Justin Sun Reportedly Controls Over 60% Of Tron’s (TRX) Supply

A new report alleges that Justin Sun holds most TRX tokens, casting doubt on Tron's decentralization and fueling market uncertainty.

A new report claims that Justin Sun holds over 60% of all Tron tokens. Although the project ostensibly aims to promote decentralization, one man allegedly holds control over TRX.

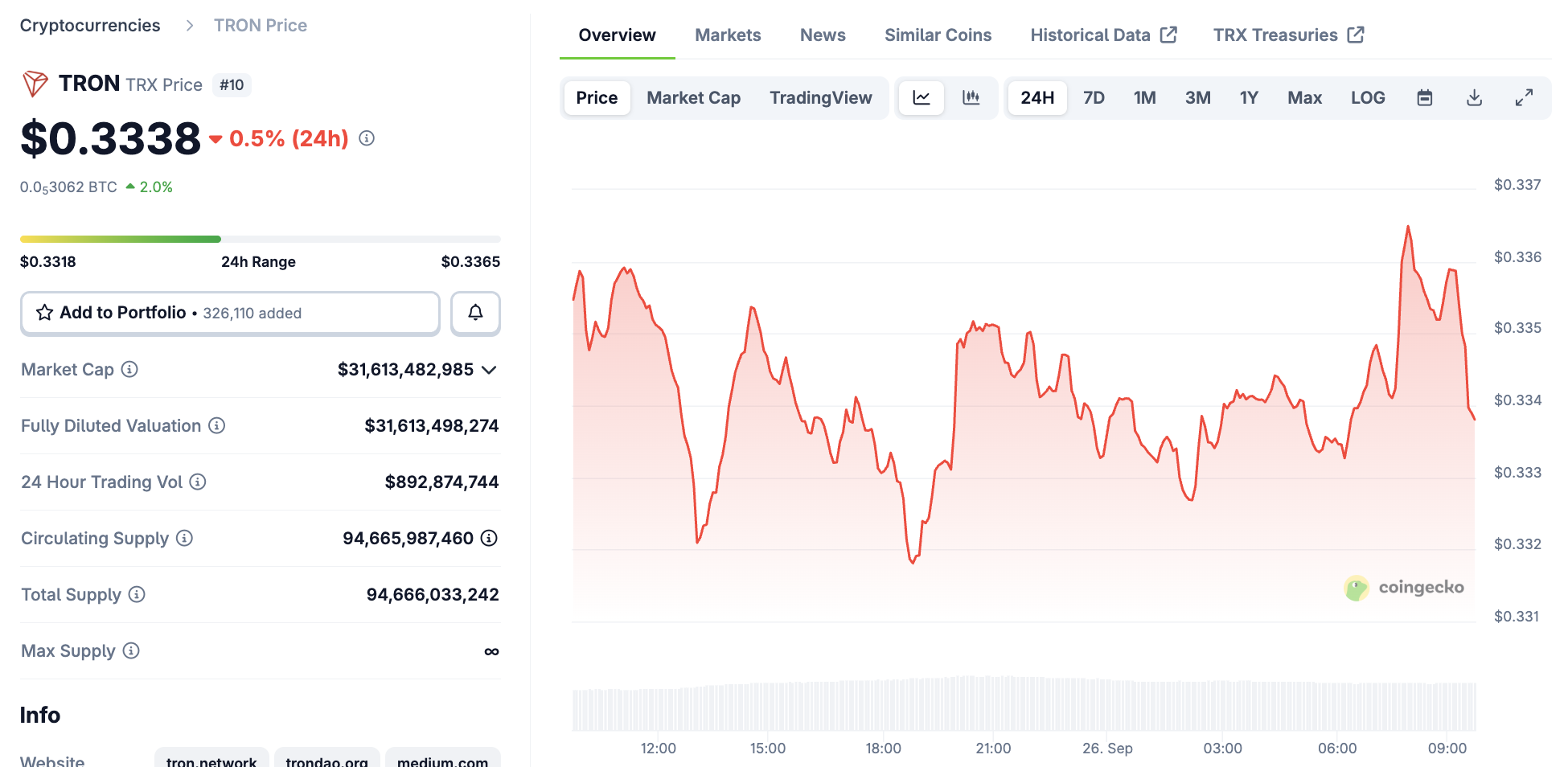

TRX price hasn’t wildly reacted to this rumor yet. The jury’s still out as to whether or not this scandal causes lasting reputational damage.

