Trader Says Bitcoin Primed for More Downside Before ‘Up-Only Mode,’ Updates Outlook on Ethereum

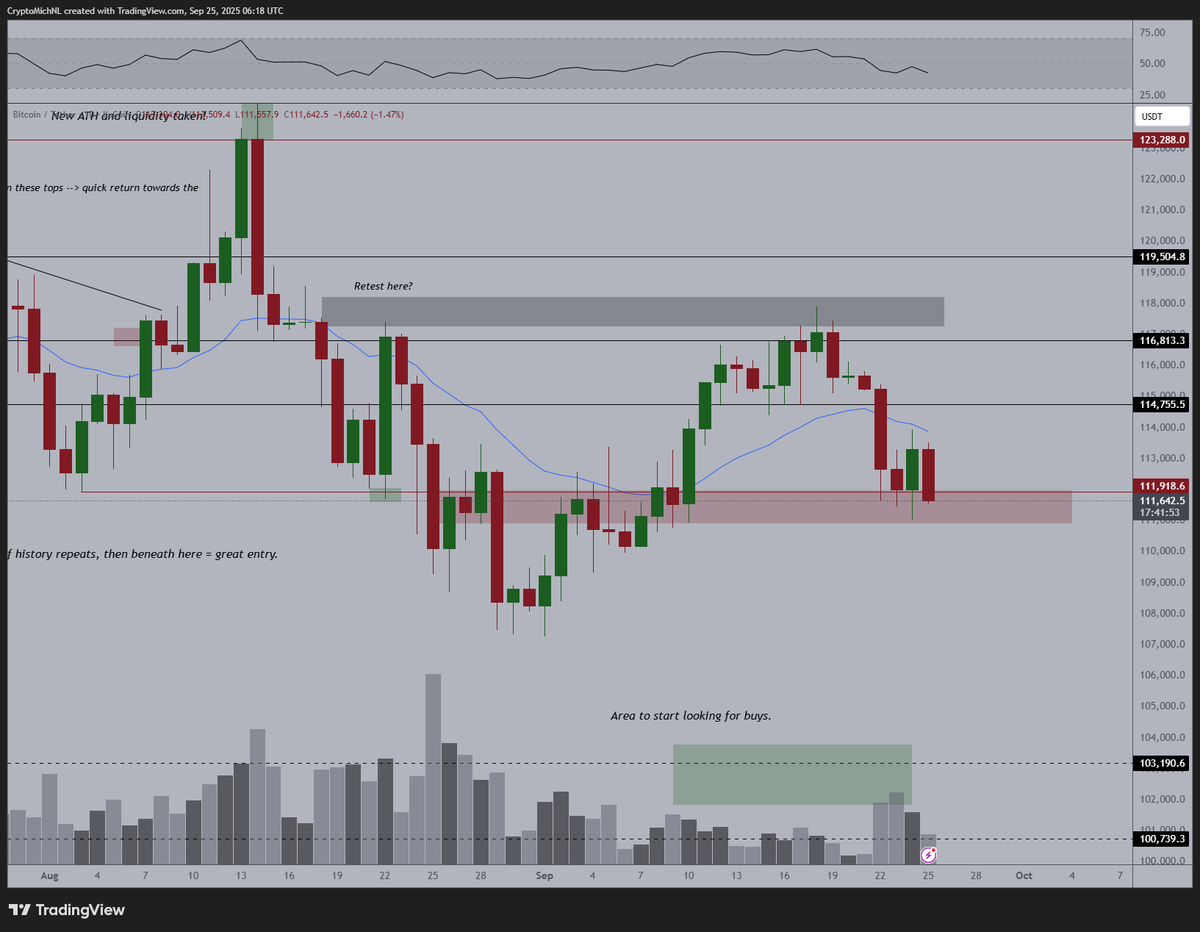

Crypto trader Michaël van de Poppe says that Bitcoin ( BTC ) may have a deeper correction before an explosive move to the upside.

Van de Poppe tells his 808,600 followers on X that Bitcoin may decline below its current $111,000 range before entering a period of bullish momentum.

“I would assume that we’ll be going to get some more downside and then we’re done for the current period, meaning that we’ll be in up-only mode.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

Looking at his chart, the trader suggests Bitcoin may retest the level around $108,000 similar to late August.

Bitcoin is trading for $111,075 at time of writing, down 2.3% in the last 24 hours.

