TOWNS experiences a 1073.83% decrease in 24 hours as the market faces a significant decline

- TOWNS token plummeted 1073.83% in 24 hours on Sep 25, 2025, with multi-timeframe declines reaching 4217.39% year-to-date. - Extreme price drops highlight liquidity issues and structural weaknesses, signaling eroded investor confidence and lack of market support. - Technical indicators confirm a bearish trend; backtesting shows short positions captured downturns but long signals failed due to sustained bear market.

On September 25, 2025,

The sharp decline in TOWNS has highlighted concerns about the token’s liquidity and underlying stability, as such steep and rapid losses often indicate weak support from both trading activity and long-term holders. Market analysts warn that unless a positive catalyst emerges—such as new project developments, governance reforms, or a strategic shift in the token’s core direction—further price swings are likely.

Short-term technical analysis places TOWNS in oversold territory, but the broader outlook remains strongly negative. The token has been unable to hold any significant support levels, and its failure to stabilize or recover suggests that market trust has eroded. Notably, TOWNS has yet to show any indication of reversing its downward momentum, even as it approaches record-low valuations.

Indicators like RSI, MACD, and moving averages all point to a continued downward trend. In this scenario, backtesting strategies can help determine if historical price patterns offer any clues for potential entry or exit points based on set criteria.

Backtesting Hypothesis

A backtesting approach was used to assess the effectiveness of a trend-following strategy for TOWNS. This method combined moving average crossovers with RSI levels. Specifically, a buy signal was generated when the 50-period moving average crossed above the 200-period moving average (golden cross) and the RSI dropped below 30, signaling oversold conditions. Conversely, a sell signal was triggered when the 50-period moving average fell below the 200-period moving average (death cross) and the RSI exceeded 70, indicating overbought conditions.

This strategy was tested on TOWNS’s historical price data over the past year. The results showed that the approach successfully identified major downturns with short positions, especially during the recent weekly and monthly declines. However, it struggled to produce profitable long trades due to the persistent negative trend. Overall, the findings underscore the difficulty of achieving gains in a prolonged bear market using only trend-following signals.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Turmoil and AI Breakthroughs: Grok 4.1, Gemini 3, Cloudflare Outage

