Date: Fri, Sept 26, 2025 | 11:46 AM GMT

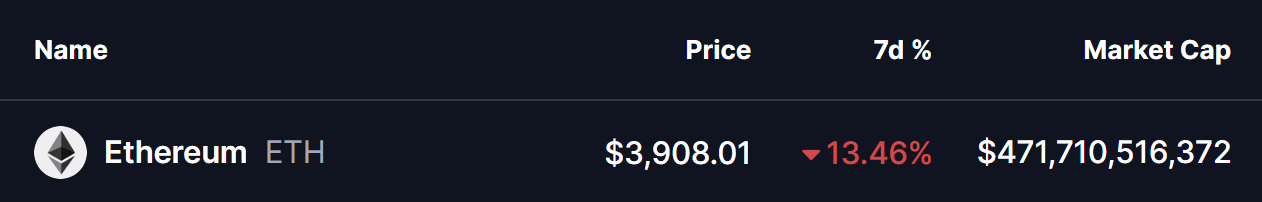

The cryptocurrency market remains under pressure this week, with Bitcoin (BTC) and Ethereum (ETH) both posting heavy losses. ETH, in particular, has slipped more than 13%, briefly touching the $3,900 level.

Despite the decline, the bigger picture tells a different story: Ethereum is now retesting a key bullish breakout zone that could dictate its next major move.

Source: Coinmarketcap

Source: Coinmarketcap

Retesting the Right-Angled Descending Broadening Wedge Breakout

On the weekly chart, ETH had been locked inside a right-angled descending broadening wedge — a bullish reversal pattern characterized by a flat resistance ceiling and gradually rising support levels. For months, ETH struggled to clear the $3,800–$4,090 resistance band.

That changed in late August, when bulls finally broke through with conviction, propelling ETH nearly 21% higher from its breakout base at $4,090 to a local peak of $4,956. The breakout signaled strong accumulation and momentum returning to the market.

Ethereum (ETH) Weekly Chart/Coinsprobe (Source: Tradingview)

Ethereum (ETH) Weekly Chart/Coinsprobe (Source: Tradingview)

Now, as is common after powerful breakouts, ETH has pulled back to retest the former resistance zone. At the time of writing, the token is trading near $3,911 — right in the retest zone marked on the chart — where bulls are likely to step in once again.

What’s Next for ETH?

The $3,800–$4,090 band is the critical area to watch. If buyers defend this region, ETH could stage a strong rebound, first reclaiming $4,956 before attempting a larger push toward the projected wedge target near $6,800 — which would represent a 73% upside from current levels.

However, if the $3,800 floor gives way, it would cast doubt on the breakout’s validity and could open the door to a deeper correction in the weeks ahead.

For now, the ball is in the bulls’ court, and how ETH reacts at this retest zone will likely determine whether the next move is a recovery rally or extended downside.