PunkStrategy Token Surges as NFT-Linked Model Gains Attention

PunkStrategy (PNKSTR) combines NFT trading with token buybacks, spurring an 87% surge in market value. Experts caution investors about significant price volatility and speculative risks in this emerging crypto strategy.

PunkStrategy (PNKSTR), a token linking NFT trading with reinvestment mechanisms, has recorded substantial growth, reflecting increasing interest in crypto-NFT hybrid strategies.

Analysts caution, however, that volatility remains high in such experimental tokens.

PunkStrategy’s Innovative Model and Recent Performance

PunkStrategy, developed by TokenWorks, utilizes a trading model that allocates 10% of transaction fees to purchase Cryptopunk NFTs. These NFTs are then resold at a markup, and proceeds are reinvested into buying back PNKSTR tokens. This cyclical approach aims to support both the NFT market and the token’s liquidity.

In the past 24 hours, PNKSTR surged by 87%, pushing its market capitalization to approximately $36.4 million. While the model has attracted attention for its innovative structure, experts emphasize that its speculative nature can lead to significant price fluctuations.

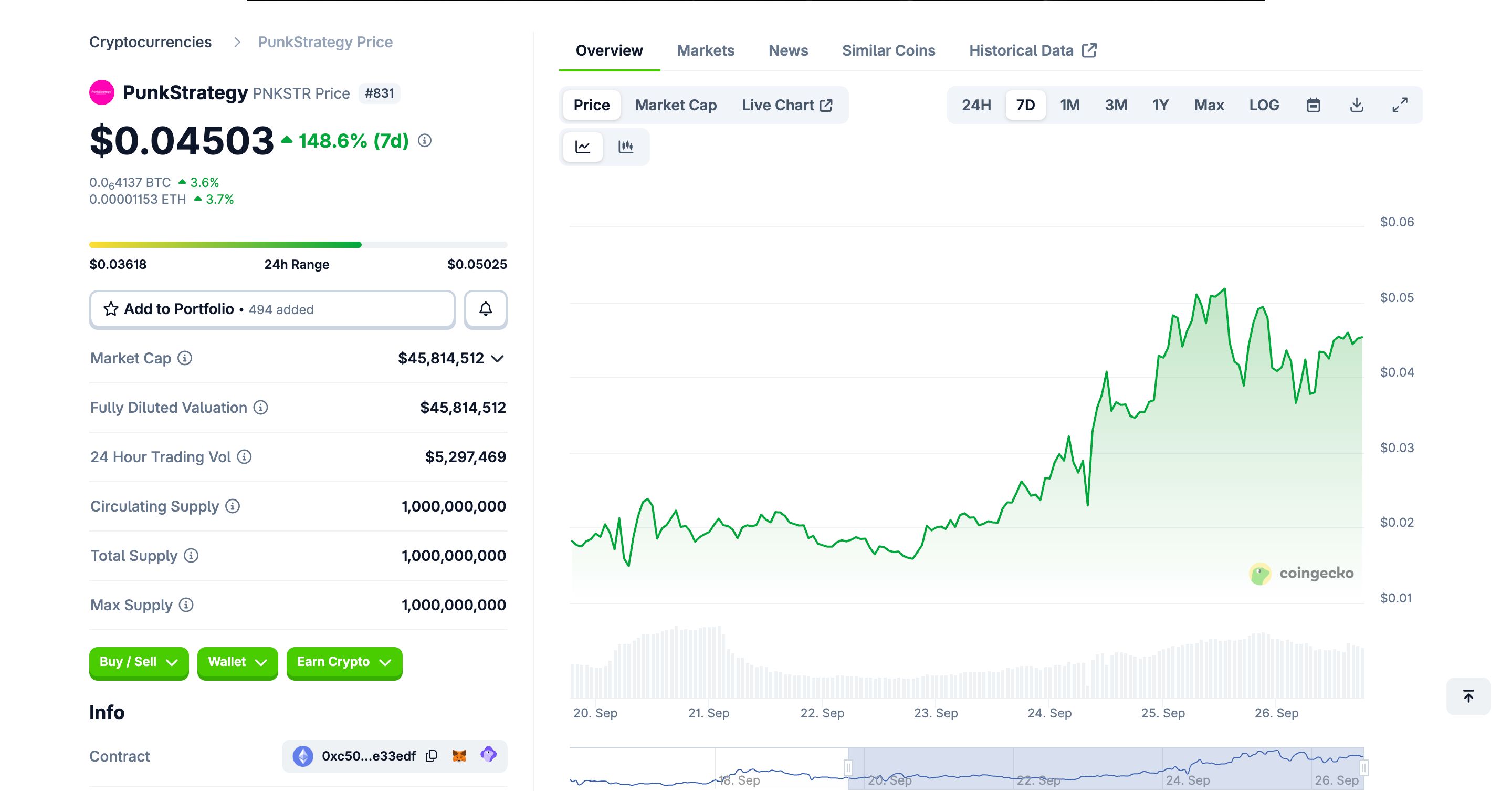

PNKSTR surged by approximately 150% over the past week. Source:

PNKSTR surged by approximately 150% over the past week. Source:

The strategy builds on earlier NFT-centric approaches, expanding the concept of tokenized art and collectibles as investment instruments. Analysts note that while the gains are notable, underlying risks remain prominent, such as NFT market illiquidity and speculative trading. Investors must evaluate the potential upside and inherent market volatility before committing funds.

Market Implications and Investor Considerations

The rapid appreciation of PNKSTR illustrates a broader trend in integrating NFTs into crypto tokenomics. By creating a flywheel effect—where NFT sales fund token buybacks—the model attempts to stabilize token price while fostering NFT demand. However, industry observers, including ChainCatcher, caution that the approach is untested at scale and may experience abrupt price swings.