Justin Sun’s Tron Holdings

Justin Sun has been involved in a few controversies this month, apparently offering to invest in WLFI after World Liberty froze his wallets.

Today, however, a new report from Bloomberg made a bold claim that Justin Sun himself controls over 60% of all Tron (TRX) tokens.

This report, which allegedly sourced its Tron data from Justin Sun’s own team, would be a bombshell for the community. TRX is marketed as a decentralized blockchain smart contract system, aiming to advance decentralization across the Internet.

Simply put, there’s nothing decentralized about one man owning more than half of all circulating tokens. Tron’s price has been volatile througout the week, but it hasn’t reacted wildly to the latest rumors.

Tron Price Performance. Source:

CoinGecko

Tron Price Performance. Source:

CoinGecko

One Battle After Another

Justin Sun has been pursuing a legal battle against the publication over these Tron claims, although the courts ruled against him this week.

In past years, Sun has levied lawsuits towards a few media outlets regarding critical press coverage, but this effort has apparently been unsuccessful. If he wishes to sue Bloomberg for libel, that’ll force both parties to publicize their proof.

All things considered, social media chatter has been fairly tame, with most commentators acting unsurprised. To be clear, reactions have not been positive, but crypto analysts have been more likely to affectionately call Justin Sun “the second-biggest market manipulator in the game” over his Tron holdings than act indignant.

Justin Sun is the second best MM in the game behind senor CZ & https://t.co/kzzuPjGpUt

— woods.ai (@robw00ds) September 26, 2025

It’ll be interesting to see how these bold claims actually impact TRX’s market performance in the long run. Justin Sun already faced controversy when Trump’s SEC dropped its investigation after huge WLFI purchases.

Will one more round of bad press change the community’s opinion any further?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Internet Computer's Latest Rally: Will the Momentum Last or Is It Just a Temporary Spike?

- Internet Computer (ICP) surged in late 2025 due to institutional partnerships, technical upgrades, and speculative trading, but faces data credibility concerns. - Discrepancies in TVL figures (e.g., $237B vs. $1.14B) and unverified active wallet claims raise doubts about reported metrics and market fundamentals. - DApp usage dropped 22.4% in Q3 2025, highlighting a gap between infrastructure growth and user adoption, despite 50% compute capacity improvements. - Speculative trading volumes rose 261%, alig

Solana's Latest Price Fluctuations and Network Efficiency: Evaluating the Long-Term Investment Potential of High-Performance Smart Contract Platforms

- Solana maintains high-performance blockchain status with sub-2-second finality and low fees, attracting institutional adoption via Coinbase and PrimeXBT integrations. - Network faces declining user activity (3. 3M active addresses) and overreliance on speculative trading/meme coins, creating volatility risks for long-term viability. - Emerging competitors like Mutuum Finance challenge Solana by offering real-world asset tokenization models, highlighting need for non-speculative use cases. - Investors mus

The Abrupt 150% Decline in Solana’s Value: Causes, Impacts, and Potential Prospects

Bitcoin Plunges 20% Unexpectedly: Unraveling the Causes of Its Wild Price Swings

- BlackRock’s ETF outflows and Bitcoin’s 20% drop to $83,461 in late 2025 highlight market instability. - Macro risks like inflation and Fed rate uncertainty amplify Bitcoin’s volatility amid geopolitical tensions. - SEC’s AI governance rules and stalled ETF approvals add regulatory ambiguity, pushing investors toward hedging strategies. - Bitcoin’s recovery hinges on reclaiming $90,000 support levels as diversified strategies counterbalance risks.