Australia's Cryptocurrency Regulations Challenge the Balance Between Fostering Innovation and Safeguarding Investors

- Australia’s government released draft crypto regulations requiring exchanges and platforms to comply with bank-like standards under the Corporations Act. - The framework introduces two regulatory categories (trading/exchange and asset storage) with AFSL licensing, capital reserves, and APRA oversight for stablecoins. - Small operators face simplified rules, while non-compliance penalties reach AUD 16.5 million, aiming to prevent misconduct post-FTX collapse. - Industry stakeholders cautiously welcome the

Australia is taking steps to bring cryptocurrency oversight into its mainstream financial system, signaling a major transformation in the country’s regulatory environment. On September 25, 2025, the federal government unveiled proposed laws that would require crypto exchanges, fintech companies, and digital asset platforms to meet financial service standards similar to those applied to banks and insurance firms. Announced by Assistant Treasurer Daniel Mulino, the new policy enforces requirements for governance, capital adequacy, and consumer safeguards under the Corporations Act. The initiative seeks to resolve ongoing regulatory uncertainty while maintaining space for innovation, a priority for industry participants.

The proposed rules establish two main categories of regulation: one for trading and exchange operations, and another for asset custody. Providers will need to secure an Australian Financial Services Licence (AFSL), which brings obligations such as minimum capital holdings, separation of client assets, and strong cybersecurity measures. Stablecoins are specifically addressed under a new “stored-value facility” framework, regulated by the Australian Prudential Regulation Authority (APRA), placing them alongside conventional financial products. Smaller providers—those managing less than AUD 5,000 per customer or processing under AUD 10 million annually—will benefit from streamlined compliance requirements.

Strict penalties are set for breaches, with fines that can reach AUD 16.5 million or 10% of yearly revenue. These tough measures are designed to prevent wrongdoing and promote responsibility, especially in the wake of failures like FTX that exposed Australian investors to risk. The legislation also requires clear procedures for transaction settlement, managing conflicts of interest, and resolving disputes.

The industry’s response has been cautiously positive. Jonathon Miller, Kraken’s Australian managing director, welcomed the reforms for lowering the threat of “debanking”—a persistent issue for crypto businesses seeking access to traditional banking. Coinstash co-founder Mena Theodorou stressed the importance of customized rules, cautioning against simply applying old financial regulations to a new sector. Jonathan de Wet of Zerocap pointed out the need to balance consumer protection with the encouragement of innovation.

On the global stage, Australia’s strategy is similar to Singapore’s method of incorporating crypto into existing financial regulations, but it also features special exemptions for smaller players. This approach aims to make Australia competitive with regulatory centers like the EU (under MiCA), the UK, and the UAE, while steering clear of the patchwork system seen in the U.S. Experts believe this legal structure could draw institutional investors and strengthen Australia’s standing as a regional crypto center.

The draft legislation is open for public feedback until October 24, 2025, reflecting a wider effort to harmonize with international standards while addressing local priorities. The final version is anticipated in 2026, with implementation timelines yet to be finalized. For companies, preparing early for compliance will be essential to adapt to the new rules.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Major Institutions Invest Billions While Solana Boosts Its Scarcity Approach

- Solana developers propose reducing future SOL emissions by 22M tokens to accelerate disinflation, targeting 1.5% terminal inflation twice as fast. - Institutional adoption grows via staking-enabled ETFs like VanEck's and Bitwise's BSOL , creating dual-income streams through exposure and yield. - Despite $424M in BSOL assets, Solana's price fell below $140 support, with derivatives data signaling short-term selling pressure and crowded long positions. - Coinbase's Vector acquisition enhances Solana's inst

Bitcoin Latest Updates: Macroeconomic Factors and Earnings Challenges Drive 44% DeFi Downturn

- Market analysts predict a 44% correction in DeFi and crypto sectors due to macroeconomic risks, Fed policy uncertainty, and weak corporate earnings. - HIVE Digital faces scrutiny over Bitcoin holdings reduction and shareholder dilution, while Hyster-Yale reports Q3 losses amid industry margin pressures. - Data center infrastructure emerges as a growth outlier with $11.1B backlog and $320B 2030 market projection, though labor shortages and permitting delays persist. - Goldman Sachs adjusts energy sector o

Ethereum Updates Today: Institutional Confidence Faces Challenges Amid Ethereum's Price Fluctuations and Upcoming Upgrades

