Short Sellers Drive October's Unexpected BTC Recovery

- Bitcoin's "Uptober" rally in 2025 is driven by shifting sentiment, technical indicators, and historical seasonal patterns as prices near $116,000. - Derivatives markets show mixed positioning, with elevated short ratios (0.87-0.90) in July 2025 contrasting March's bullish peak (1.77), while September's 49.77% long/50.23% short split signals indecision ahead of October volatility. - Technical analysts highlight $100,000-$104,000 as a potential catalyst for rebounds, with contrarian opportunities emerging

Bitcoin’s traditional October surge, popularly known as “Uptober,” has made a comeback in 2025, fueled by evolving market attitudes, technical signals, and established seasonal trends. With the cryptocurrency hovering near $116,000, market participants are keeping a close eye on derivatives activity and exchange data to assess whether the upward momentum can persist through the year’s end.

Data from perpetual futures—a primary measure of trader sentiment—shows a mildly bearish outlook in July 2025, with Binance’s long/short ratio at 0.87 and OKX’s at 0.90, indicating a slight edge for short positions. This is a shift from March 2025, when optimism peaked with a 1.77 ratio and Bitcoin reached $121,000. By September, the market appeared balanced, with longs at 49.77% and shorts at 50.23%, reflecting uncertainty ahead of expected October swings. Notably, Binance’s 50.69% long exposure differs from Bybit’s 48.65% and Gate.io’s 49% long positions, illustrating varied trader perspectives across exchanges.

October’s rallies for Bitcoin are often attributed to recurring historical and seasonal influences. Since 2013, the asset has typically seen a 3.77% drop in September, with these downturns frequently paving the way for October recoveries. Technical experts point out that a 20% pullback to the $100,000–$104,000 zone—matching important Fibonacci and moving average levels—could spark a rebound. Well-known analyst Peter Brandt has cautioned about a possible move to $78,000 due to a head-and-shoulders setup, while others, such as MelikaTrader94, expect a dip below $100,000 to “flush out weak holders.”

The dynamic between institutional investment and cautious retail traders is heightening October’s importance. Despite open interest hitting a record $86 billion and strong ETF-driven spot inflows, short positions remain high, pointing to ongoing macroeconomic doubts. High funding rates in perpetual futures suggest bullish undertones, but mixed ratios across exchanges reveal a struggle between institutional confidence and retail hesitancy. Experts warn that a fall below $105,000 could lead to further declines, while a recovery above $113,000 may restore bullish sentiment.

Historically,

Market participants should keep an eye on funding rates, open interest, and exchange-specific positioning for early signs of a shift. Binance’s higher leverage offerings and Gate.io’s wider altcoin variety could affect risk appetite, but the spotlight remains on Bitcoin’s underlying fundamentals. With ETF inflows and broader economic signals in focus, October’s outcome may depend on whether the $100,000 support level holds—a threshold crucial for both technical and psychological momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AAVE drops 1.47% amid Aave’s overhaul of its multichain approach

- Aave's multichain strategy shift caused AAVE to drop 1.47% despite 7.08% weekly gains. - Governance proposal aims to consolidate operations on high-revenue chains like Ethereum , phasing out low-performing deployments. - Strategy prioritizes capital efficiency and risk management by focusing liquidity on core networks with stronger revenue potential. - Unanimous DAO support signals industry trend toward quality-focused chain selection over maximalist expansion in DeFi.

