged correction amid mixed technical and institutional signals. - Analysts highlight a possible 40% rebound by year-end, driven by bullish figures like Michael Saylor and whale accumulation of 345,000 BTC since October. - Retail investors flee as fear metrics hit extremes, contrasting with institutional confidence seen in Czech National Bank's $1M Bitcoin pilot and ETF inflows. - Technical indicators warn of

COAI Experiences Significant Price Decline in Early November 2025: Combined Impact of Disappointing Earnings and Changing Market Sentiment

- COAI Index fell 88% YTD in 2025, sparking debates over AI/crypto AI sector revaluation vs. overreaction. - Mixed Q4 earnings: Cisco showed $14.7B revenue growth, while C3.ai reported $31.2M operating loss despite 26% revenue rise. - C3.ai's leadership crisis (CEO change, lawsuit) and governance issues amplified COAI's decline amid regulatory uncertainty. - CLARITY Act's ambiguous crypto regulations and institutional flight to stable tech stocks worsened sector sentiment. - Market re-rating of speculative

Hyperliquid (HYPE) Price Rally: Institutional Embrace and Changing Market Sentiment in Decentralized Trading

- Hyperliquid's HYPE token surged due to institutional adoption and shifting market sentiment, defying broader crypto slumps. - A $1B HYPE Digital Asset Treasury merger with Rorschach I LLC and partnerships like Hyperion DeFi's HAUS protocol boosted token utility and capital inflows. - Q3 2025 analysis shows HYPE trading between $35-$60 with strong on-chain metrics, though manipulation risks and Fed policy remain critical factors. - 21Shares' HYPE ETF application and Hyperliquid's expanded $1B fundraising