- Galaxy Digital's 7,098 ETH withdrawal from Binance raises concerns over Ethereum's institutional activity and market stability amid macroeconomic pressures. - ETH faces $993M long liquidation risk below $2,600 and $1.07B short liquidation risk above $2,900, highlighting leveraged position fragility. - Institutional staking inflows remain steady despite declining ETH futures open interest (-7% weekly) and reduced ETF net inflows ($10M vs. $65M in October). - Upcoming Dencun upgrade (EIP-4844) aims to redu

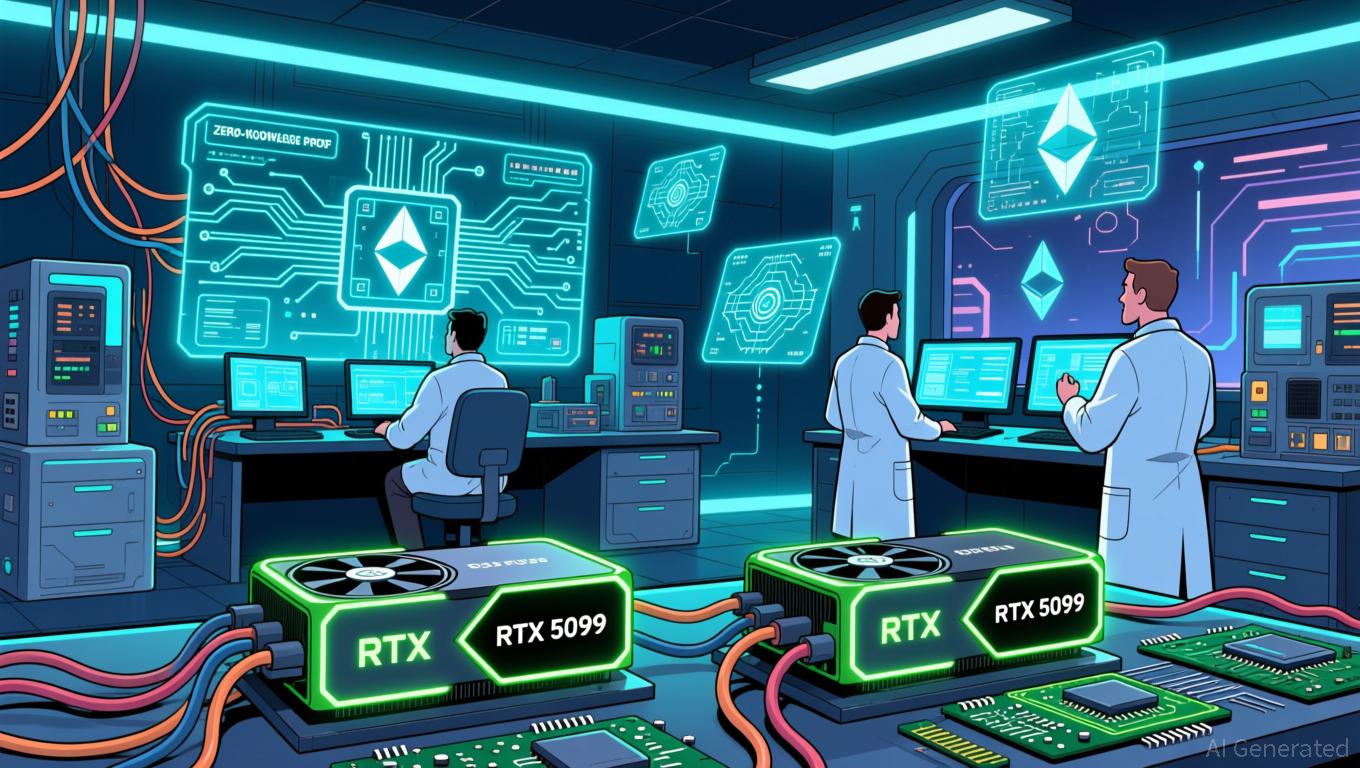

Ethereum Updates: Consumer Graphics Cards Drive Cost-Effective and Decentralized Ethereum Scaling

- zkSync's Airbender prover achieved L1 block proofs using two RTX 5090 GPUs, praised by Vitalik Buterin as a "huge milestone" for Ethereum's scalability. - The breakthrough enables "gigagas L1" expansion, potentially reducing fees and enabling near-zero L2 costs through consumer-grade hardware accessibility. - Succinct's SP1 Hypercube demonstrated 99.7% real-time L1 proving under 12 seconds with 16 RTX 5090s, advancing ZK tech alongside zkSync's progress. - Buterin cautioned against over-optimism, noting