Financial analysts stress that such tokens exemplify the growing intersection of digital art and blockchain finance. Institutional investors and retail participants are observing PNKSTR as a case study in NFT-token synergy. Despite impressive short-term gains, the model’s long-term sustainability depends on continued market interest in NFTs and the token’s ability to maintain liquidity amid price volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ICP Value Jumps 30% Over the Past Week as Ecosystem Broadens Strategically

- ICP's 30% price surge stems from strategic expansions, institutional partnerships, and decentralized AI advancements. - AIO-2030's launch positions ICP as a core infrastructure layer for privacy-preserving, cross-chain AI collaboration. - Inovia Capital's Abu Dhabi expansion signals institutional interest in ICP's blockchain-driven AI solutions in the Middle East. - Technical indicators show bullish momentum, with $6.00 as a key target and $8.25 as potential long-term resistance. - ICP's unique decentral

Internet Computer's Latest Rally: Will the Momentum Last or Is It Just a Temporary Spike?

- Internet Computer (ICP) surged in late 2025 due to institutional partnerships, technical upgrades, and speculative trading, but faces data credibility concerns. - Discrepancies in TVL figures (e.g., $237B vs. $1.14B) and unverified active wallet claims raise doubts about reported metrics and market fundamentals. - DApp usage dropped 22.4% in Q3 2025, highlighting a gap between infrastructure growth and user adoption, despite 50% compute capacity improvements. - Speculative trading volumes rose 261%, alig

Solana's Latest Price Fluctuations and Network Efficiency: Evaluating the Long-Term Investment Potential of High-Performance Smart Contract Platforms

- Solana maintains high-performance blockchain status with sub-2-second finality and low fees, attracting institutional adoption via Coinbase and PrimeXBT integrations. - Network faces declining user activity (3. 3M active addresses) and overreliance on speculative trading/meme coins, creating volatility risks for long-term viability. - Emerging competitors like Mutuum Finance challenge Solana by offering real-world asset tokenization models, highlighting need for non-speculative use cases. - Investors mus

The Abrupt 150% Decline in Solana’s Value: Causes, Impacts, and Potential Prospects