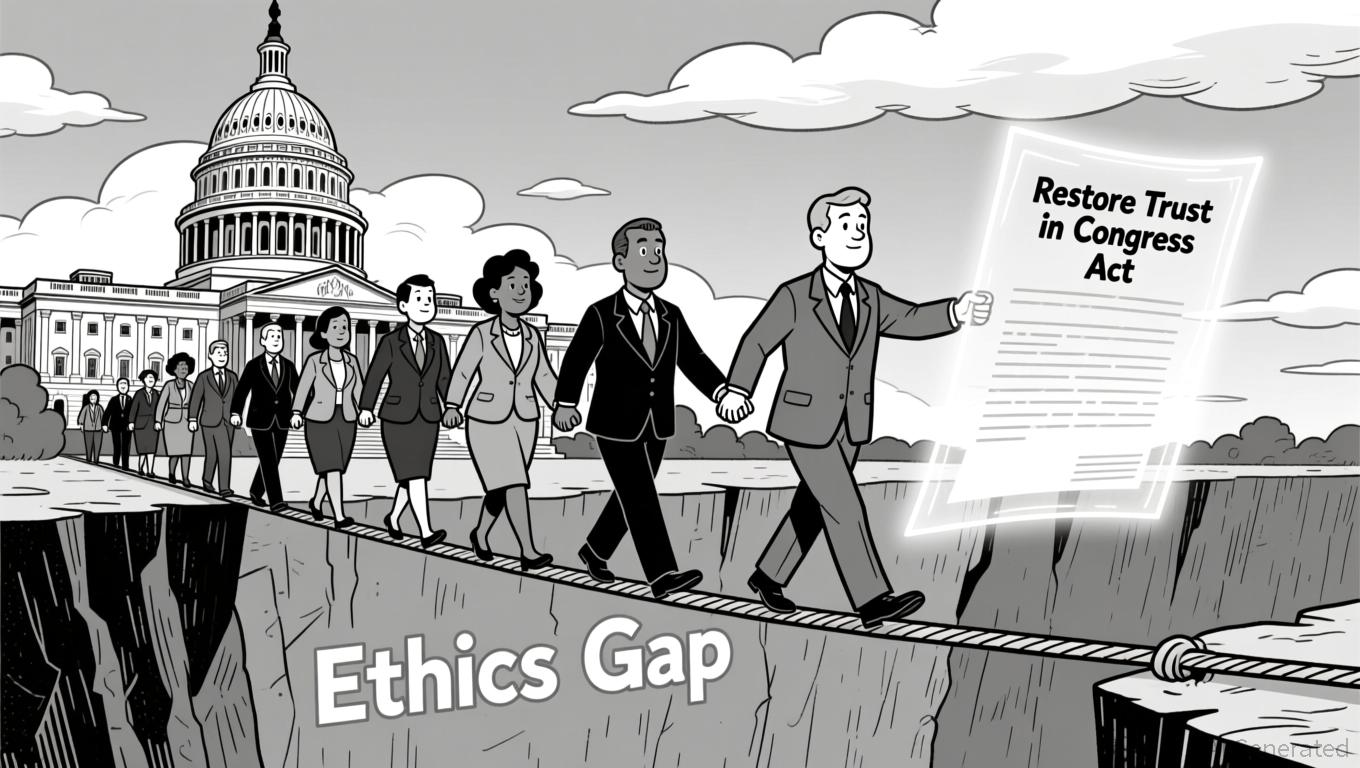

LUNA Price Remains Steady as U.S. Lawmakers Advance Stock Trading Ban

- LUNA's price remained stable at $0.0727 in 24 hours but fell 82.47% annually amid U.S. legislative efforts to restrict congressional stock trading. - Rep. Anna Paulina Luna's bipartisan bill seeks to ban lawmakers, spouses, and children from individual stock trading to address ethical conflicts. - The bill, supported by 100+ co-sponsors, faces opposition over financial flexibility concerns for lower-income legislators amid unchanged congressional salaries since 2009. - A discharge petition aims to force

PENGU Price Forecast for 2026: Managing Fluctuations and Momentum from Key Catalysts After the 2025 Market Adjustment

- 2025 crypto market correction reshaped altcoin dynamics as Bitcoin/Ethereum declined amid macroeconomic uncertainty and regulatory pressures. - Pudgy Penguins (PENGU) saw sharp volatility post-correction, with technical indicators suggesting potential $0.069 rebound by 2026 if adoption metrics align. - Strategic partnerships with Bitso and cross-chain integrations, plus Kung Fu Panda NFT collaborations, aim to boost PENGU's liquidity and mainstream adoption. - Despite 12% early 2026 price drop, Pudgy Inv

ZEC Value Increases by 4.82% Following Recent Exchange Listing

- Zcash (ZEC) surged 4.82% in 24 hours after Bitget listed it for spot trading on Dec 3, 2025, boosting short-term liquidity and visibility. - Zcash’s zero-knowledge proof technology enables encrypted transactions while maintaining blockchain integrity, distinguishing it as a privacy-focused asset. - Bitget’s UEX model supports multi-chain access, aligning with Zcash’s goal to balance transparency and privacy, though recent 7-day and 1-month declines highlight market volatility risks.