AI Confidence and Economic Concerns Set Crypto Strength Against Market Downturn

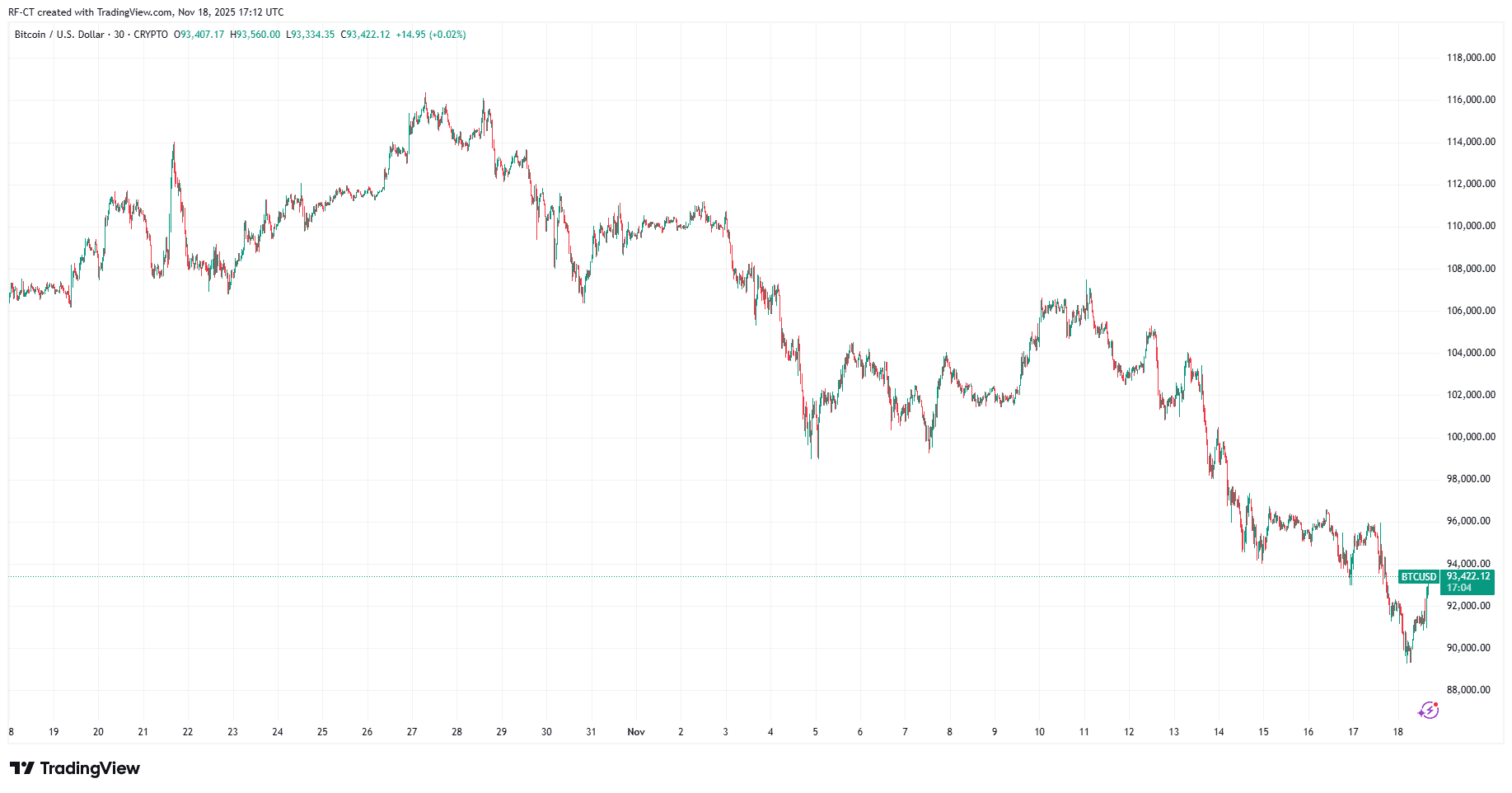

- U.S. stock indexes fell on Nov. 18, 2025, while crypto and AI-linked stocks showed resilience amid broader market weakness. - Nvidia's upcoming earnings and 54% YOY EPS forecast fueled gains in correlated stocks like TSMC (+41% YTD) and SMCI (+15% YTD). - Bitcoin rebounded 1% temporarily, but analysts warned crypto remains vulnerable to inflation fears and $1B+ leveraged liquidations. - Home Depot's 3% premarket drop dragged on the Dow after missing Q3 earnings and slashing profit forecasts amid housing

Solana's Breakthrough: Ushering in a New Age of Fast and Scalable Smart Contracts?

- Solana's 2025 upgrades (Firedancer, Alpenglow) achieved 1M TPS and sub-150ms latency, outperforming Ethereum and Sui . - Enterprise partnerships with Visa , PayPal , and Stripe leverage Solana's speed and low fees for payments and remittances. - Institutional ETF inflows and energy-efficient proof-of-history consensus boost Solana's appeal for green finance. - Challenges include competition from Ethereum upgrades, stablecoin liquidity declines, and regulatory risks.

Trump’s Federal Reserve Shakeup Raises Concerns Over Stagflation and Divides Within GOP

- Trump announced his Fed chair pick but withheld the name, criticizing resistance to removing Powell before his 2026 term ends. - Shortlisted candidates include Waller, Bowman, and Rieder, with Trump hinting at a "standard" choice amid political tensions. - The dispute with Rep. Greene over Epstein files highlights GOP fractures, as Trump accused her of betraying party loyalty. - Critics warn politicizing the Fed risks stagflation, while the Epstein files debate underscores transparency vs. loyalty tensio