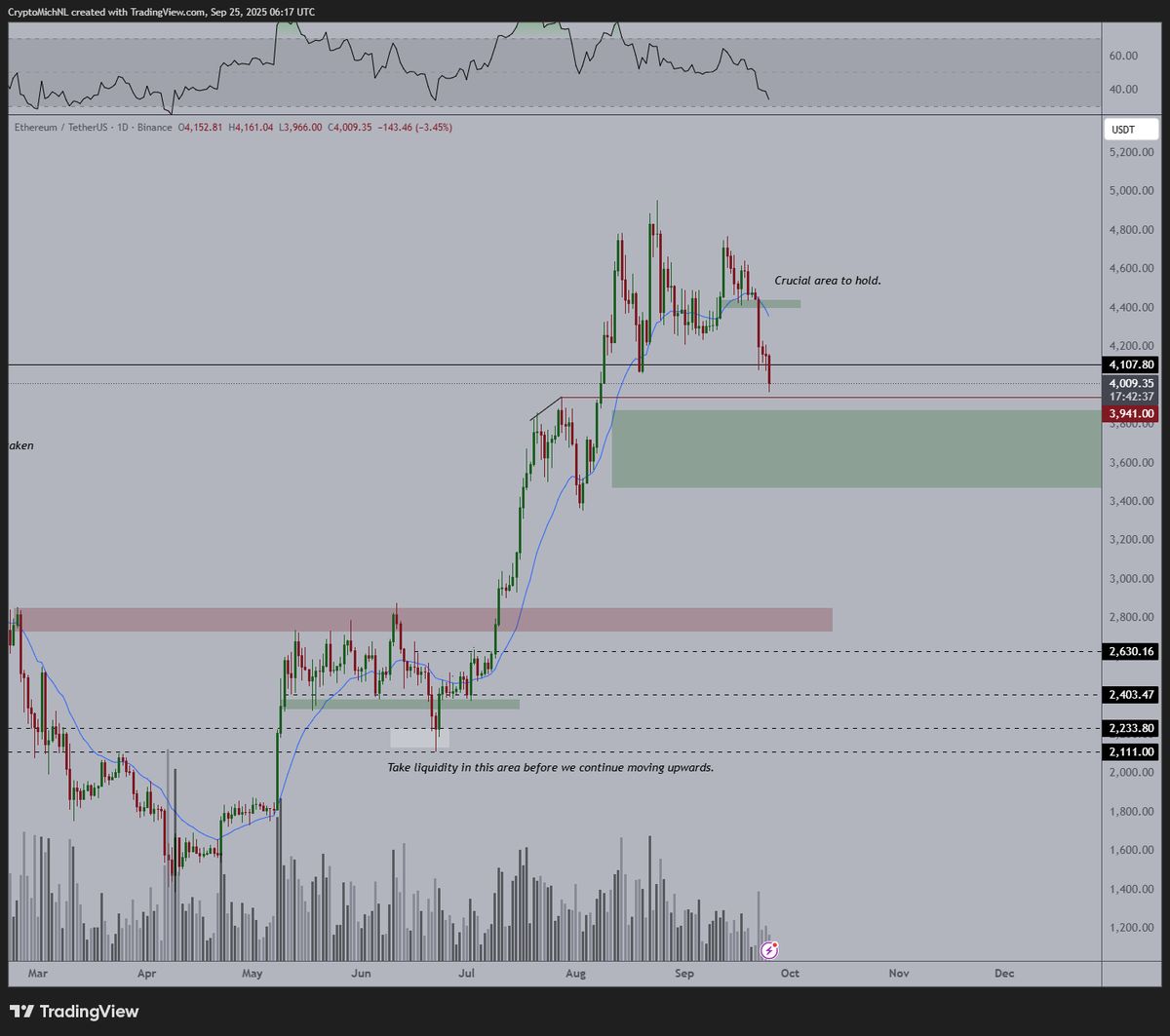

Next up, the analyst says that Ethereum ( ETH ) may form a local market bottom around the $3,800 level.

“I don’t think there’s much more downside to come. Would suggest that the green zone is where we’ll be bottoming out. Perhaps another 5% drop on ETH and that should be it.”

Source: Michaël van de Poppe/X

Source: Michaël van de Poppe/X

The analyst also predicts that ETH will hit five-figures this cycle and other altcoins may increase 400% from their current values.

“It’s near the bottom on altcoins and ETH. What’s next? ETH at $10,000. Altcoins to go 3-5x. It’s not the end of the bull market, it’s the start of the bull market and recent listings have shown proof of this.”

ETH is trading for $4,002 at time of writing, down 4.5% in the last 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: MicroStrategy's Bold Bitcoin Investment Stands Strong Despite 57% Drop in Stock Value

- MicroStrategy's CEO reaffirms Bitcoin buying strategy amid market volatility, adding 8,178 BTC for $835.6M. - Despite 57% stock decline, MSTR's Bitcoin holdings reach $61.7B, funded by preferred shares and convertible notes. - Critics question debt-driven model's sustainability, but analysts praise its Bitcoin-per-share growth and $535 price target. - Saylor envisions $1T Bitcoin balance sheet, leveraging appreciation for credit products and reshaping global finance.

Ethereum Updates Today: Buddy Goes All-In on ETH with $13 Million Leveraged Wager Amid Market Slump

- Buddy Huang’s ETH long position was liquidated, prompting a $9.5M reentry amid market turmoil. - Market selloff attributed to macroeconomic pressures, with BTC dropping 28.7% below $90K. - A $1.24B ETH whale added 13,117 ETH despite $1.59M unrealized losses, signaling bullish conviction. - Institutional caution grew as SoftBank exited $5.8B NVIDIA stake, while Coinbase hinted at December 17th product launch. - Buddy’s $13M leveraged bet faces liquidation risk if ETH fails to stabilize above $3,000, highl

The Rapid Drop in COAI Shares: Red Flag or Investment Chance?

- COAI Index fell 88% YTD in Nov 2025, sparking debate over systemic collapse vs undervalued opportunity. - Market sentiment diverges from fundamentals: C3.ai shows 26% YoY revenue growth despite governance crises and $116M Q1 loss. - CLARITY Act regulatory uncertainty, leadership turmoil at C3.ai, and crypto frauds like Myanmar's $10B scam fueled sector-wide selloff. - C3.ai's $724M cash reserves and 69% gross margin highlight resilience, but legal battles and regulatory ambiguity persist as key risks. -

DappRadar's Shutdown Reflects Challenges Faced by the Industry Amid Market Volatility

- Web3 analytics firm DappRadar announced its shutdown due to "financially unsustainable market conditions," causing its RADAR token to drop 30%. - Companies like PG Electroplast and GEM Aromatics reported revenue declines amid U.S. tariffs, GST changes, and raw material costs, reflecting broader economic challenges. - Geox cut 2025 sales forecasts by high single digits after 6.2% year-to-date revenue fall, while cost cuts helped stabilize its EBIT margin. - Tech stocks face volatility: Nvidia downgraded a