Ethereum (ETH) Price Prediction for September 26

The market is totally red at the end of the week, according to CoinStats.

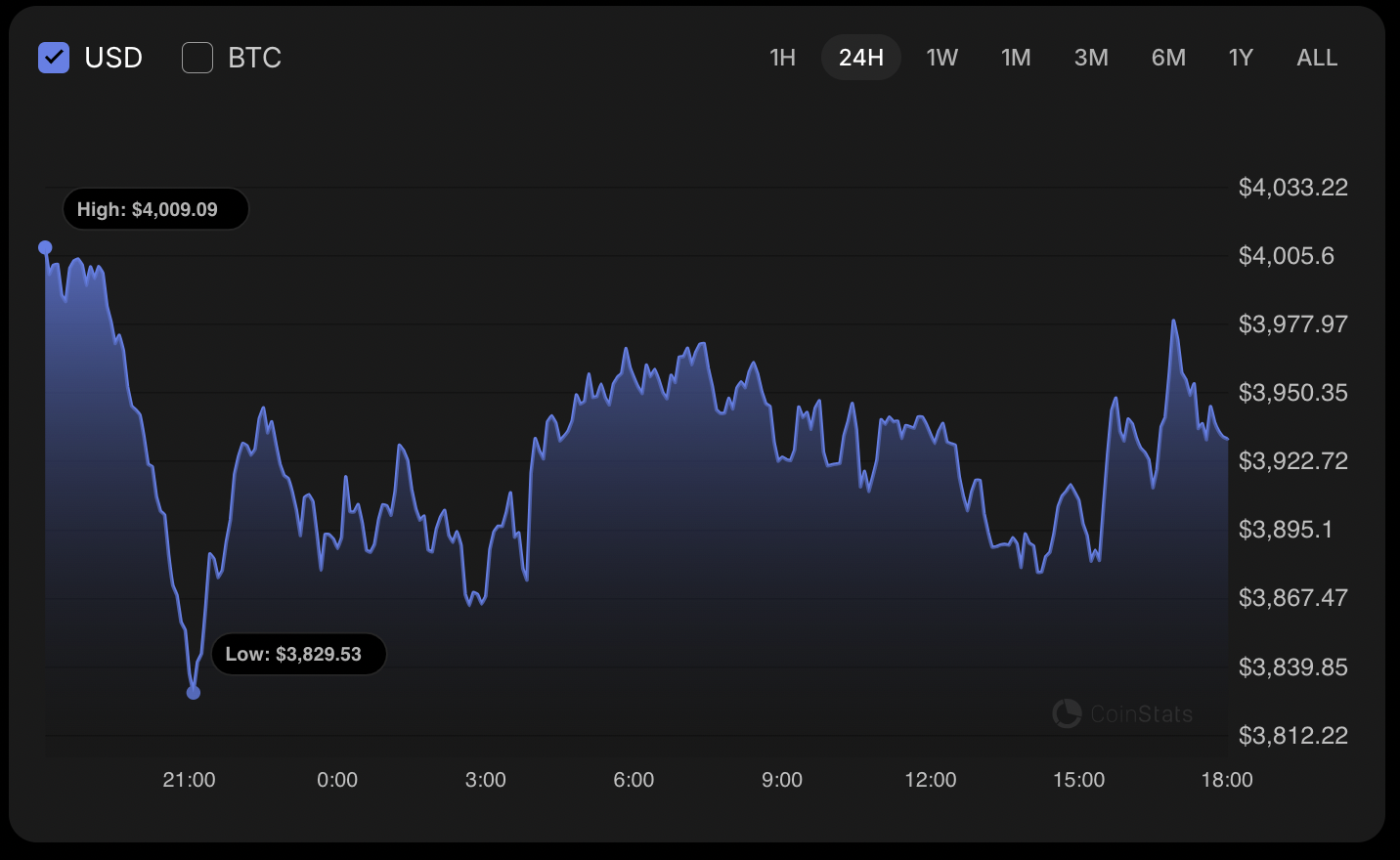

ETH/USD

The rate of Ethereum (ETH) has declined by almost 2% over the last 24 hours.

On the hourly chart, the price of ETH has made a false breakout of the local resistance of $3,976. However, if the daily bar closes around that mark, traders may expect a test of the $4,000 zone by tomorrow.

On the longer time frame, the rate of the main altcoin has entered a bearish area after breaking the $4,107 level.

Until the price is below that mark, sellers keep controlling the situation on the market. In this case, one can expect a further decline to the $3,700-$3,800 range.

From the midterm point of view, one should focus on the weekly candle's closure in terms of the $4,107 level. If it happens below it, the correction is likely to continue to the $3,600 mark.

Ethereum is trading at $3,937 at press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysis: Bizarre divergence in US economic data leaves the Federal Reserve in a policy dilemma.

Bitcoin Updates: Supporters of Bitcoin Challenge JPMorgan to Stop MSCI’s Plan for Exclusion

- Bitcoin advocates and MicroStrategy supporters boycott JPMorgan over MSCI's plan to exclude crypto firms from major indices starting 2026. - Prominent figures like Grant Cardone withdraw funds/lawsuit JPMorgan, warning the rule could trigger $11.6B losses for MicroStrategy via index-linked sell-offs. - MSCI's proposal risks destabilizing crypto markets by forcing companies to reduce holdings, with Bitcoin down 30% from October peaks and MicroStrategy's valuation premium collapsing. - The debate highlight

Trump Clan Faces Setbacks as Bold Crypto Moves Falter Amid Market Downturn and Escalating Political Tensions

- Trump family's crypto/stock investments lost $1B as DJT shares fell 70% YTD amid market downturn. - Tokenized Maldives resort project aims to revive crypto-linked real estate after memecoins and Trump Media's ETFs underperformed. - Political tensions escalate with port fire criticism, GOP fractures, and Trump's 38% approval rating—the lowest of his term. - Analysts warn pro-crypto policies may fail to offset market declines as memecoins and DJT trade near 2021 lows.